We’ve spent a lot of time talking about the housing market recently and figured it was time for a discussion on commercial property. So we’ve written a note on the recent downturn across commercial property in the midst of high interest rates. And some major behavioural shifts that have changed the state of play for commercial property.

Of particular interest was the divergence in performance across the different sectors. All industries have seen a decline in sales activity following 2021. However, the industrial sector has outperformed both office and retail properties over the downturn in terms of higher rents and lower vacancies.

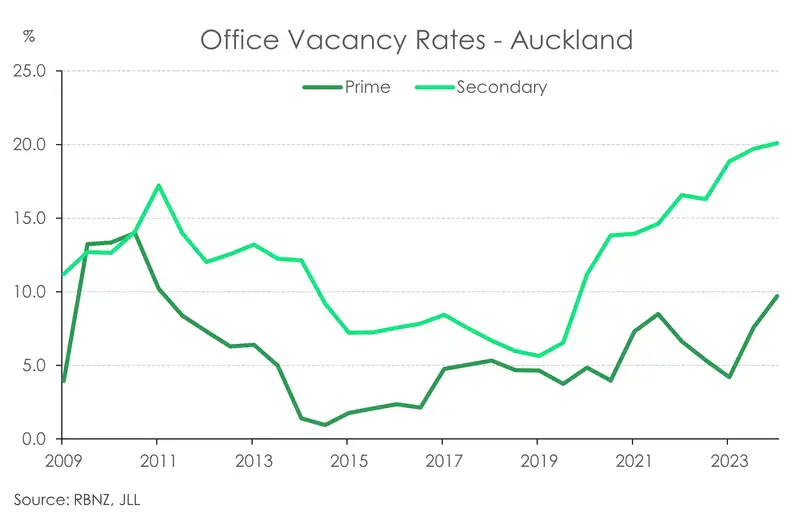

With more people opting to work from home, businesses have sought to entice workers back by opting for better and flashier offices. As such the office sector has seen a growing divergence in tenancy demand between what is classed as a prime and secondary office. The quality of an office is judged by factors including, sustainability, amenities, age of building etc. And in recent years, the prime office market has outperformed the secondary office market. This ‘flight to quality’ phenomenon has seen significantly lower vacancy rates and higher rental growth among prime offices.

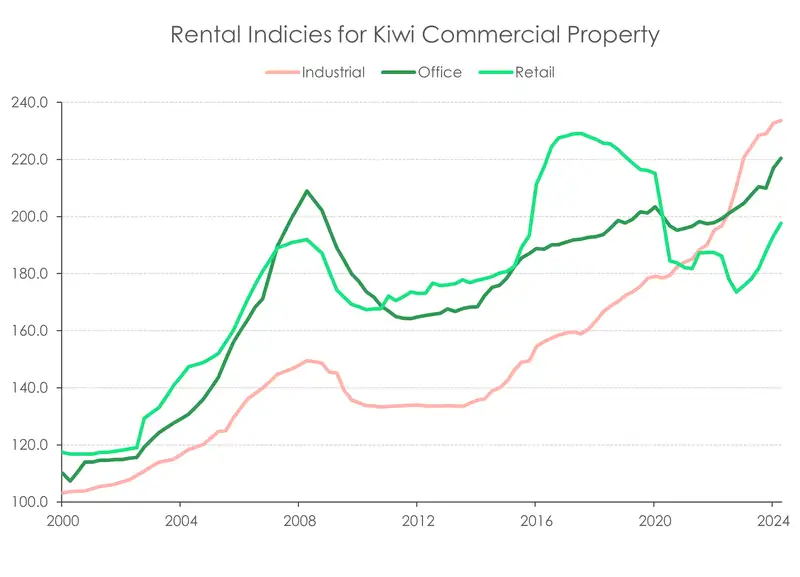

Then there’s retail. Tough economic conditions from high inflation to high interest rates in recent years has in many cases led to the closure of retailers. On top of that, more people working from home has also resulted in less foot traffic in typical hustle and bustle areas. Plus the rise of e-commerce during and following the pandemic have all had an adverse impact on the property sector with higher vacancies and waning demand for new retail spaces. And with less demand, rental indices for retail spaces fell nearly 20% from the start of Covid to their recent trough at the end of 2022. Since then, rental indices for retail property have made somewhat of a recovery, but remains around 8% below pre-covid levels and well below the rents for offices and industrial properties.

But it’s not all doom and gloom in commercial property. There is one bright spot - industrial property, which is outperforming the rest. The shift to online retailing has been a headwind for retail properties, but has acted as a tailwind for the industrial sector. With the shift to online retailing the demand for warehousing and logistics has climbed. At the same time, the supply of new industrial spaces has been severely depressed amidst tough economic and financial conditions, as well as land availability issues. Increasing demand yet limited supply – think back to Econ 101, and you’ll quickly piece together how that’s supported rents and prices in the industrial property sector. Unlike the retail sector which saw declining rents from around the start of Covid, the industrial sector has seen rental growth accelerate. Since Covid, rents for industrial properties are up 30%, of which 20%pts of the move has been in the last two years alone. And the shortages are likely to continue.

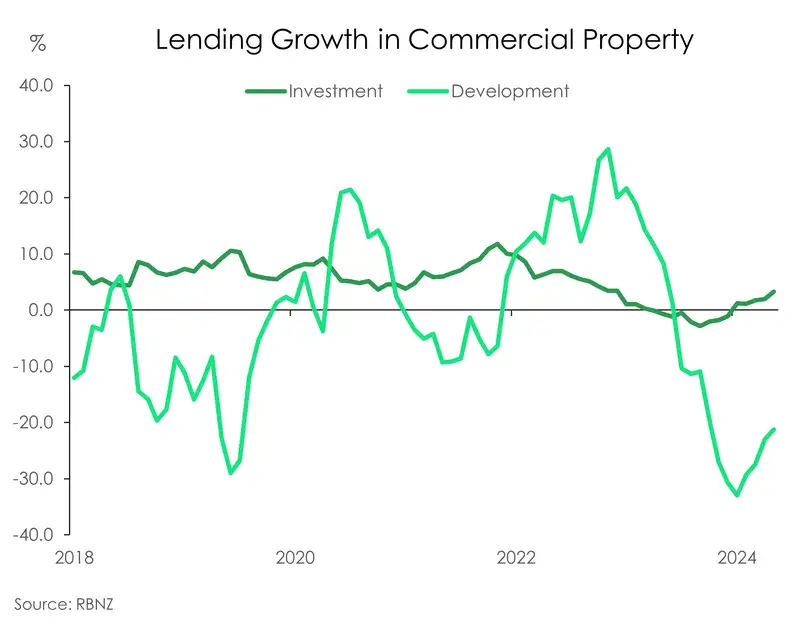

Lending growth for the development of commercial property as a whole has dropped significantly over the past couple of years, falling as much as 33% at the start of the year. It’s a clear reflection of investor appetite in the market as high interest rates and high costs, along with these structural shifts, has made development in commercial property less appealing at present.

Be sure to check out the full report "Ch-Ch-Ch-Ch changes in commercial property. Turn and face the strange" for more insights

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.