The Drop

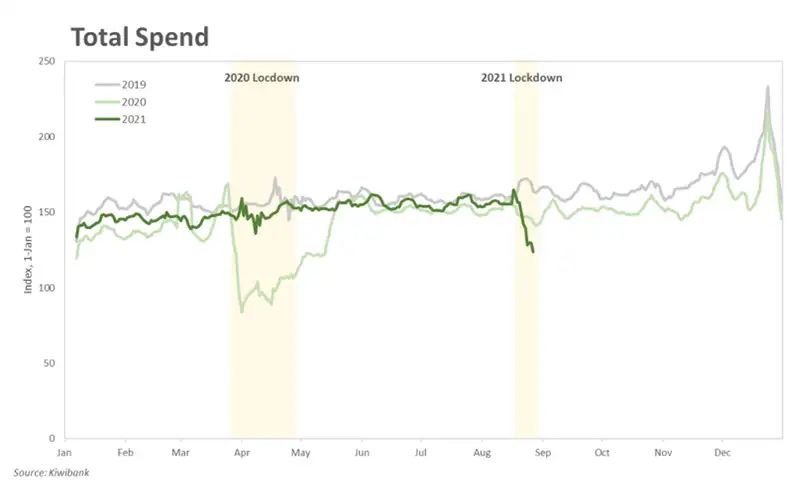

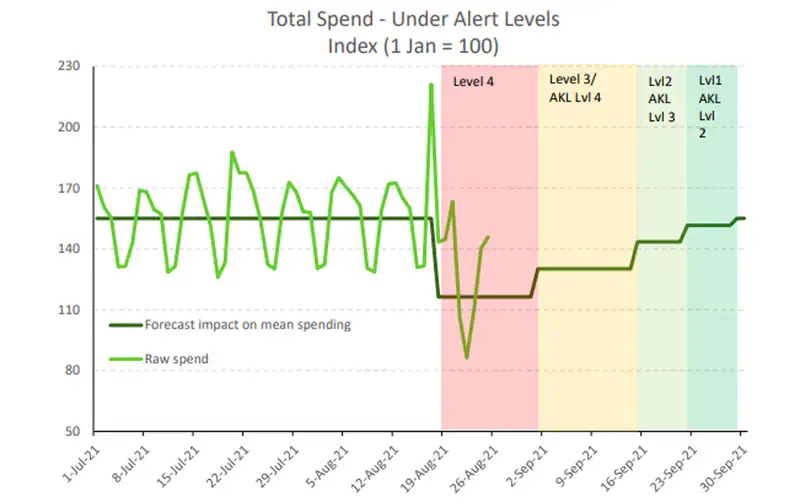

Total Kiwibank credit and debit card spend plunged 20% once the lockdown came into effect, compared to a 45% drop last year.

Data included in this chart pack is of daily frequency, up to and including 26 August 2021 (9 days of lockdown). The data is indexed to the beginning of each year. And 2019 is included as the baseline, to allow comparison.

