In a speech last week, RBNZ Governor Adrian Orr said: “On the way down we can be more incremental, and we have been… We’re being more incremental because we’re in calmer waters but also because of that lingering inflation persistence on the domestic side.”

So what does being “more incremental” mean?

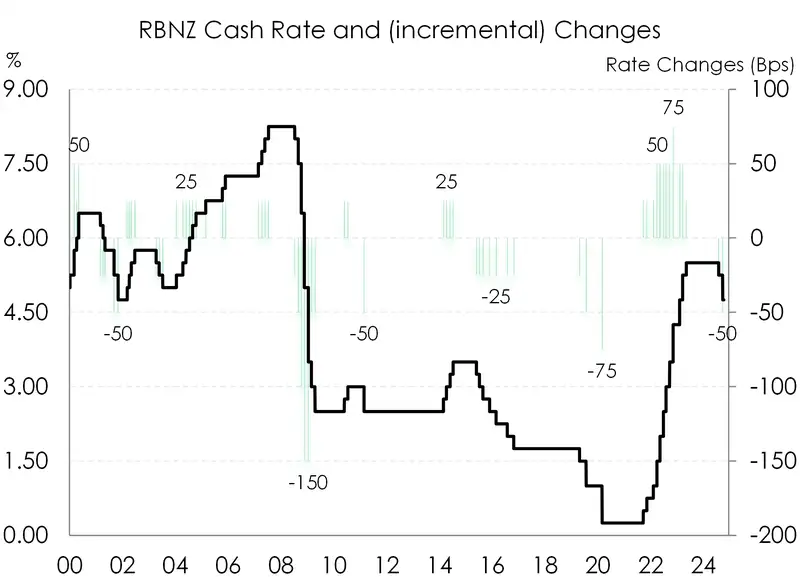

Well, the RBNZ were very aggressive in their tightening of monetary policy, following the surge in inflation as we broke out of Covid. The RBNZ was the first major central bank to start hiking in late 2021. They started off with a few 25bp hikes, and then they delivered seven 50bps moves with one 75bp hike for good measure. The cash rate was catapulted from just 0.25%, to 5.5%. It was the hardest and fastest tightening cycle we’ve seen. A cash rate of 0.25% was too low in hindsight, but they were talking about a negative cash rate at the time (which we fiercely opposed). And 5.5% was arguably too high. We’ve been in a recession for two years, and we’re losing businesses and jobs.

So incremental, to us, means less than that on the way down. And no one is suggesting we need to go all the way back to 0.25%. So, a move to neutral (around 2.75%) would be more incremental, and involve fewer 50s. But more 50s nonetheless.

Indeed, we think the RBNZ will deliver another 50bp move in November (to 4.25%), and they can easily justify another 50bp cut in February (to 3.75%).

Cutting from 5.5% to 3.75% makes policy much less restrictive. But it will still be restrictive, and “will remain [restrictive] over the coming quarters as we get more and more confident that pricing behaviour has renormalized,” (Governor Adrian Orr). The RBNZ needs to get the cash rate below 4% ASAP. And then they can cut in 25bp increments in a search for a neutral setting.

Our take on the Governor’s comments also suggest some guidance for market traders. It does seem that Orr was pushing back a little on the call by some in markets for a 75bp cut in November. We’re in the dovish camp, and think 50 is enough, especially if followed up with a third 50 in February.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.