- Though once thriving, commercial property has not been immune to the recent economic downturn brought about from the RBNZ’s heavy handed hikes. Property values, rental indices, and sales volumes have all suffered declines, while vacancies have risen.

- But the downturn in commercial property has not solely been interest rate related. Shifts in behaviour and demand, from increased hybrid working and online retailing have changed the game for commercial property.

- Looking forward, the outlook is for a mixed recovery across commercial property. A lower interest rate environment will drive the recovery in part. But the structural changes in demand will continue to exert pressure and weigh on different sectors with varying impacts.

We’ve spent a lot of time talking about the housing market recently and figured it was time for a discussion on commercial property. Much like the housing market, commercial property has suffered over the past few years. Up until the latter part of 2021, commercial property was performing well. Property values even appreciated as much as 18% in the year to September 2021. But not long after, we saw property prices plummet just shy of 10% at the start of 2023.

In part, the downturn across commercial property has been a result of the RBNZ’s heavy handed hikes. High interest rates have crushed investor appetite. While tough financial conditions have forced many businesses to downsize or close shop entirely. A walk down Broadway, Queen St or even Courtenay Place confirms as much. And with lower demand, plus increased vacancies, commercial property values and sales have taken a nosedive.

However, the recent downturn in commercial property goes beyond a story of high interest rates. Since Covid, and the lockdowns that followed, the commercial property landscape has seen some big behavioural shifts that have weakened demand further. Working from home started as an order, transitioned to a choice, and now for many has become their god given right. And then there’s the rising popularity of online shopping that has taken off since the pandemic. Both trends have been major developments, changing the state of play and outlook for commercial property.

Differences across the sectors

Looking at the recent downturn in commercial property it’s important to note that not all sectors have been impacted the same. In fact, we’ve seen some growing divergences across the three main pillars of commercial property.

- Offices;

- Retail – think clothing stores, restaurants, department stores;

- Industrial – that’s your factories and warehouses.

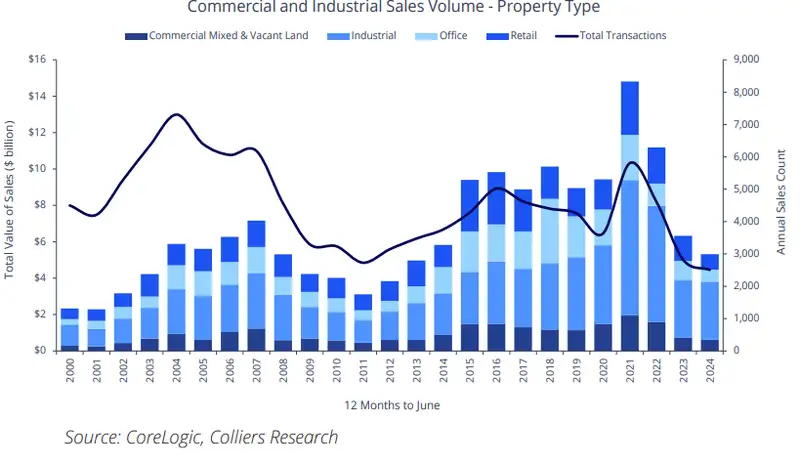

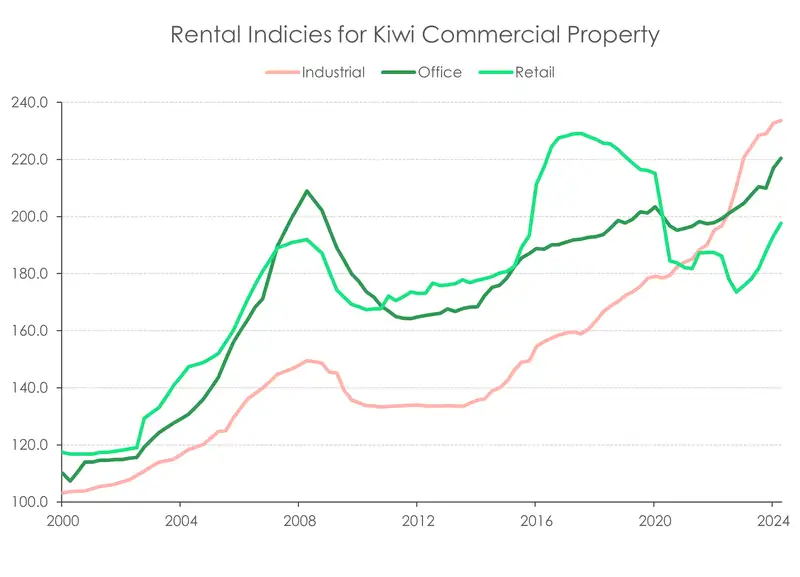

All industries have seen a decline in sales activity following 2021. However, the industrial sector has outperformed both office and retail properties over the downturn in terms of higher rents and lower vacancies.

Office Overhaul

Thanks to the Covid lockdowns, working from home has become more prevalent. As of 2023, nearly 20% of employed adults work mostly from home. While nearly 50% of New Zealanders have the option to work from home accofding to data from StatsNZ. And despite the naysayers who claim it’s time to go back to the offices, it’s clear that hybrid working is the way of the future and already deeply embedded in society. We could spend a lot of time (actually a whole note) talking about the benefits that comes with more hybrid working. But keeping this note centred around commercial property, it’s the shift in office demand that’s important.

