- The RBNZ delivered on expectations, cutting the cash rate 50bps to 3.75%. With inflation tamed and expectations anchored, more rate cuts are on their way.

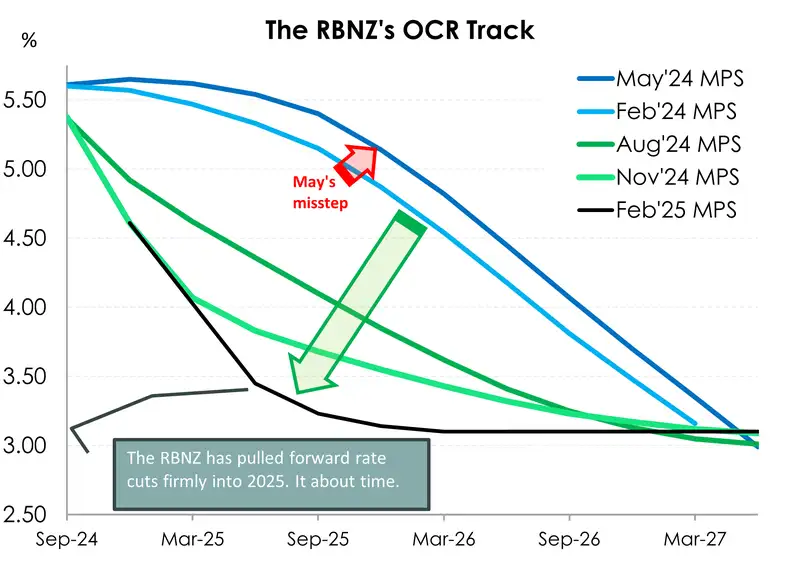

- The RBNZ’s OCR track, which provides guidance on future policy moves, was lowered and pulled forward. There was a welcome drop to 3.14% by year-end. We see risks tilted to the downside.

- Our view remains the same. We have rising unemployment and inflation rangebound near target. Job done. Release the brake and put it in neutral. If anything, the RBNZ may need to stimulate, by putting the economy in drive, tapping the accelerator, and cutting below 3%.

Yes, the RBNZ cut 50bps today, as expected. The cash rate sits at 3.75%. RBNZ officials have proven to be nimble, again, and thankfully. The economy needs help.

But the main message from today's MPS is the lowering of the OCR track (again). The RBNZ are signalling more cuts, sooner. The RBNZ has effectively matched market pricing, and moved closer to our long-held view of a 3% terminal rate. There's only 10bps between us now. It pays to be stubborn. And we agree with the move. We're all on the same page, now.

Here's the key dates: the OCR track implies a 25bp cut in April and May to 3.25%. And then there is a welcome drop to 3.14% to end the year. The track then flatlines at 3.1% out to 2028. That's the RBNZ's way of saying there's a 60% chance they go from 3.25% to 3%. You know, it's kind of needed, but we’re not quite there yet. In time, they should get to 3%. And the risks are to the downside.

We must point out that a 3.75% cash rate remains well above estimates of neutral - which are close to 3%. So, interest rates remain at levels that restrain demand. And after a severe recession, it's hard to justify. We have rising unemployment and inflation rangebound near target. Job done. Release the brake and put it in neutral. If anything, the RBNZ may need to stimulate, by putting the economy in drive, tapping the accelerator, and cutting below 3%.

The REALLY good news is that RBNZ has tamed the inflation beast. And it’s time to drag the economy out of recession. With more interest rate cuts on the way, we see the economy recovering in 2025. Rate cuts are feeding through fast, with 81% of mortgages fixed for less than a year. That points to a firmer recovery in the second half of 2025. Along with gains in the housing market. And of course, 2026 is looking better than 2025, which will be a lot better than 2024.

It’s a confidence game. It’s all about confidence. And we expect the lift in confidence to persist, and eventually feed into activity, profitability, hiring and investment. We’re more confident in the recovery.

