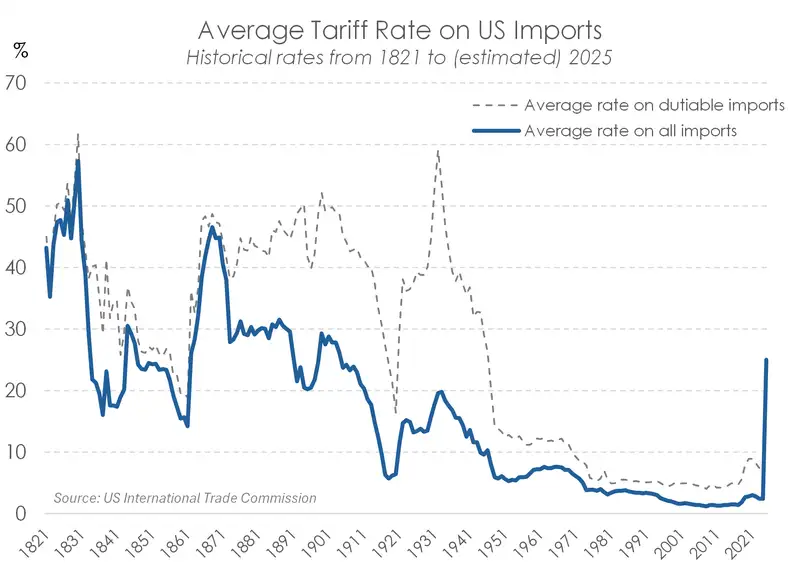

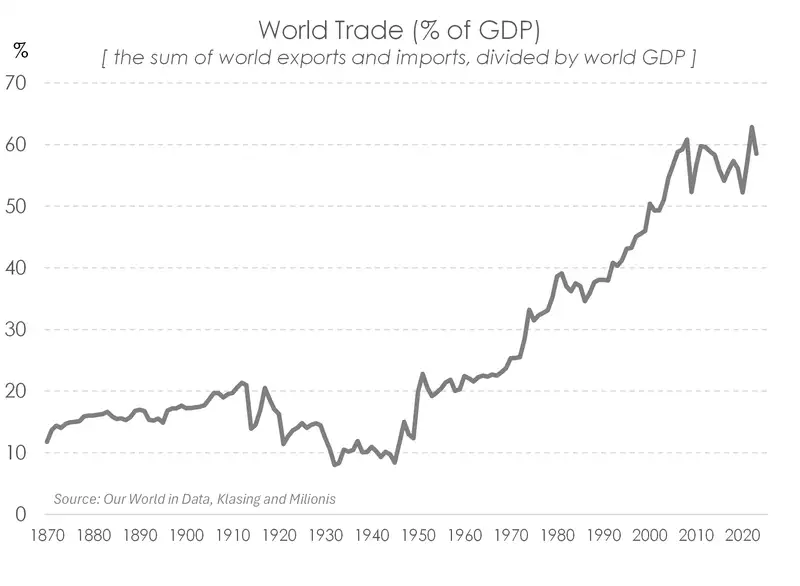

Our chart of the week plots the average tariff rate on US imports all the way back to the 1800s. Trump’s “Liberation Day” tariffs will take the average rate to the highest level since 1906, before the first world war. A hundred years of reducing tariffs, and globalisation, is now reversing. Our second chart plots the rapid globalisation post world war II. But globalisation became slowbalisation with risk of deglobalisation after the 2008 global financial crisis. Trade wars will only make this ‘trend’ worse.

Between escalating geopolitical tensions and growing risk of geoeconomic fragmentation, the global outlook is shrouded in uncertainty. Trump’s “Liberation Day” has left us contemplating how much all these tariffs will weigh on global growth. And it’s still hard to quantify, but negative nonetheless.

We see the downside risks to global growth dominating the economic landscape, magnified in retaliations, and painful for our exporters.

But it could have been a worse… NZ may be getting off relatively lightly, with the blanket 10% tariff. But a heavier hand was dealt on China (54%) and other Southeast Asian countries. On the one hand, our exports may become relatively attractive compared to other competitors facing higher tariffs. And on the other hand, these tariffs will hurt our largest trading partners, especially China, potentially reducing demand for our exports.

Wholesale interest rates have moved decisively lower following the said “tariff debacle”. Lower global growth puts downward pressure on commodity prices, including Kiwi commodities, and may reduce demand for our exports. If some or all of these tariff hikes hold, then there is a growing case to be made for stimulatory monetary policy. And that means cutting assertively below 3%... the market is pricing in a good chance of 2.5%.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.