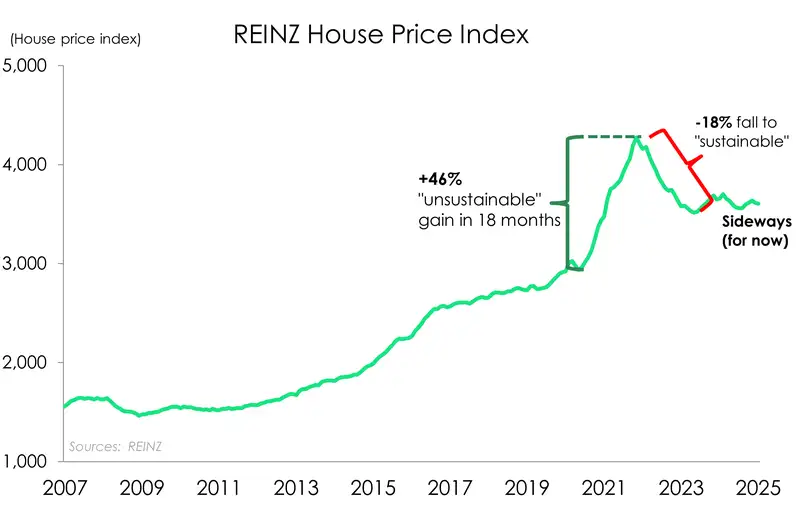

Potentially lost in the noise of the Reserve Banks rate cuts, we also saw the latest REINZ housing data last week. Seasonally adjusted, house prices were up 0.2% over January, marking the third consecutive month of positive, albeit small, gains. But compared to their November 2021 peak, house prices are still down around 15%. Sales, despite some monthly volatility continue their slow upwards trajectory. Compared to last year sales were up 17.5%. Meanwhile listings and stock levels hit decade-high over the month. For now, things are still sluggish on the ground. But we’re hopeful for housing this year as lower interest rates spark life back into the market. Especially now that the RBNZ’s have signalled more rate reductions and potentially a move towards 3% this year. Our view remains - we expect to see house price growth of about 6% this year.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.