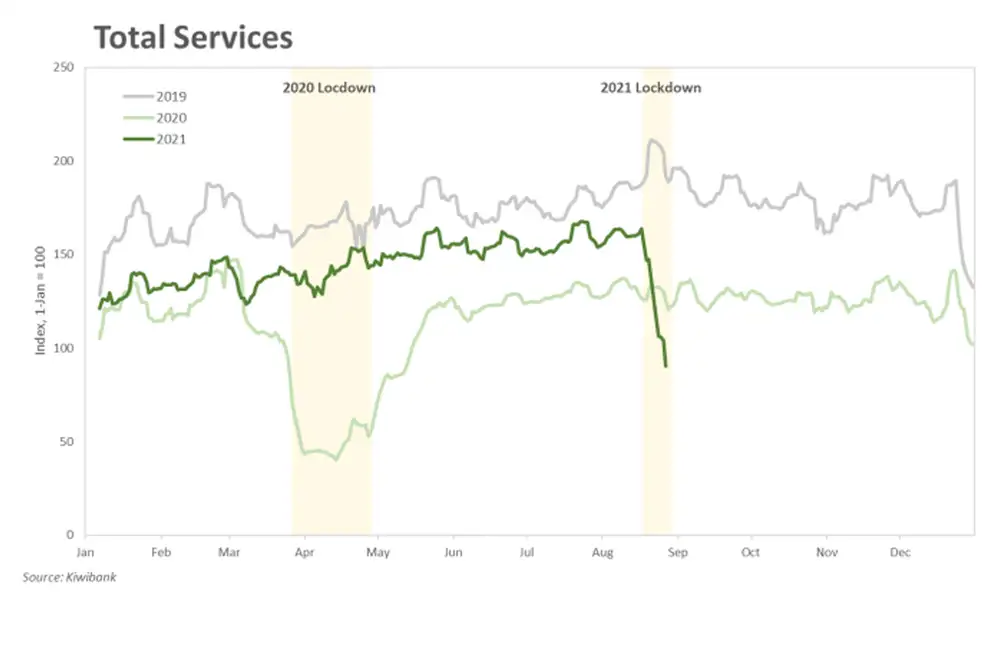

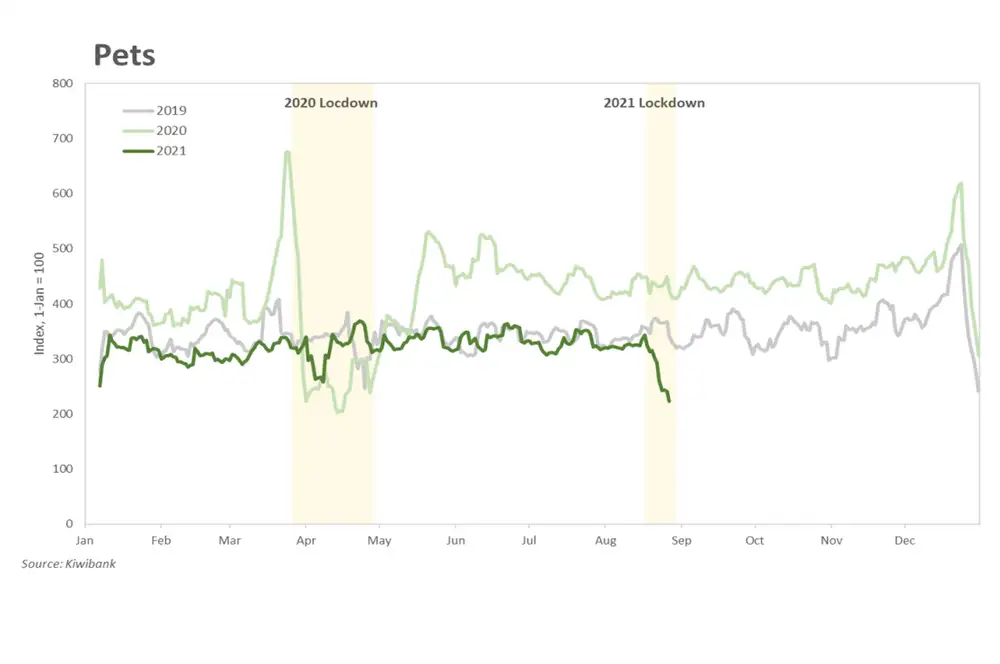

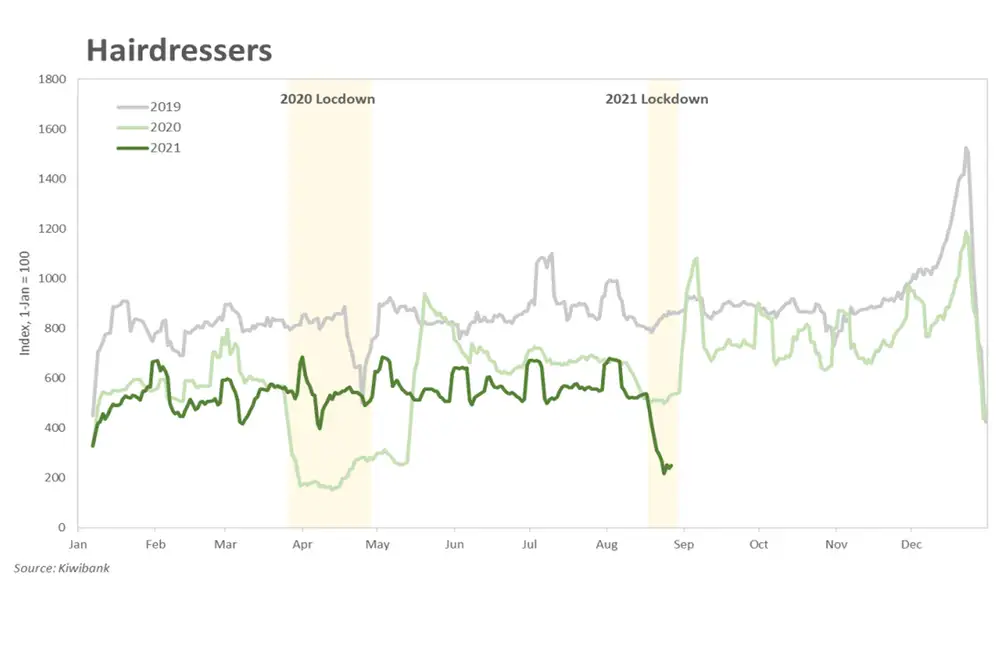

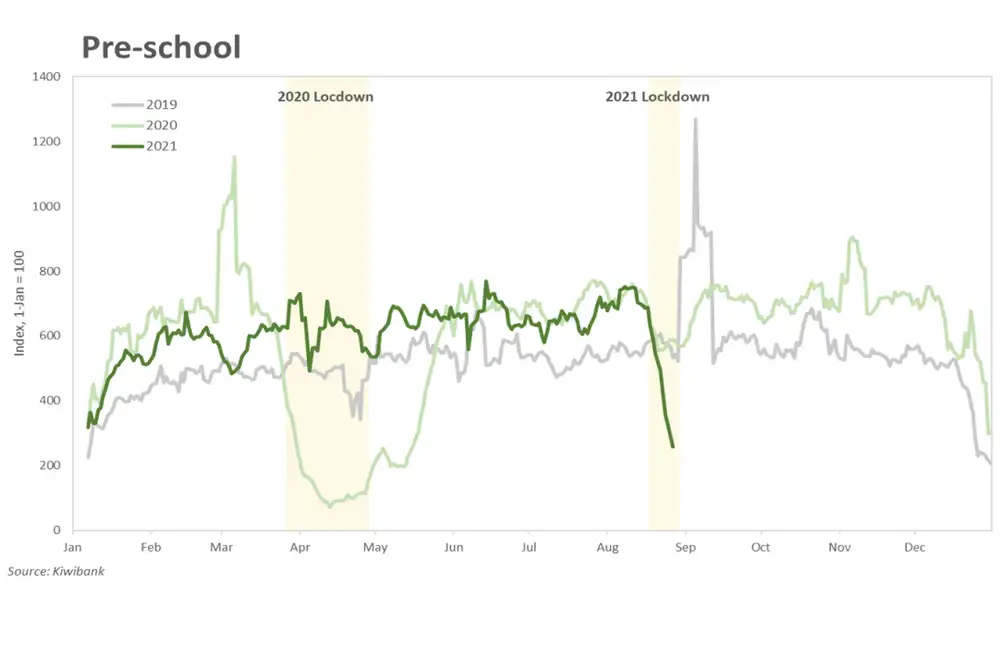

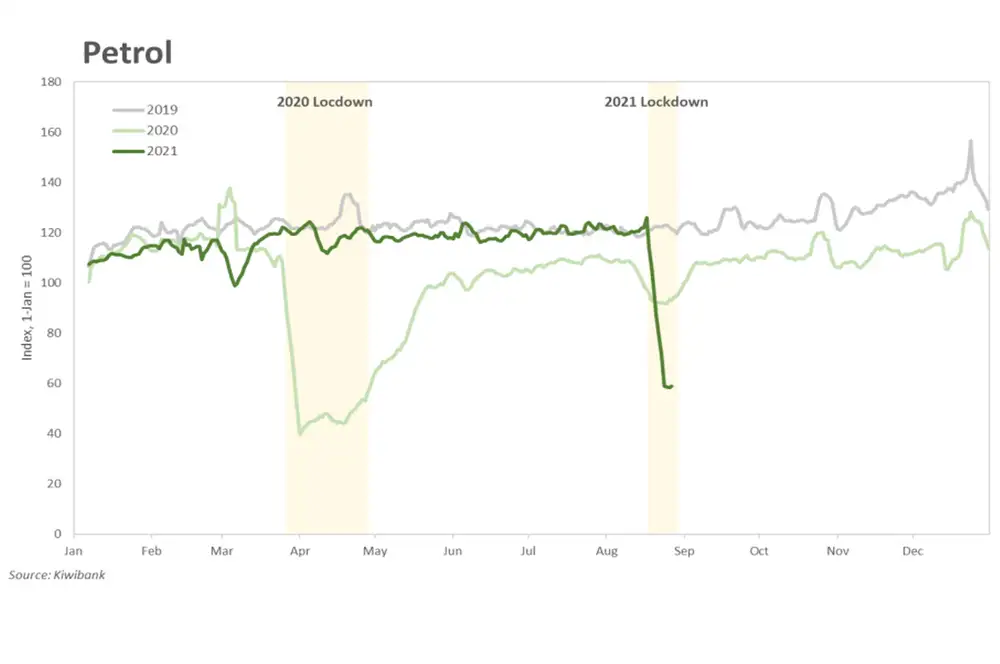

Service industries are hit the hardest

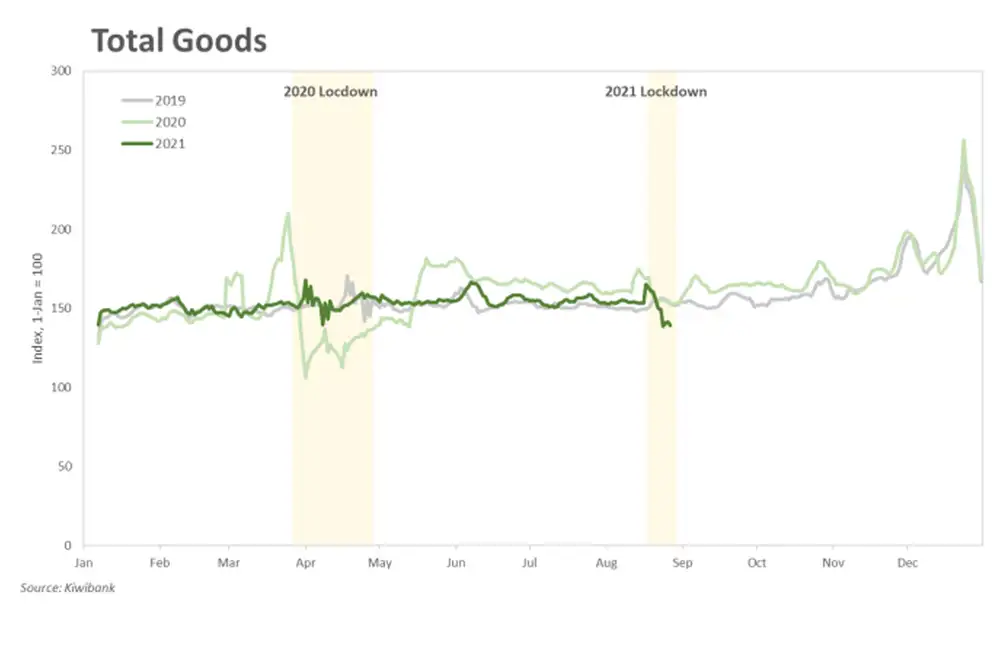

