- Black Friday has grown in popularity in Aotearoa. And with each year, the deals and discounts seemed to be advertised earlier and earlier. According to Kiwibank electronic card transactions, the volume of retail spend rose 4.4%, while the dollar spend declined 2.5%. Best put, the value per transaction in November was down 6.2% compared to last year. For a change, we’re spending less and getting more.

- Beyond the usual ups and downs in spend in any given year, underlying consumer behaviour is shifting. Kiwi want experiences over physical products. We overconsumed over covid. But now we prefer buying concerts over Converse and coffee over couches.

- Household balance sheets have come under significant pressure over the last few years. Consumer confidence is low and consumption weak. But the outlook for spending in 2025 is slowly improving. First, it’s about bringing balance sheets back to baseline. The change in interest rates and expected rise in house prices should improve the financial position of the household sector. Second, the cost-of-living crisis has ended, and income growth will outstrip inflation.

Add to cart: Breaking down Black Friday

Spam in inboxes, posters in storefronts, and flooded social media feeds – Over the last decade or so, Black Friday has grown in popularity in Aotearoa. What began in the United States, has gone global with many Kiwi retailers jumping on the bandwagon. The ‘unbeatable’ sales seemed to spring up everywhere you looked. The last Friday of November is officially the date. But with each year, the deals and discounts seemed to be advertised earlier and earlier. For some the day lasted a week. While for others, the bargains began not long after the witch hats and black cats of Halloween were packed away.

We trawled through Kiwibank electronic card transactions and uncovered an encouraging improvement in consumer spending. Last year, households had little appetite to spend. The number of core retail (excluding hospitality and food) transactions declined almost 5%. However, 12 months and a couple of interest rate cuts later, the appetite and ability to spend is recovering – slowly. The volume of core retail spend rose 4% on last year’s levels. Black Friday discounting and a slowdown in consumer price inflation resulted in a 2.5% decline in the nominal value of spend. Better put, the value per transaction is 6.2% cheaper than last year.

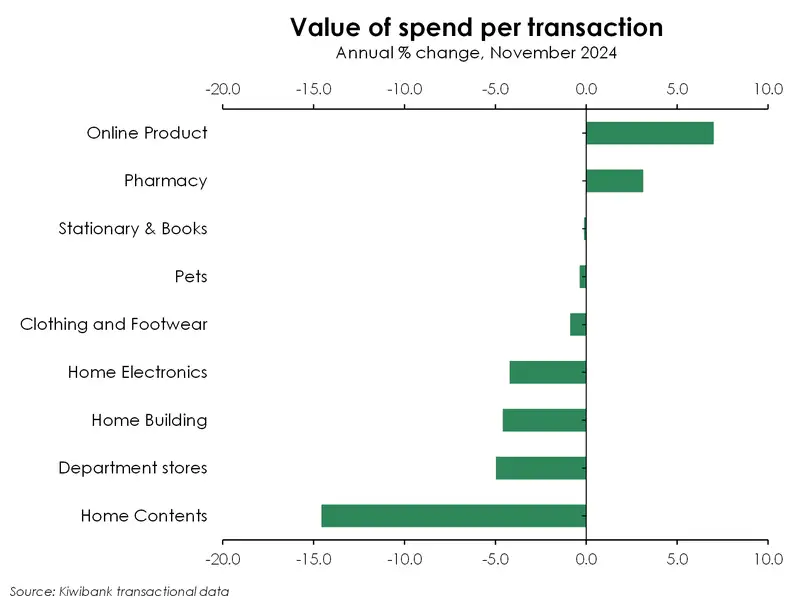

By sub-categories, all things home recorded the deepest decline in average spend. Home contents and furnishings recorded a 14.6% fall, while home electronics were down 4.2%. The average spend at department stores was down 5%. Interestingly, the average spend at pharmacy stores rose 3.1%. The increase is largely due to the reintroduction of the $5 prescription fee in July 2024. The value of transactions at the pharmacy jumped 128% from November last year. We thought to exclude spend at pharmacies. But shops like Unichem, Life Pharmacy and (chaotic) Chemist Warehouse stock more than just pharmaceutical products. Some of the best winter scarves, summer sunnies, and cosmetics lie inconspicuously on shelves at your local pharmacy (thank me later).

