Looking deeper into the details of the recent labour market report reveals sobering weakness. Worker demand continues to wane, with employment contracting 0.1% over the quarter, and down 1.1% over the year. It marks the second consecutive annual decline for employment growth and the deepest since the GFC.

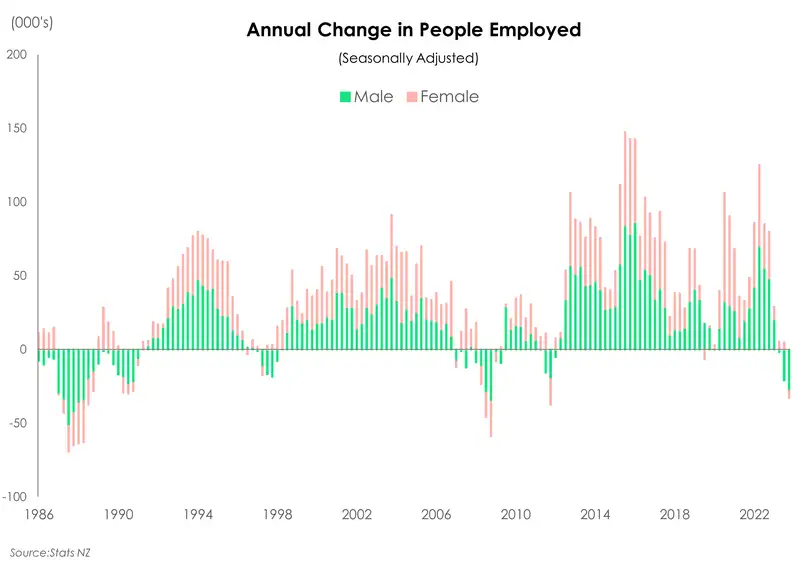

Digging into the demographics, men have borne the brunt of job losses in 2024. Of the 32k decline in employment, 85% were men. According to Stats NZ, employment losses were concentrated in male-dominated occupations – notably, technicians and trades workers, and machinery operators and drivers.

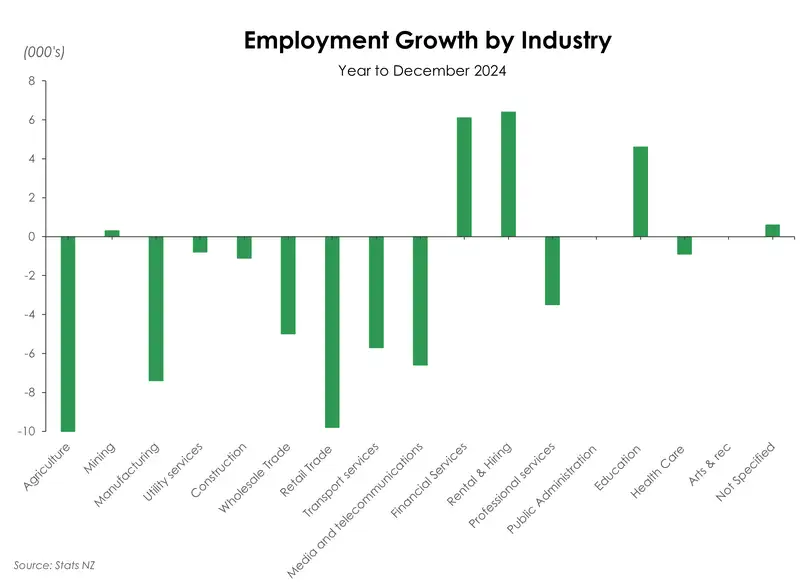

The bulk of job losses over the year were concentrated in the agricultural sector (20%), as well as retail trade (19.6%) and manufacturing (14.8%). Somewhat surprisingly, job losses across the construction sector were not as deep as we’d expect given the downturn in activity. Construction made up just 2.2% of total job losses in 2024. We’d expect a larger share but employment expanded 3.2% over the December quarter, breaking a six-quarter streak of either flat or declining jobs growth. It’s still early days, but it may be the beginning of a (slow) recovery for the construction industry. We’re hopeful for a gradual expansion in the sector from here as lower interest rates and a warmer housing market support the industry

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.