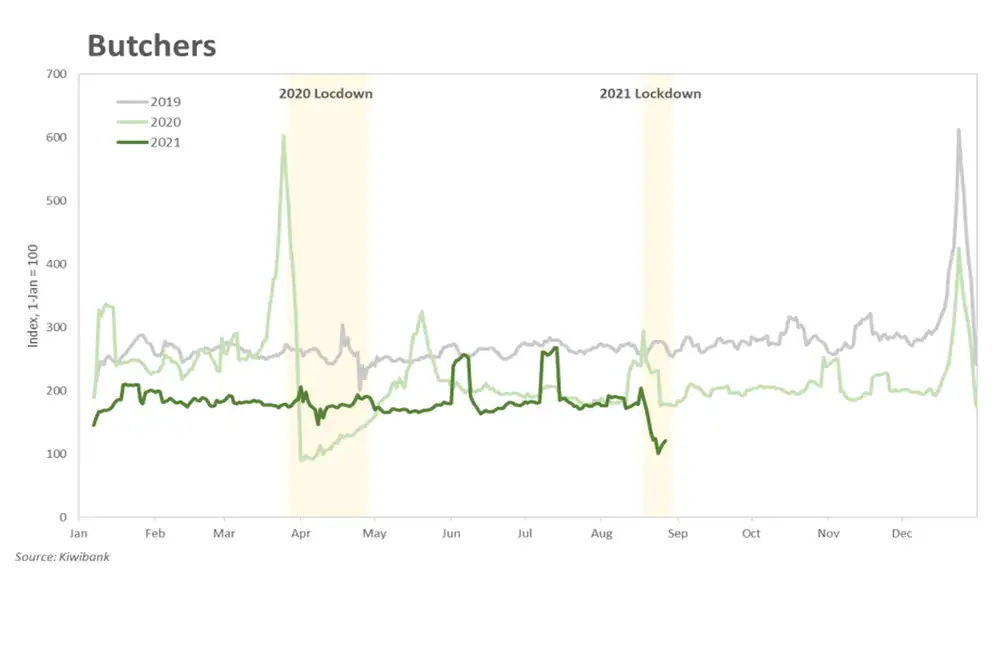

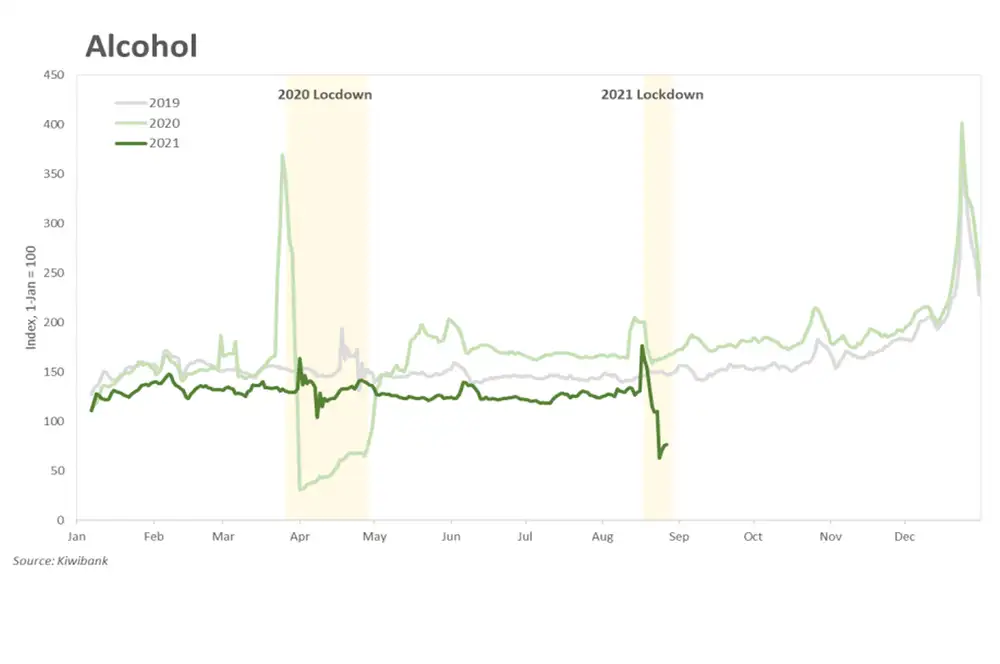

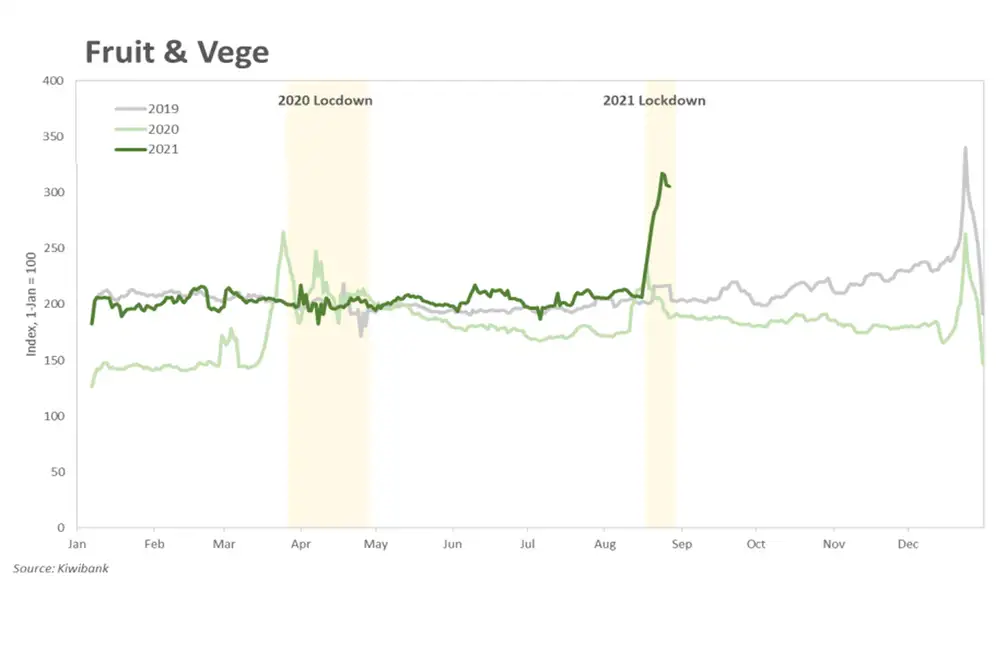

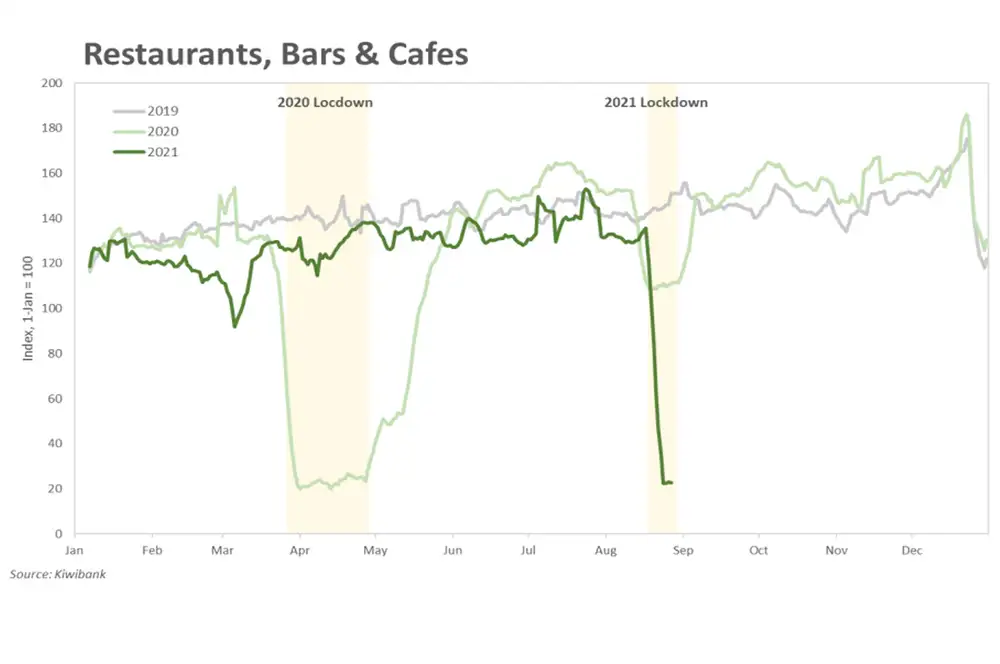

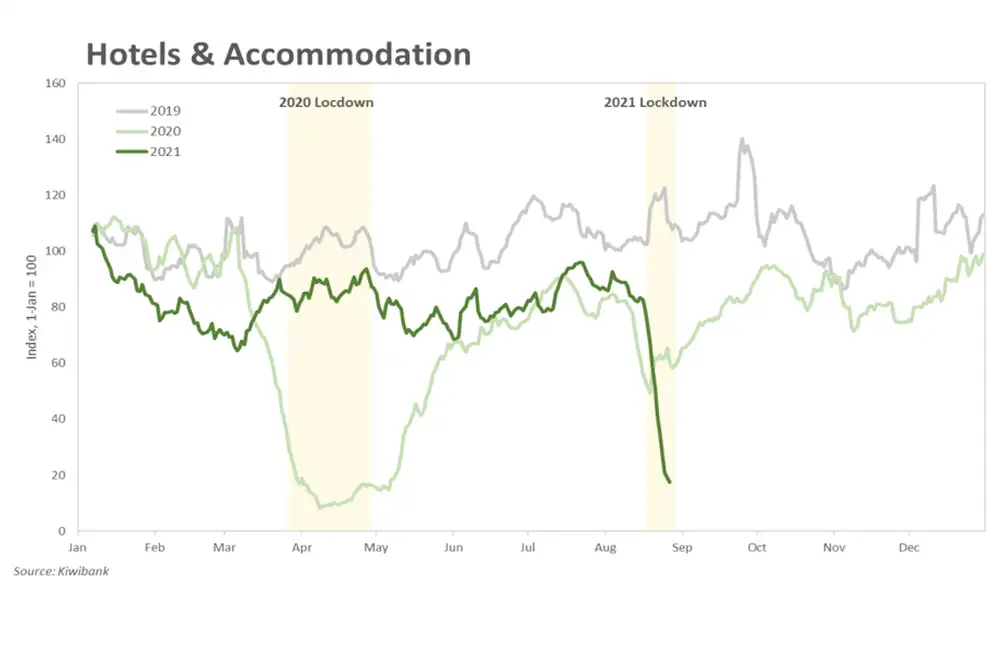

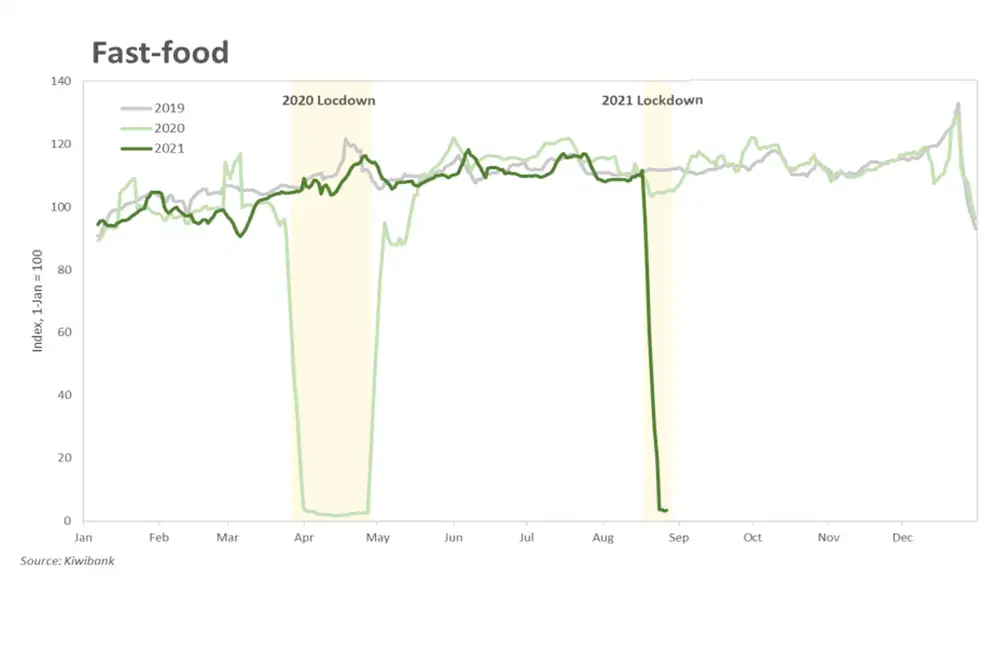

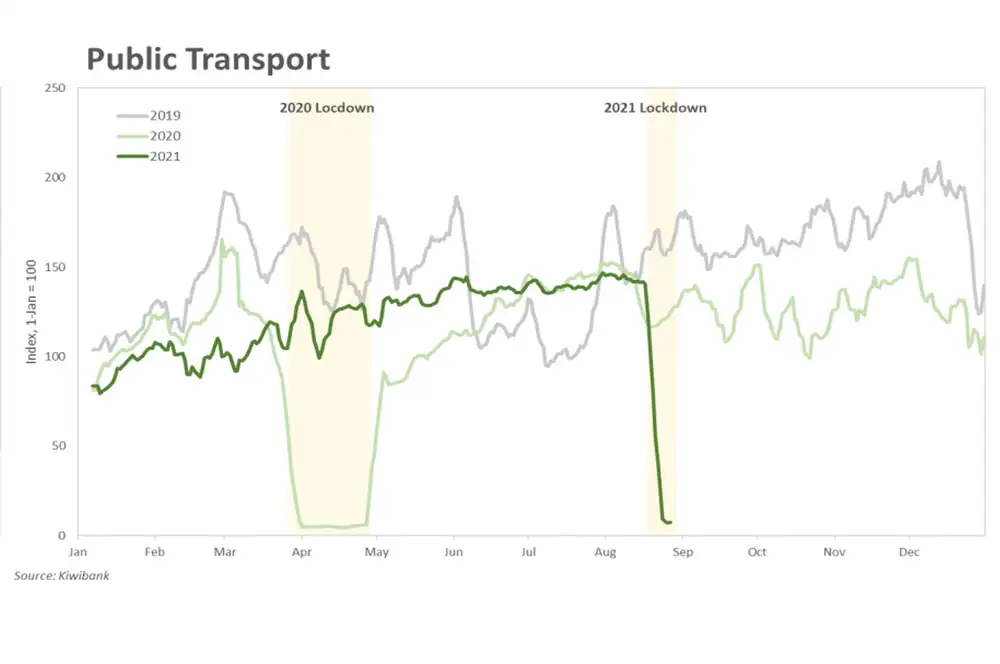

