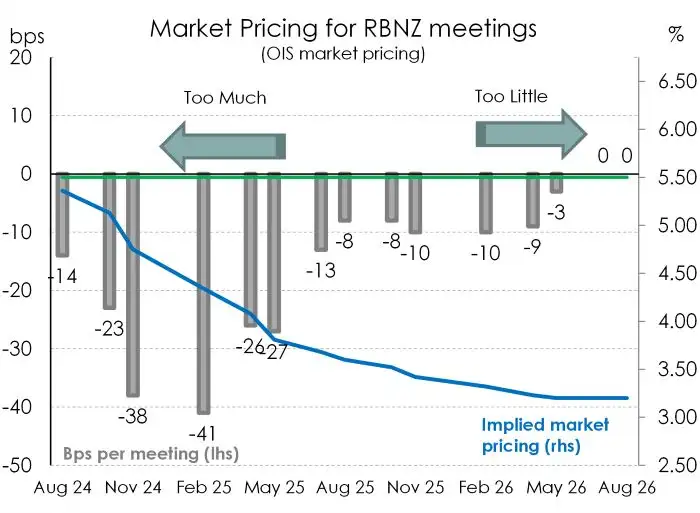

We find ourselves in an interesting situation. We have been banging the table for rates cuts. And we were (proud) outliers when calling for cuts to commence in November. That view is now consensus. And market traders are betting on more, a lot more. Market implied pricing for the RBNZ has collapsed.

In our charts of the week, we highlight the moves. Our first chart plots the pricing, per meeting, out to 2026. Traders have 14bps, or 55% chance of a 25bp, for 14th August MPS. For October’s MPR, there’s 37bps to 5.13%. And November is punchy, with a full 75bps to 4.75%. Remember, we were once outliers calling for 25bps in November. In February 2025, the market has a whopping 41bps for that meeting alone, taking the cash rate to 4.33%. We broadly agree with the pricing. This is what should happen. But will it? Probably not.

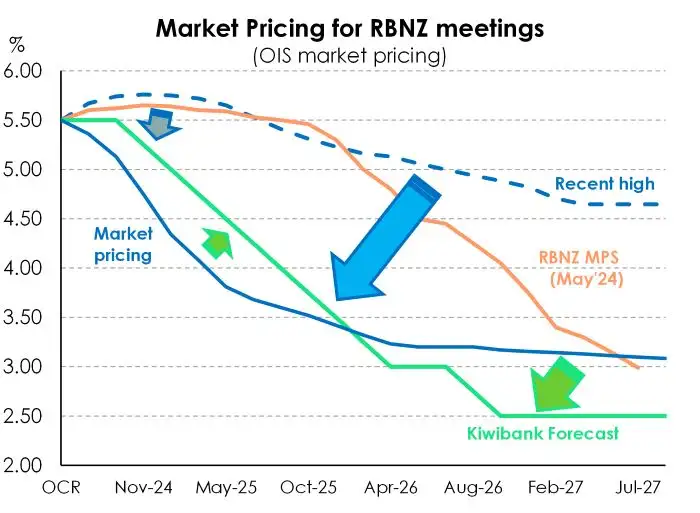

Rate cuts from August is a massive move from the RBNZ’s current OCR track. There’s a 3-day camel trek between market pricing, and RBNZ forecasts. One of them is wrong. We suspect the RBNZ will move much closer to the market, and deliver at least one cut this year. At the same time, market pricing will be pushed out again. Our second chart shows the gap between the market (blue line) and the RBNZ (orange line). Our forecasts are also illustrated in green. We think the market will prove to be a little aggressive near term, but still lacks the downside risk to the terminal rate. The RBNZ’s terminal rate should be close to their forecast neutral rate of 2.75%. The market has 3.2%. And we see a move slightly below neutral to 2.5%. Either way, the magnitude of cuts to come, is big. And that’s what businesses and households focus on.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.