- The improvement in business confidence continues. Expectations of further RBNZ rate cuts underpins the improved sentiment. However, experienced trading activity remains weak. There’s risk the current recession is extended. The here and now demands further rate relief.

- Given the weak demand environment, capacity pressures are easing. And that’s good news for tackling (homegrown) inflation.

- The economic outlook has improved, so long as the RBNZ keeps cutting. Businesses are more optimistic. But that optimism has yet to translate into activity.

The improvement in business sentiment continues. The NZIER’s quarterly survey of business opinion (QSBO), the best on the street, shows a further lift in business confidence. In the December quarter, a net 9% (seasonally adjusted) now expect economic conditions to improve in the coming months – a starkly different result to the net 4% of firms in the September quarter expecting a deterioration in the economic outlook. It’s the first positive outlook in over three years (since the June 2021 quarter), and the highest reading since 2017. After hitting a series-low at the end of 2022, business confidence has been on a slow road to recovery. There was a brief improvement in confidence following the change in government. But it has been the pivot in monetary policy that has prompted a stronger, seemingly sustained, lift in sentiment. Since the RBNZ commenced the cutting cycle in August last year, business confidence has lifted almost 50pts. The economic outlook is improving, and Kiwi businesses are lifting their heads.

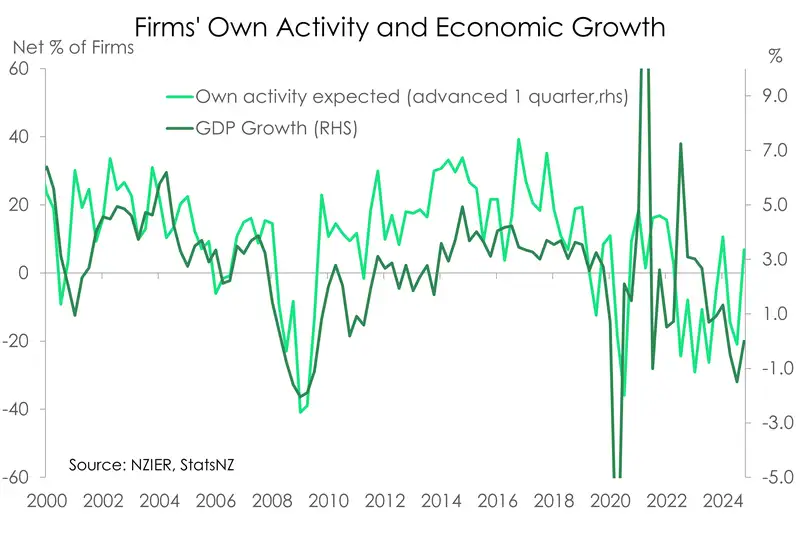

There is light at the end of the tunnel. But it’s still some distance until we’re out of the shadows. According to Kiwi businesses, it is still a challenge to navigate the current economic environment. Experienced activity levels remain subdued, painting ongoing weak demand. Over the December quarter, a net 26% of firms reported a decline in trading activity. There’s risk the current recession is extended. The data points to yet another quarter of the Kiwi economy running backwards. At the very least, below-trend growth remains the near-term outlook.

Expectations of activity however shows promise of a turnaround. A net 9% of firms expect an increase in activity in the next year. The dichotomy between what firms are experiencing and what they expect in terms of activity is clear. That is, businesses are more optimistic. But that optimism has yet to translate into activity.

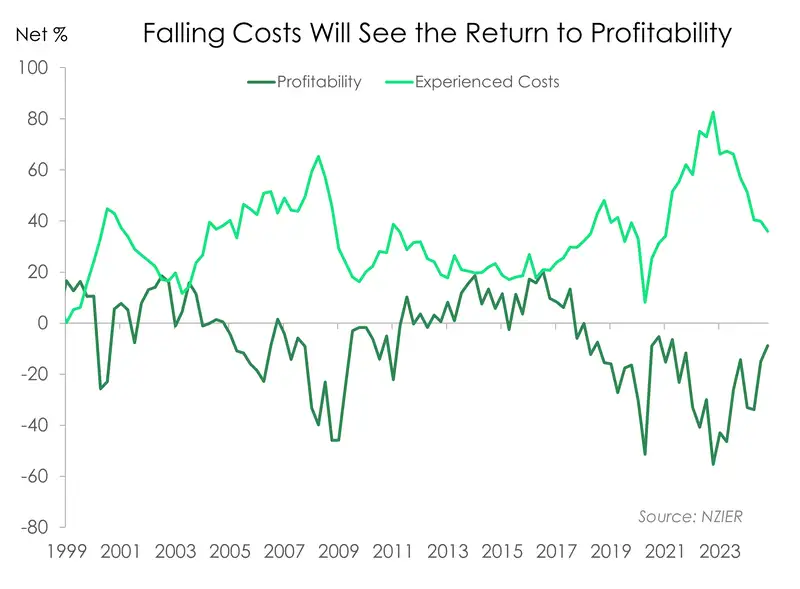

The retail sector is still feeling upbeat about the economic outlook. A net 5% of retailers expect activity to improve next quarter. Lower interest rates, and thus higher disposable incomes, underpins the sector’s optimism. The same is true for the lift in expectations across the services sector. Indeed, all sectors reported an increase in sentiment. But it was the building sector that was crowned the most upbeat over the December quarter. A net 29% of building sector firms were optimistic about the general economic outlook – a whiplash-type change from this time last year when over half of the sector was feeling downbeat about the outlook. Another common thread across the sectors surveyed is that profitability remains under pressure. A net 36% of firms experienced declining profits in the quarter. A weak demand environment continues to hamper the ability of many firms to raise their prices.