Nearing a turning point

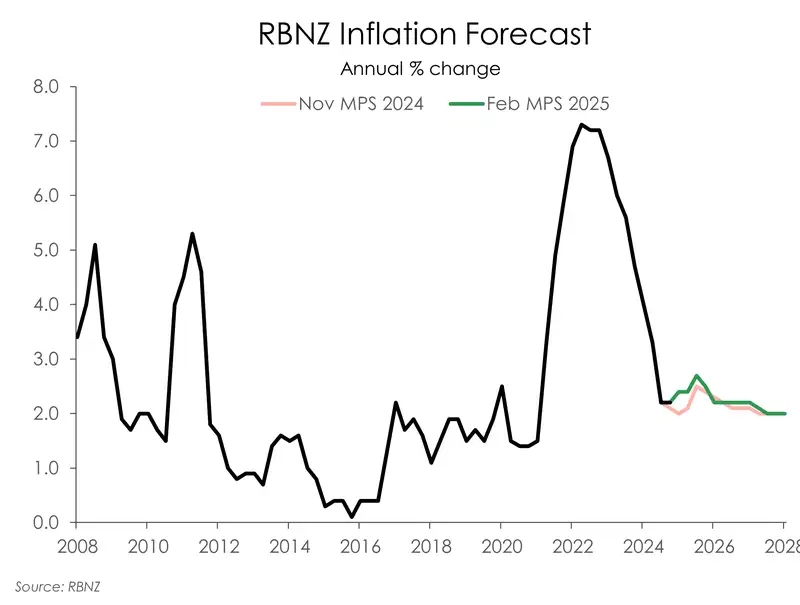

The RBNZ’s new set of forecasts show little change to the outlook. Inflation is forecast to be rather volatile with an upward bias in the near-term, primarily due to the highly uncertain global environment. Between elevated geopolitical tensions and risks of geoeconomic fragmentation, risks are abound. It’s still too early to make any firm conclusions. But as history reminds us, tariffs and trade wars are negative for economic growth and carry inflationary implications.

As we’ve projected, the Kiwi dollar has significantly weakened since late last year. And that’s inflationary. The RBNZ’s forecasts of imported inflation were appropriately revised higher given the weaker currency and rising petrol prices. Negative supply-shocks such as these however should not result in persistent inflationary pressure. So, it’s something the RBNZ should ‘look through’. And comfortingly, spare capacity within the economy continues to put downward pressure on domestic prices, helping to offset a reacceleration in imported inflation. Inflation is stabilising at the 2% targeted mark.

“Non-tradables inflation has fallen but remains high. With spare productive capacity remaining in the economy over the next 12 months, the Committee is confident that domestic inflationary pressures will continue to abate.” (RBNZ Feb’25 MPS)