This year’s Black Friday experience suggests that Kiwi are now spending less and getting more. It follows a period where the rise in inflation eroded the purchasing power of our hard-earned dollar – we were spending more and getting less. But we’ve returned to more stable price growth, and even deflation in parts. Indeed, the evolving trend may also be a function of changing consumer patterns. In recent times, our household imports of low-value goods have skyrocketed, up 40% in the last year. The retail landscape is shifting, with the likes of Temu – the Chinese online shopping behemoth – entering the market.

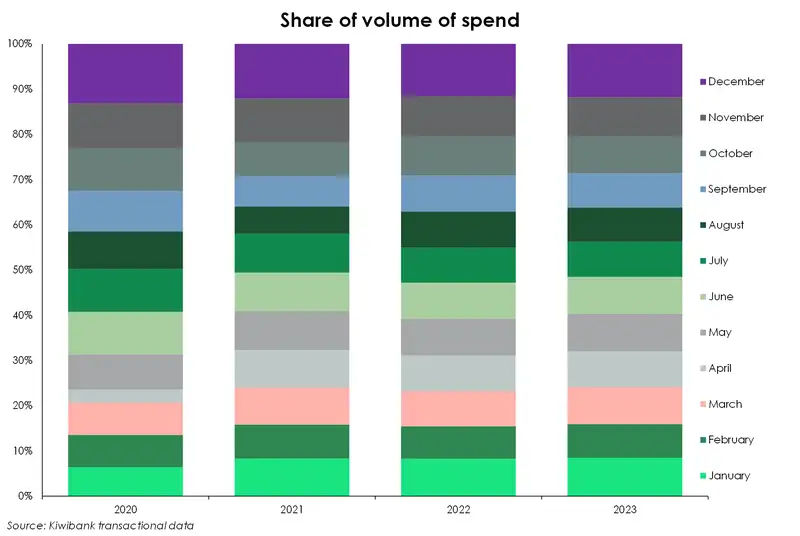

Boxing Day: The undisputed spending champ

Black Friday kicks off the holiday spend period. But according to Kiwibank data, Boxing Day is the reigning pound for pound spending champ. By both value and volume of spend, Boxing Day is the biggest and busiest shopping day of the year. Like Black Friday, some Boxing Day sales begin even before we have cut into the Christmas ham. Still, the post-Christmas bargain hunt far eclipses spend in any other time of the year. In 2023, almost 20% of total retail transactions in December took place in the final five days of the month/year. Christmas Eve is also a particularly busy day for spending, exposing our last-minute dash to the shops. The seasonal spike in December is so strong that the month accounts for about 13% of total annual spend.

