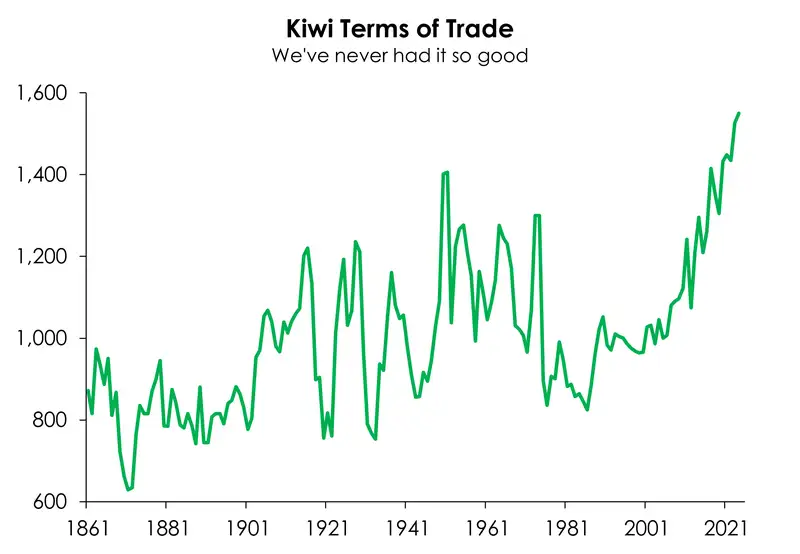

Terms of trade is the ratio of prices at which a country sells its exports to the prices it pays for its imports. Put simply, terms of trade is a measure of a country’s purchasing power with the rest of the world. And at the end of last year, NZ’s terms of trade improved off the back of higher export prices for meat and dairy. Over the December quarter, export prices increased more than import prices, leading to a 3.1% increase in our terms of trade. Export prices for dairy – our top export commodity by value – rose 3.5% over the quarter, with milk powder up 3.5% and butter up 3%. While meat products – our second largest export commodity – saw a 6.8% lift in export prices. Lamb prices are up 7% and veal prices up 6.1%.

Making the most of the higher prices, manufacturing sales volumes of dairy and meat products lifted 3.1%. And according to StatsNZ, increased meat exports contributed to the rise in volume of sales for the industry. Milk production too has been healthy, with Dairy Companies Association of NZ reporting close to 4% increase in solids for the 2024-25 season compared to the previous season. No doubt the dairy industry continues to face rising input costs, including feed, fertiliser and fuel. But higher prices and strong production should generate a meaningful boost to export earnings. And adding extra oomph is a favourable NZ dollar. The NZD has been under pressure against a strengthening US dollar, currently trading at two-year lows. And a weaker dollar makes our exports more competitive on the global stage. With strong incomes in our rural regions, the health of the primary sector is improving.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.