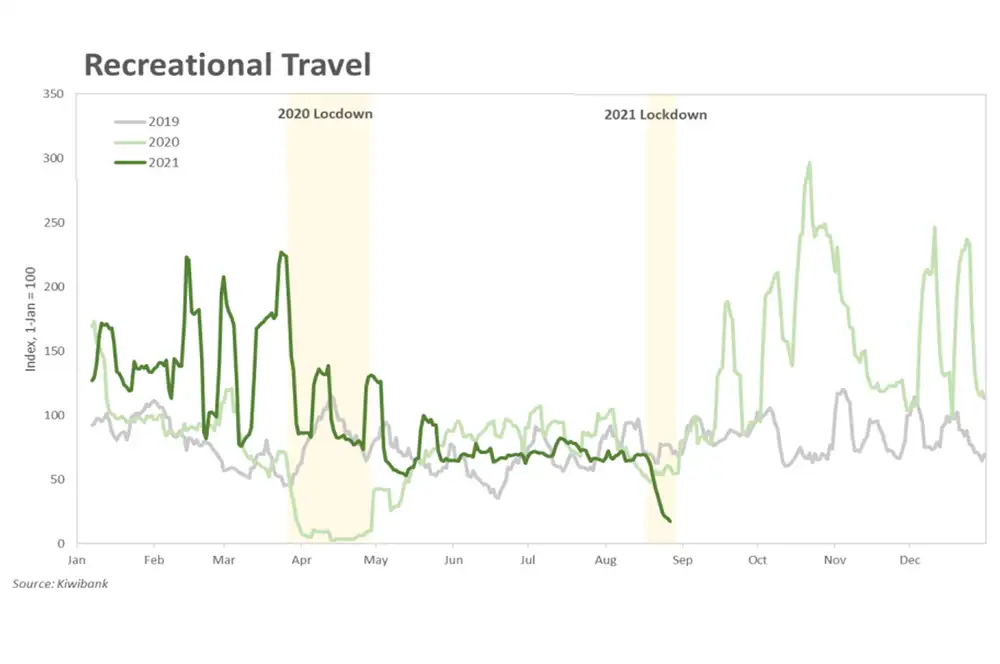

The fall in spend across categories look similar to that seen in Lockdown 2020. Indeed, spend on services has mimicked the drop in 2020. Haircuts can’t be done virtually, and the back kitchen is closed. Hospitality again