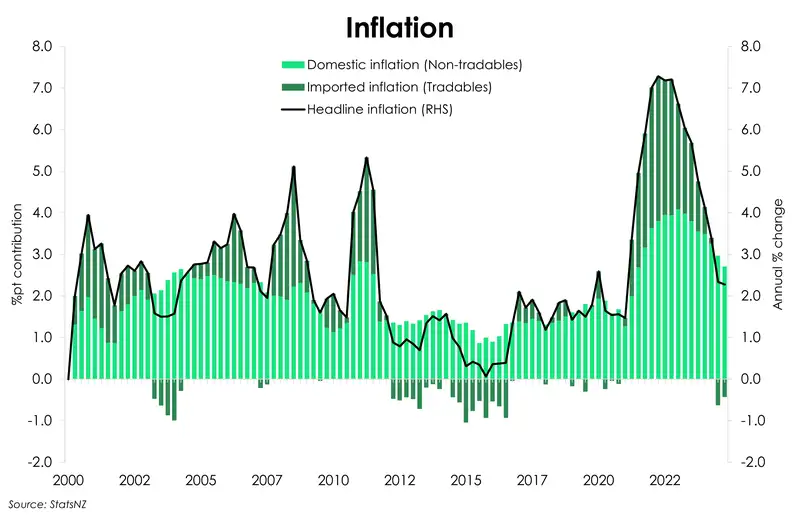

Headline inflation is holding steady at 2.2%. And it’s the rapid deceleration in imported prices that has done most of the work in wrangling inflation back within the RBNZ’s target band. Despite a slight rebound over the December quarter, over 70% of the move in headline inflation from the 7.3% peak to 2.2% is thanks to the fall in tradables. Imported prices peaked at a whopping 8.7%yoy and have fallen swiftly to -1.1% with the decline in global inflation rates. Momentum, however, can be easily disrupted. And the recent depreciation in the Kiwi dollar is a lurking threat. The Kiwi dollar began 2025 on the backfoot, falling to the lowest level since 2022. The fall in the Kiwi currency is a double-edged sword. On the one side, our exports become cheaper to foreigners, as New Zealand goes on sale. That's good for goods demand, and tourism. It provides an income boost for exporters who are paid in dollars and convert back to Kiwi. Think farmers and growers. But our purchasing power declines on the other side. Imports become more expensive... including petrol.

Today’s inflation is all homegrown. Domestic inflation is the stickier, more persistent kind of inflation. Nontradables peaked at 6.8%. Although it is slower to turn, the good news is that it has and is now moving in the right direction (south). At 4.5% nontradables is pulling further and further away from the peak. That said, domestic inflation is still sitting high above where it needs to be (~3%) to see overall inflation anchored at the RBNZ’s 2% target. There are still some frustrating pain points, particularly around council rates and insurance costs still running hot. Nonetheless, we see more disinflationary pressure in the pipeline as the Kiwi economy continues to operate below its productive capacity. A further loosening of the labour market should also keep downward pressure on domestic prices.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.