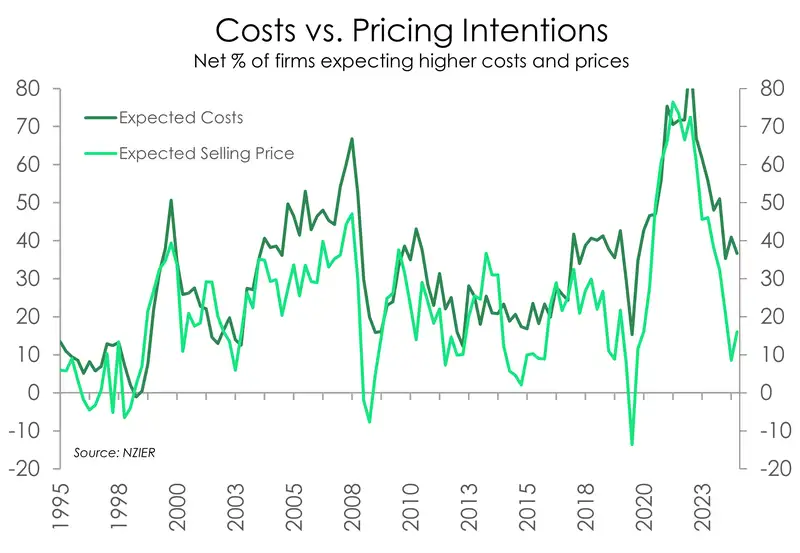

Importantly, today’s report confirmed the continued easing in inflation pressures. Fewer firms reported higher costs over the quarter, and the share of firms that raised their prices also remains historically low. The weak demand environment continues to reduce capacity pressures. And that’s good news for tackling (homegrown) inflation. More firms are reporting the ease in finding labour. And now, the lack of sales is the main constraint on business.

The outlook has improved. But the here and now demands further rate relief from the RBNZ. We continue to expect a 50bp cut from the RBNZ in February. The lift in business confidence is underpinned by the expectation of more rate cuts. The RBNZ must deliver.

Despite the100bps of cuts delivered over the December quarter, firm’s own trading activity remained weak. On a seasonally adjusted basis, a net 26 % of firms reported reduced activity in the December quarter. As we know too well, it will take time for rate cuts to make their way through the economy. But the turn in sentiment, with more rate cuts to come, is sparking hope and expectations for a better start to the year. And we agree. A net 9% of firms now expect a lift in activity in the current quarter. 2025 should be a year of two halves. The second half should see economic growth gain momentum and translate to further lifts in activity for kiwi businesses.

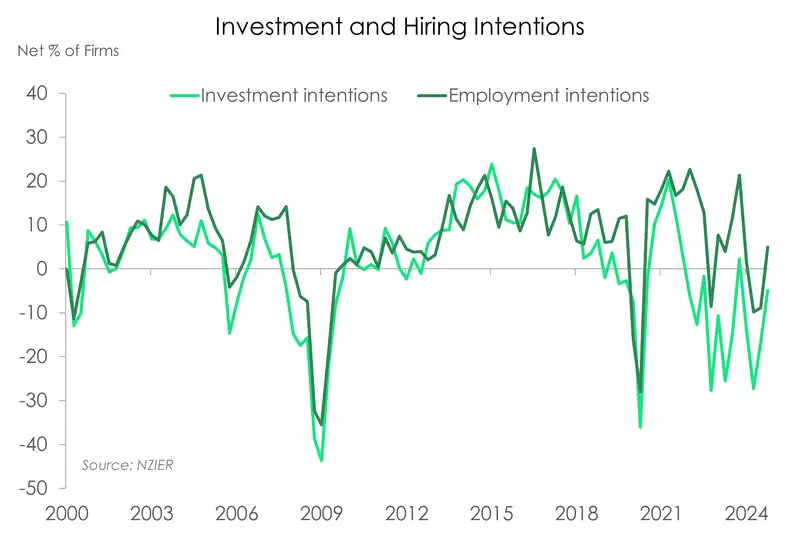

While businesses may be going into 2025 with lifted spirits, caution remains around investment and expansion. Investment intentions overall, though improved from last quarter, remain negative. In the year ahead, A net 14% of firms intend to reduce investment in buildings, while a net 5% intend to reduce investment in plant and machinery. It’s going to take a bit more time and a sustained recovery in demand before firms jump back into the investment game. However, when it comes to staff, it seems some firms are looking to expand their workforce in coming months. A net 5% of firms expect to hire over the coming quarter. Although, we still forecast the unemployment rate climbing further in the near-term. Today’s data confirms as much – a net 17% of firms cut staff in the December quarter. A bit more pain to come.

We’re excited to see more costs pressures coming off for firms. The December quarter saw the smallest proportion of firms experiencing increased costs since March 2021. Just 35% of firms experienced higher costs over Q4, a far fewer number than the net 41% last quarter and the net 56% last year. And while there was a slight pick up in the number of firms raising prices over the quarter, from a net 5% to a net 10%, the proportion of firms raising prices in the December quarter remained historically low. Weak demand is still weighing on firms’ ability to lift prices.

Thanks to falling costs, businesses are slowly beginning to see a recovery in profitability. Yes, there’s still a long way to go before profitability truly returns. A notable share (net 36%) of firms a reported a decline in profits last quarter – but that share is shrinking. High inflation coupled with weakening demand had hurt firms’ profitability. But the inflation dragon has been slayed. That’s one part of the equation solved. The next part is coming out of recession and seeing a return in sustained demand. And with interest rates having further to fall, we’re hopeful for that turnaround this year.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.