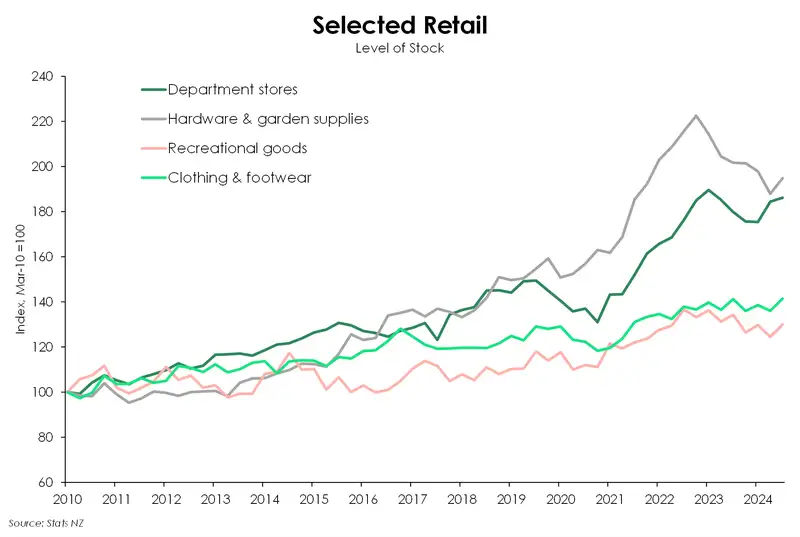

Inventory levels is always something we watch closely heading into the Christmas period. Retailers built up their stock during the pandemic. Inventory management pivoted from ‘Just in Time’ to ‘Just in Case’, leading to oversupplied warehouses. Chunky price discounting was inevitable – not great for profitability. Lesson learnt. Retailers would much rather be caught short of stock for the seasonal tsunamic of shoppers. Today, inventories for some retail sectors have fallen below the pandemic highs. Hardware, building and garden supplies are down 12.5% while recreational goods are down 5%. Stock of electronic goods has fallen 30% below its pandemic peak, to be 11% below 2019 levels. In saying that, most other industries still carry more inventory than prior to the pandemic.

And I am (not) a material girl: Prioritising experiences

Sorry, Madonna but times are changing. Consumers these days prefer to spend with the intent on making memories rather than purchasing material goods. Beyond the usual ups and downs in spending in any given year, our data signals this shift in underlying consumer behaviour. As witnessed globally, Kiwi are prioritising experiences with a rise in spending among categories like hospitality. Think restaurants, bars and café’s, movies, concerts, festivals, sport events etc. In the year to November 2024, the number of transactions relating to so-called ‘experiences’ has increased 7% since 2022. The demand for physical goods is correcting lower following covid, with the volume of spend in fact declining in 2023.

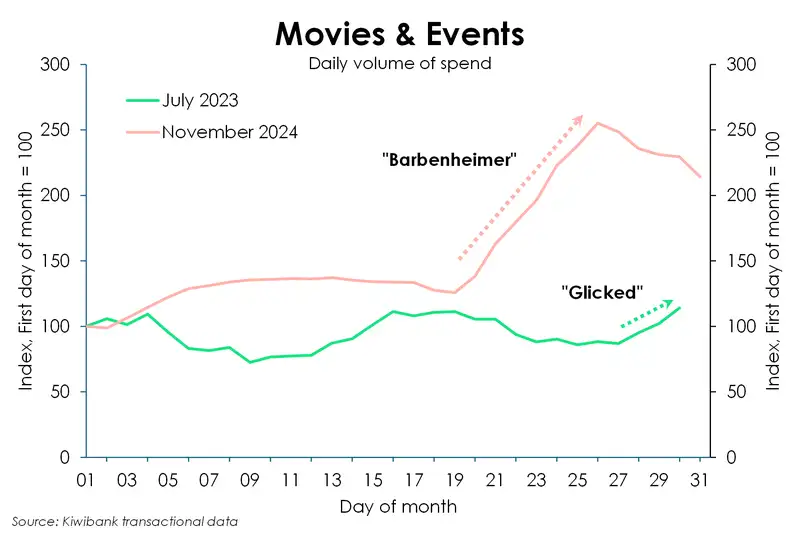

By sub-category, sport events has seen the largest increase. In the year to November 2024, the number of transactions is 38% more than the volume in the year to November 2022. We love our rugby, netball and cricket, but football is also popular. And Auckland FC may have had a hand in this. Similarly, recreational accommodation is up 11% and flight bookings up 18.5%. Restaurants and bars are up 4.4%, and cafes up 8%. A special mention to movies and events which has struggled not only during the pandemic but also with the rise in streaming services. Nonetheless, the volume of spend rose 9% in the final week of November as Gladiator and Wicked battled it out for the Box Office crown. But ‘Glicked’ simply cannot compete with the success of Barbenheimer in July 2023 – the number of transactions rose an atomic 45% in the premiere week.

