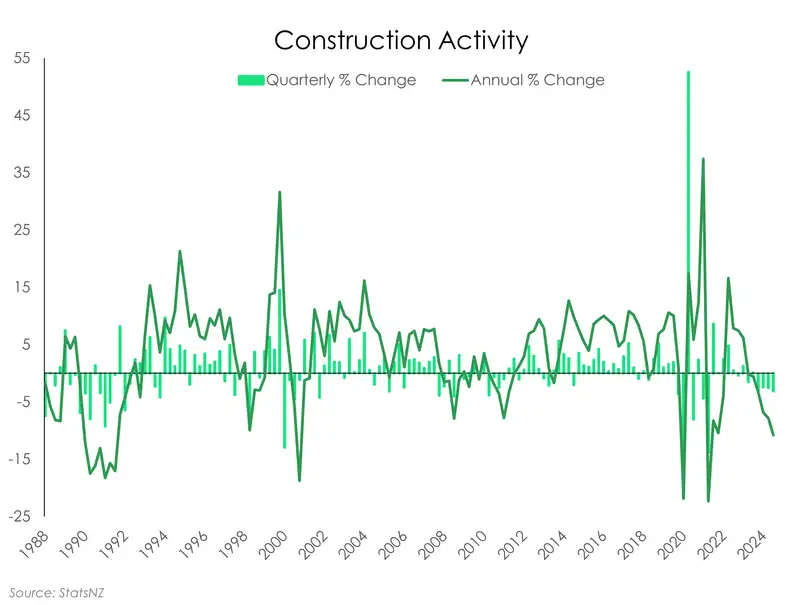

One area we thought warranted particular attention in last week’s GDP report was the ongoing decline in activity within the construction sector. While falling consents and a decline in building activity had already signalled another contraction, the 3.1% drop in construction activity certainly still stung. On an annual basis, things are even more grim. Activity has plunged a massive 10.8%. Excluding the Covid period, that’s the deepest decline in over 20 years.

The declines, as painful as they are, come with little surprise given the combination of high building costs and a sluggish housing market. However, with the construction industry being highly sensitive to interest rates, we remain hopeful that lower rates and a stronger housing market will provide the much-needed spark to revitalize the sector.

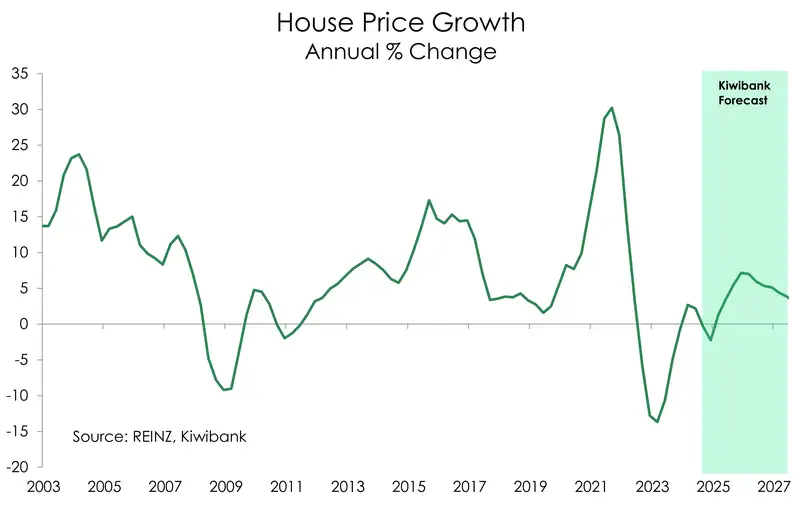

With lower rates continuing to take effect, we remain optimistic that house prices will increase by 5-7% in 2025, which should, in turn, provide a boost to the construction industry.

It’ll take some time but we’re starting to see some green shoots in the latest REINZ data. House prices rose 0.4% (seasonally adjusted) in February, marking the highest monthly gain in about a year. Activity in the market is also picking up. For the first time in three months, sale volumes increased, and the median days to sell is slowly decreasing, from 47 to 46 days. While these are small improvements, they are encouraging, especially given the surge in new listings we’ve seen over the past couple of months. Currently, the total housing market stock is at its highest level in nearly a decade which in the near term is capping price growth. However, as we work through this stock and as lower rates take effect, we expect to see a more substantial lift in activity and gains as the year progresses.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.