is the most adversely affected. Spend on transport has also flatlined as the commute to work (from home) for most of us consists of just a few steps. Spend at supermarkets however has spiked once again. In the few hours leading up to the lockdown, Kiwi stocked up to bunker down. And beer, bread and broccoli were top of the list. Throughout the lockdown period, supermarket spend has remained elevated, with few alternatives.

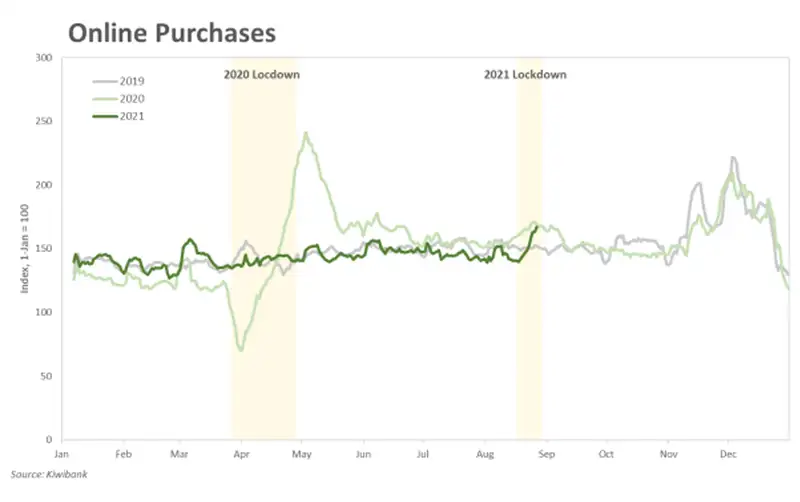

Online resilience

Overall spend is showing better resilience helped by the shift to online.

