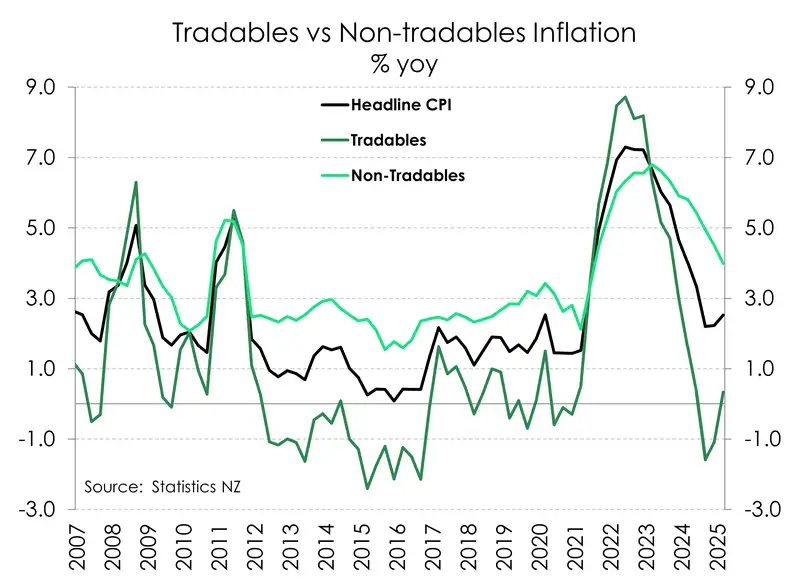

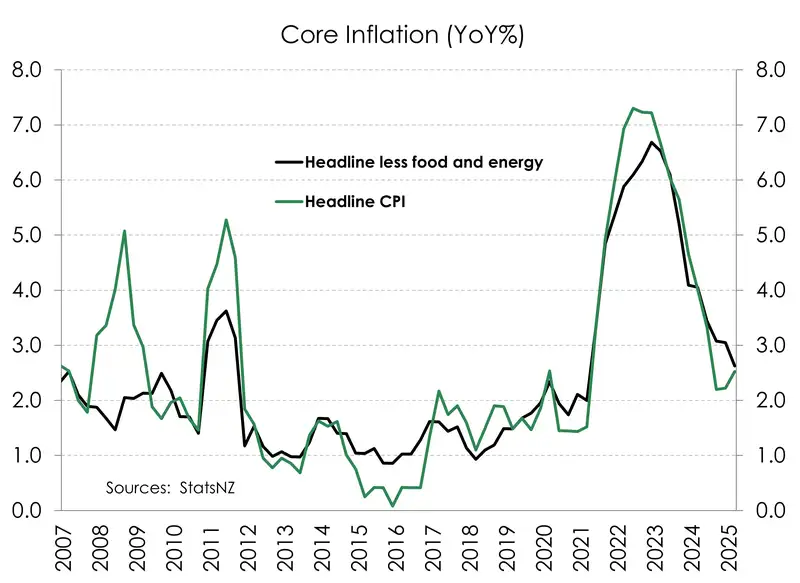

Kiwi inflation accelerated at the beginning of the year. The annual headline rate lifted to 2.5% from 2.2%. The move in the headline rate is in the wrong direction. Tradable (imported) inflation continued to creep higher, moving from -1.1%yoy to 0.3%yoy. The lower Kiwi dollar no doubt had a hand in this. But there’s no need to panic at the monetary HQ. Inflation remains within the RBNZ’s 1-3% target band. And most importantly, the underlying trend in consumer prices continues to be one of cooling. Excluding the volatile movements in food and fuel, annual core inflation has fallen to 2.6% - the first time below 3% since March 2021.

The RBNZ would also take comfort in how domestic inflation is progressing. Annual non-tradables is peeling further away from the 6.8% peak, now sitting at 4%. Rental inflation was a key driver, but it’s strength is fading. For the first time since 2021, annual rent increased by less than 4% (at 3.7%). Home construction costs also continue to cool significantly, dropping to 1.9% - the lowest since September 2010. Also symptomatic of a weakening economy and labour market is the continued slowing in services inflation, from 4.8% to 4.2%. There are still some lingering frustrations, especially when it comes to council rates and insurance. Nonetheless, domestic price pressures, in aggregate, are cooling.

The prospect of a global trade war will likely keep downward pressure on prices. Whether that’s a consequence of a slowdown in global economic growth or a diversion of trade marked at a discount. Downside risks to medium-term inflation are growing. And so the case for more accommodative interest rate settings is strengthening. More is needed from the RBNZ to stimulate the recovery into 2026 and beyond. We believe households and businesses need rate relief. We expect the RBNZ to deliver another 100bps of rate cuts to a 2.5% cash rate by the end of the year.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.