You may have heard last week that Stats NZ announced some changes and revisions to their GDP calculations. As such it seems like much of the recession we’ve been in over the last couple of years is going to be ‘technically’ revised away. Initial estimations show real GDP growth is likely to be revised up by 0.8%pts in the year to March 2023. And in the year to March 2024, economic activity is expected to be revised a solid 1.1%pts up. Overall implying that the Kiwi economy did not shrink by as much as previously reported. We’ll find out more in a fortnight (Q3 GDP data release).

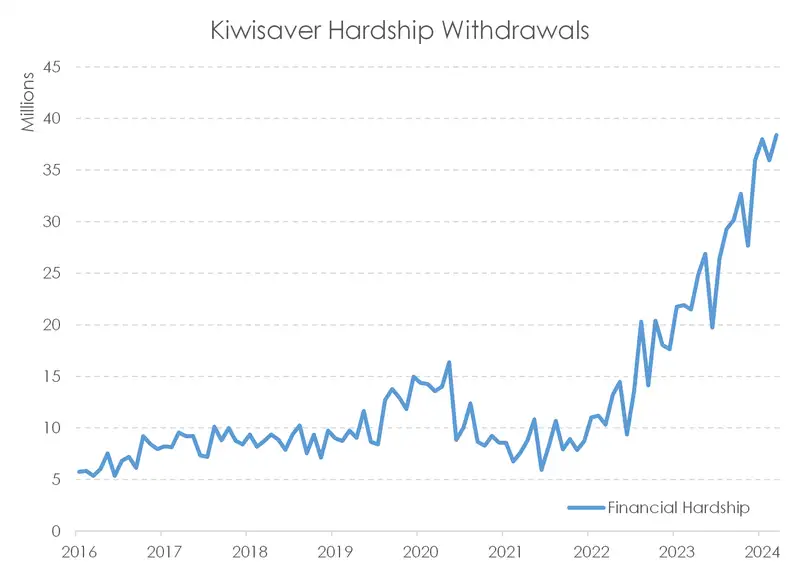

But regardless of the revisions, the Kiwi economy is still in a recessionary environment. And there’s plenty of recent data showing the ongoing pain and weakness out there. Take KiwiSaver withdrawals for example. “Hardship withdrawals” have spiked from $10 million is January 2023, to $38 million in October. These withdrawals are not easy to make. “To withdraw savings, you will need to provide evidence you are suffering significant financial hardship.” That’s significant financial hardship as a direct impact of restrictive monetary policy settings.

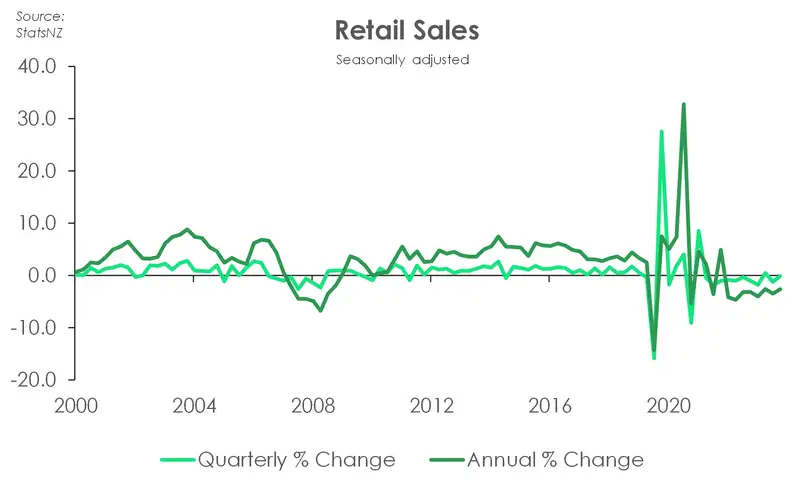

Then there’s the ongoing weakness in consumer spending. Last week, StatsNZ released the latest data in retail spending which showed another quarter of declines across the industry. The September quarter marked the eighth annual decline in retail sales with sales contracting 2.6% over the year. That’s two years of decline! And lines up perfectly with the two years of recession we’ve been in. Consumer confidence is starting to pick up now with the rate cutting cycle underway. But it will take time to see this translate through to sales as households recuperate their savings.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.