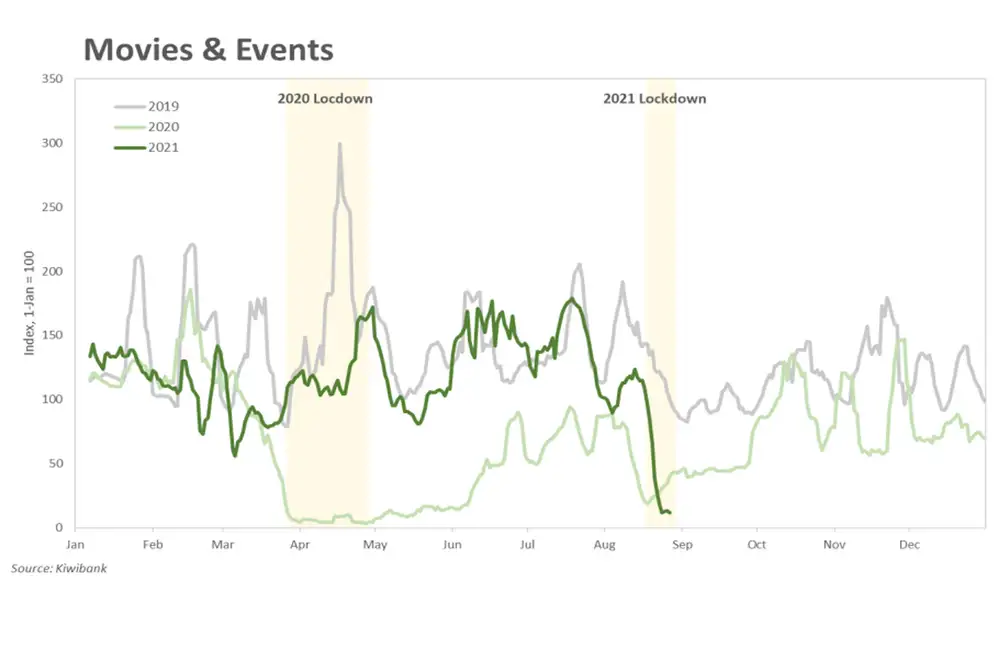

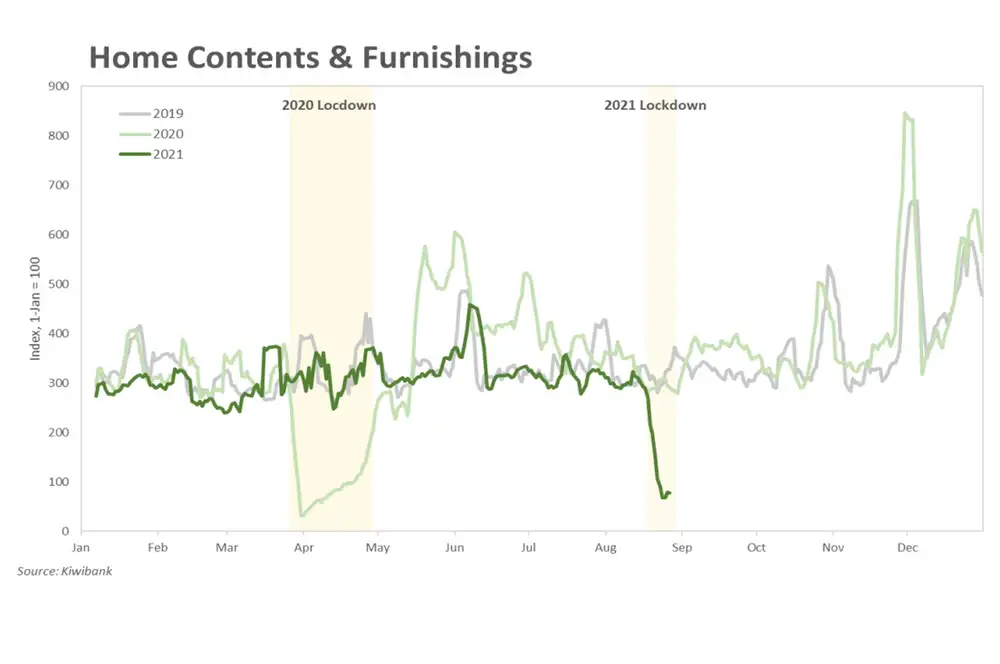

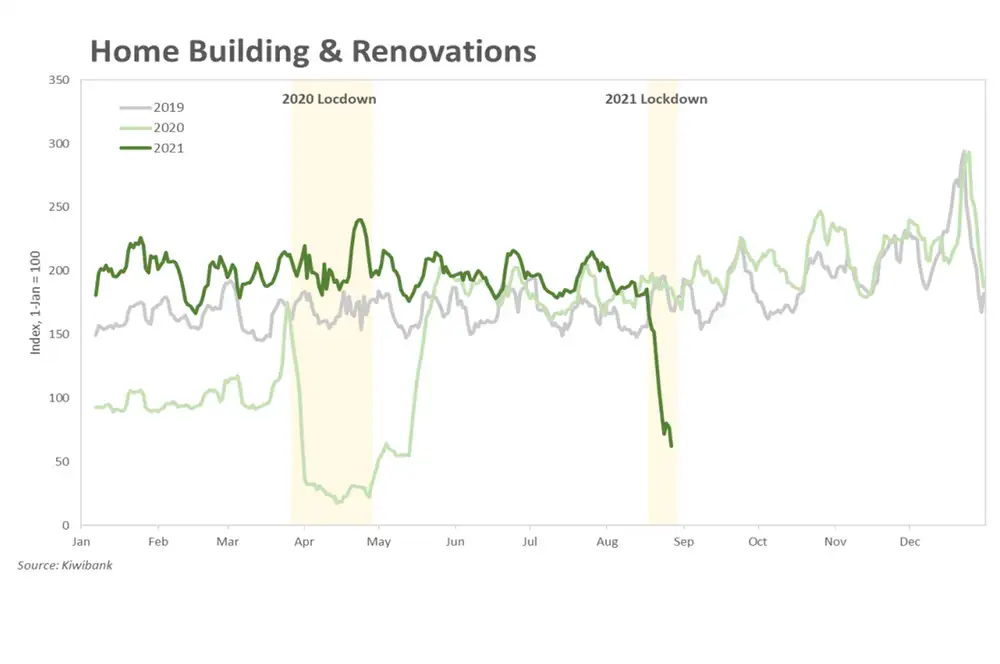

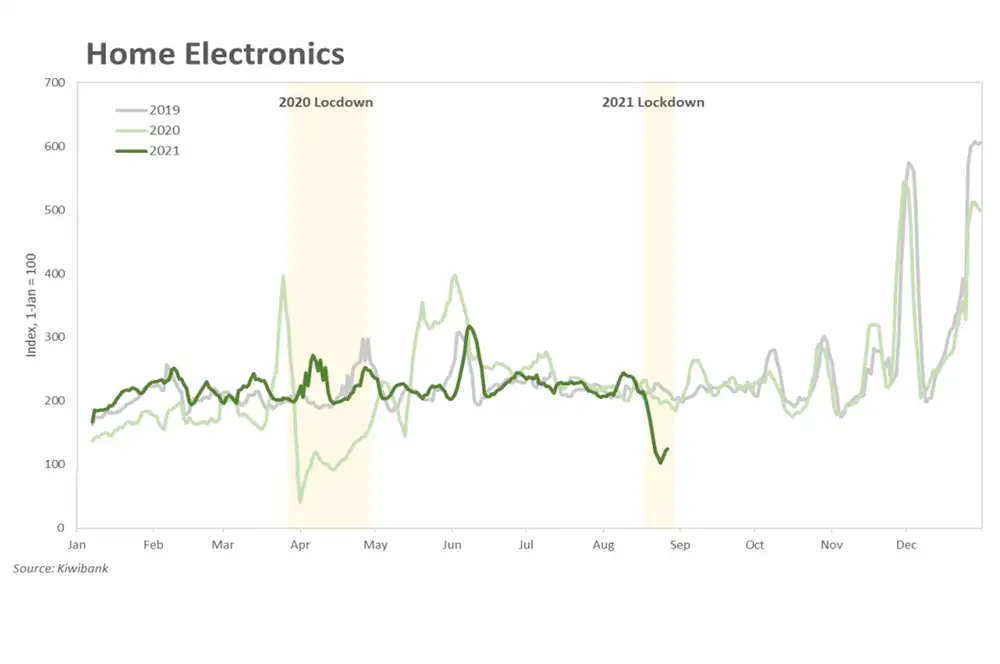

Last year’s lockdown prompted many business to establish an online presence. 18 months later, and it’s paying off. The ability to shop online appears to be supporting spending during the lockdown. We may not be able to collect, but we’re still clicking. Once the restrictions are relaxed, there’ll be plenty of orders ready to dispatch. The drop in spend on home electronics was also not as deep as seen in 2020. Auckland aside, it’s been over a year since many of us have had to work from home, and our equipment is due for an upgrade. Because online retail is holding up better than last year, the drop in overall spend is much smaller than the 45% drop last year. We’ve learnt and we’ve adapted.

Demand is deferred, not destroyed

We have the playbook

The trends in spending are playing out just as expected, if not showing more resilience. Following last year’s playbook, we know that spend will rebound as soon as the restrictions are relaxed. Once we (eventually) move down the alert levels, more businesses will be allowed to operate. Economic activity will bounce back, and spending will catch up. Demand is being digitised or deferred, but not destroyed.