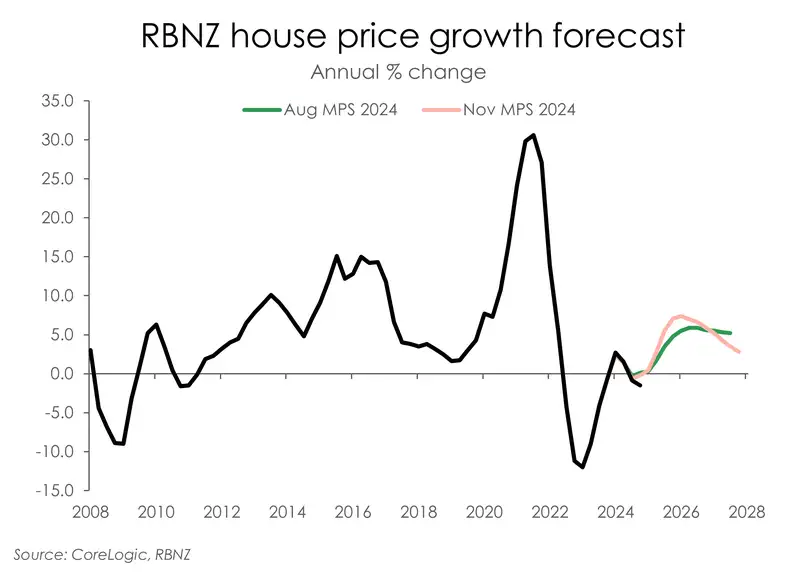

Turning to the housing market, the RBNZ, like us, sees the move toward lower interest rates as a key driver for a rebound in housing activity. However, with cooling net migration and a still sluggish housing market, the RBNZ now expects a more gradual and subdued growth trajectory for house prices. 2023 marked a year of record-breaking net migration growth. But 2024 marked a year of record-breaking migration outflows. We had 128,700 migrants leave the country over the December 2024 year – provisionally, it’s the highest departure numbers on record for an annual period. Despite this, net migration overall remains positive. But it's running at a considerably slower pace and likely feeding through onto housing demand. As a result, the RBNZ now forecasts house price gains to peak at 5.2% (down from an earlier projection of 7.4%), with the peak expected to occur later, in the second half of 2026, rather than in the first quarter.

Overall, the outlook is broadly unchanged. And similar to ours. The Kiwi economy is expected to stay in this awkward phase for a little while longer. Economic growth lacks a pulse and unemployment is still climbing. The RBNZ sees unemployment peaking at 5.2%. We are however, nearing a turning point – if not there already. Some more timely indicators of economic activity, already show signs of improvement. The second half of 2025 should see growth gather pace, and a rebound in employment demand.

Matching market means minimal movement

With today’s move perfectly priced by markets, the move in Kiwi yields was mostly minimal. Following the RBNZ announcement both the 2-year and 5-year swap rates dropped 6bps to a low of 3.48% and 3.76% respectively. Though much of the move has reversed with the 2-year sitting at 3.52% and the 5-year at 3.80% at time of writing. Market pricing remains largely unchanged from prior to the MPS announcement, with the RBNZ’s fresh OCR track effectively meeting market.

On currencies, the Kiwi took a roundtrip. Market traders ran with the key quote from the MPS – “scope to lower the OCR further through 2025” – which saw the Kiwi flyer lose flight, dropping 30bps and hitting an intraday low of 56.78USc. However, a signal from the Governor during the press conference that there may be no more 50bps cuts up its sleeves, saw the Kiwi pare its losses against the Greenback. As the updated OCR track projects, the RBNZ is likely to move in more measured 25bp increments from here.

We expect the Kiwi dollar to remain in a broad downtrend in the next 3-6 months. The speed and magnitude of expected easing (rate cuts) underpins our currency forecasts. And we expect the RBNZ to deliver a more aggressive cutting cycle than its peers. That is indeed the case for the US Federal Reserve. Recent comments from officials signal “no rush” to adjust their policy stance.

RBNZ statement

“Annual consumer price inflation remains near the midpoint of the Monetary Policy Committee’s 1 to 3 percent target band. Firms’ inflation expectations are at target and core inflation continues to fall towards the target midpoint. The economic outlook remains consistent with inflation remaining in the band over the medium term, giving the Committee confidence to continue lowering the OCR.

Economic activity in New Zealand remains subdued. With spare productive capacity, domestic inflation pressures continue to ease. Price and wage setting behaviours are adapting to a low-inflation environment. The price of imports has fallen, also contributing to lower headline inflation.

Economic growth is expected to recover during 2025. Lower interest rates will encourage spending, although elevated global economic uncertainty is expected to weigh on business investment decisions. Higher prices for some of our key commodities and a lower exchange rate will increase export revenues. Employment growth is expected to pick up in the second half of the year as the domestic economy recovers.

Global economic growth is expected to remain subdued in the near term. Geopolitics, including uncertainty about trade barriers, is likely to weaken global growth. Global economic activity is also likely to remain fragile over the medium term given increasing geoeconomic fragmentation.

Consumer price inflation in New Zealand is expected to be volatile in the near term, due to a lower exchange rate and higher petrol prices. The net effect of future changes in trade policy on inflation in New Zealand is currently unclear. Nevertheless, the Committee is well placed to maintain price stability over the medium term. Having consumer price inflation close to the middle of its target band puts the Committee in the best position to respond to future inflationary shocks.

The Monetary Policy Committee today agreed to lower the Official Cash Rate by 50 basis points to 3.75 percent. If economic conditions continue to evolve as projected, the Committee has scope to lower the OCR further through 2025.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.