Overall, the rise in spend on experiences may be a correction in our over consumption during covid. Locked up at home, with an overstimulated housing market, we witnessed exorbitant demand for all things pools and pizza ovens. The travel jar was emptied and instead used to splurge on new toys – big and small. But lockdowns have been lifted and borders reopened. Travel is back on the cards and in person events have returned. It’s back to meeting IRL, head banging in the bleachers, and cheering in the cheap seats. We prefer coffee over couches. And we’re making up for lost time.

Outlook 2025: Tailwinds and headwinds

Household balance sheets have been stretched. Debt servicing costs had risen from historically low levels during the pandemic. For mortgaged households, debt repayments had taken bigger and bigger bites into disposable incomes. The correction in the housing market also lowered household net worth, weakening balance sheets and ultimately consumption. And it was predominately discretionary goods and services that were culled from the budget.

However, the tide is turning. There are several key tailwinds for consumer spending in 2025.

- Falling interest rates: The RBNZ has cut the cash rate 125bps from the 5.50% peak, and we expect another 125bp of cuts to come. Wholesale rates have further to fall, and along with them, retail interest rates.

- Real income growth: For the last three years, the cost of everyday essentials outpaced household incomes. But now, pay rises are running above inflation. The cost-of-living crisis is coming to an end, slowly. It may not feel like it yet, but we are entering a period of real income growth.

- Rising house prices: We know over two-thirds of household wealth is equity in a home. The performance of the housing market is key to the recovery in consumer spend. With falling interest rates and changes to investor tax policies, we expect a decent recovery in house prices next year. And as equity builds, the wealth effect should kick in and kick consumption higher.

A grey cloud hovering in the horizon is the deteriorating labour market. The past two years of weak economic activity is now hitting the labour market. Hours are being slashed, and many businesses are downsizing. Employment growth is running backwards. And we expect further job loss-led increases in unemployment. Weakening job security risks a slower and more muted pick up in household spending next year.

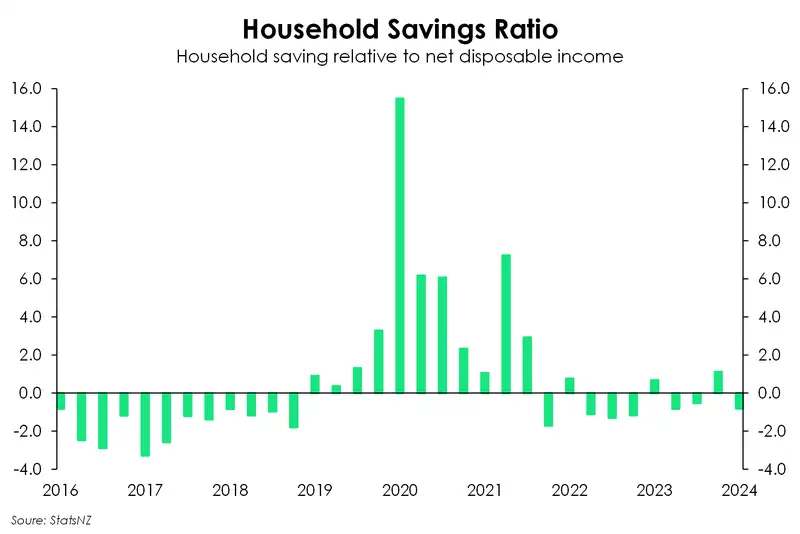

The outlook for household spending is slowly improving. Next year should be a better year. But we’re unlikely to see the same splurge as in previous years. Because repairing balance sheets is the near-term focus for many households. We’ve been in a per capita recession since December 2022. And household savings has fallen in five of the last seven quarters. Net disposable income fell in the June quarter, with the household sector funding the increase in spending through borrowing and drawing on existing funds. The change in interest rates and expected rise in house prices should improve the financial position of the household sector. But first, it’s about bringing balance sheets back to baseline.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.