Some spend categories will see an immediate bounce back once in Level 3, namely Fast-food. But for others, spend won’t recover until we enter alert level 2 where restrictions are loosened further. And Auckland is still locked down. It’ll be a slow grind higher for service spend, especially.

An engineered shock

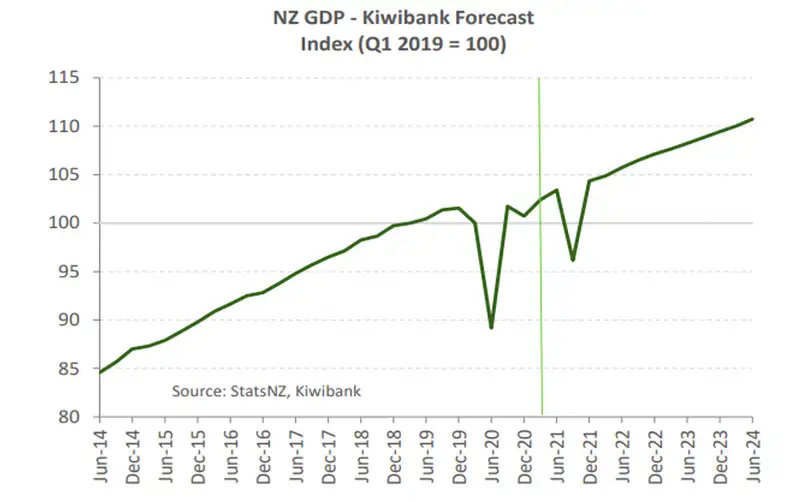

A short sharp lockdown causes a short sharp shock to GDP

We’ve made a first stab at forecasting the current hit to GDP from lockdown. We estimate a 7% decline in the September quarter, followed by an 8½% jump in the fourth quarter. The economy took solid momentum into the current lockdown, with growth of near 1% expected for the June quarter GDP when it’s released midSeptember.

Our estimated hit to GDP is on the conservative side. And we could easily see a fall in GDP in the range of between 5-7%. Our pick is based on guesstimates of the time spent under different alert levels. We expect that NZ will largely be back at alert level 1 by quarter-end. However, delta is an aggressive strain of covid and could easily throw-up a curve ball or two.

Food spend

Hospitality Spend

Household Spend

Retail Goods & Services Spend

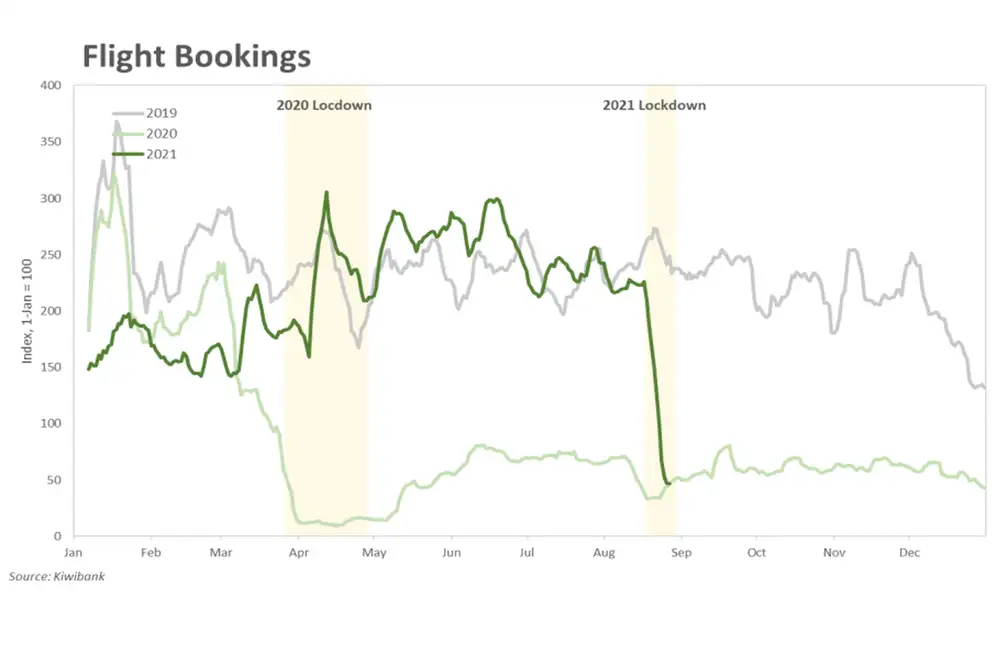

Transport & Travel Spend

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.