It was sobering to hear RBNZ Chief Economist, Paul Conway discuss the brutal truth of Kiwi growth beyond the current business cycle. Yes, a recovery in activity is expected for the Kiwi economy. But there are some structural issues that are going to inhibit both the quality and size of the recovery.

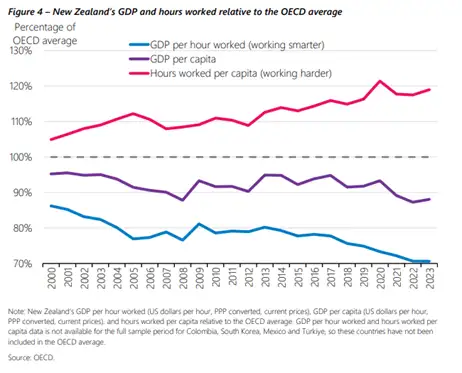

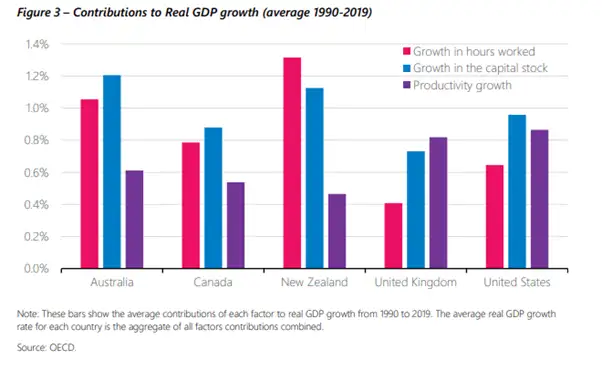

The main factor holding us back is our favoured labour-intensive approach to economic growth. But it’s not working, as labour productivity has been in steady decline over the years. We have been engineering growth by simply deploying more people and working longer hours. We’re working harder, not smarter. And it’s getting us nowhere. Kiwi now work almost 20% more hours per person than the OECD average but produce around 25% less output per hour. Our output per capita is underperforming, and our rank among OECD economies fall from 2nd place to 20th.

Our geographical isolation isn’t helping either. At the bottom of the globe, international markets are hard to reach. We’re simply less connected with the rest of the world. And as a result, we’re, as Conway described, “technology laggards”, which doesn’t help us work any smarter.

And adding to the problem is our immensely shallow capital markets. We’ve overinvested in housing (an unproductive asset) and underinvested in everything else. The solutions, though easier listed than implemented, are right in front of us. Investment in businesses, infrastructure, research & development, and even education, are all needed. And alongside it, we need the right policies to support long-term investments. We’ve had governments talk the talk. Now we need them to walk the walk.

For more, we really recommend checking out Conway’s speech “Beyond the cycle: Growth and interest rates in the long run.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.