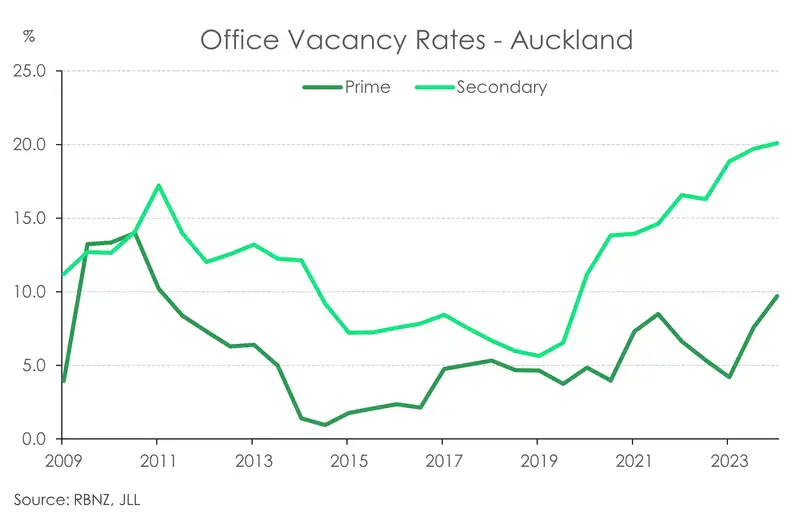

With more people opting to work from home, businesses have sought to entice workers back by opting for better and flashier offices. As such the office sector has seen a growing divergence in tenancy demand between what is classed as a prime and secondary office. The quality of an office is judged by factors including, sustainability, amenities, age of building etc. And in recent years, the prime office market has outperformed the secondary office market. This ‘flight to quality’ phenomenon has seen significantly lower vacancy rates and higher rental growth among prime offices. Though that’s not to say prime offices have neither been exempt from the recent economic downturn. Ultimately though it’s the owners of lower quality office spaces that are being hit the hardest as they’ve struggled to lease and sell these properties.

Rethinking Retail

When it comes to the retail sector, well where do you even begin with the headwinds they’ve faced. Retailing itself has been one of the hardest hit areas over the two year recession we’ve had. First with high inflation, which was then met with high interest rates. Consumer confidence went kaput. Tough economic conditions have in many cases led to the closure of retailers which in turn has had a negative impact on the commercial property sector with higher vacancies and waning demand for new retail spaces.

But that’s just one part of the story. Because then there’s also the fact that more people working from home has resulted in less foot traffic in typical hustle and bustle areas. Sure, you can argue that there’s more foot traffic now during the week in your suburban cafes or shops. But there’s still a gaping hole in these once busy hot spots... and in the hearts (or wallets) of investors. Weakened demand has again lowered property values, raised vacancies, and made selling these property all the more difficult.

And then we haven’t even mentioned the rise of e-commerce during and following the pandemic. Yeah, online shopping was around before then, but certainly not to the scale it is today. And it’s thanks to the urgency of the Covid lockdown that many retailers adopted online retailing at such pace. At the same time, being forced to stay at home saw around 300,000 kiwis shop online for the first time in 2020 according to NZ post. And what can we say, we’re hooked. Online retailing in New Zealand continues in an upwards trend.

But again, it’s not great news for investors in the retail property space. Retail vacancies have been climbing, a clear sign of the waning demand in the industry. And with less demand, rental indicies for retail spaces fell nearly 20% from the start of Covid to their recent trough at the end of 2022. Since then, rental indicies for retail property have made somewhat of a recovery, but remains around 8% below pre-covid levels and well below the rents for offices and industrial properties.

Industrial Ignited

It’s not all doom and gloom in commercial property. There is one bright spot - industrial property, whcih is outperforming the rest. The shift to online retailing has been a headwind for retail properties, but has acted as a tailwind for the industrial sector. With the shift to online retailing the demand for warehousing and logistics has climbed. At the same time, the supply of new industrial spaces has been severely depressed amidst tough economic and financial conditions, as well as land availability issues. Increasing demand yet limited supply – think back to Econ 101, and you’ll quickly piece together how that’s supported rents and prices in the industrial property sector. Unlike the retail sector which saw declining rents from around the start of Covid, the industrial sector has seen rental growth accelerate. Since Covid, rents for industrial properties are up 30%, of which 20%pts of the move has been in the last two years alone.

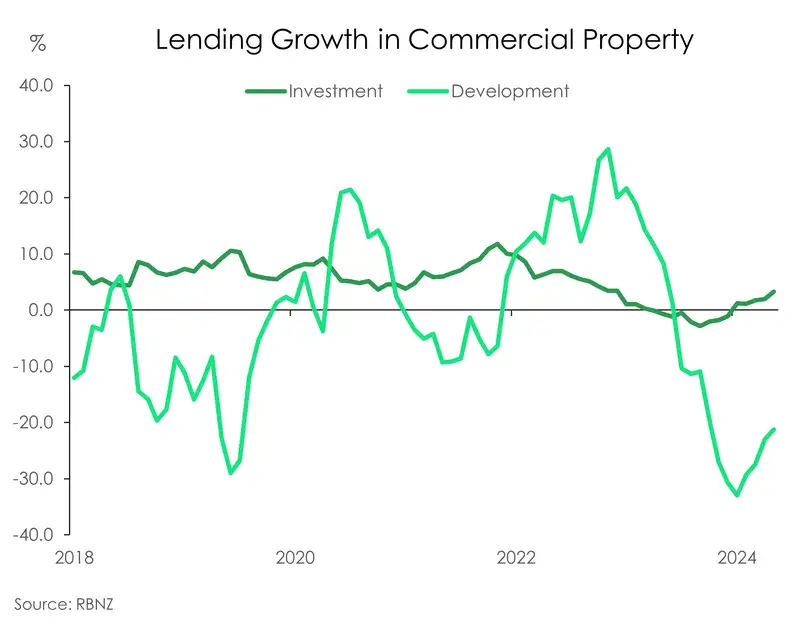

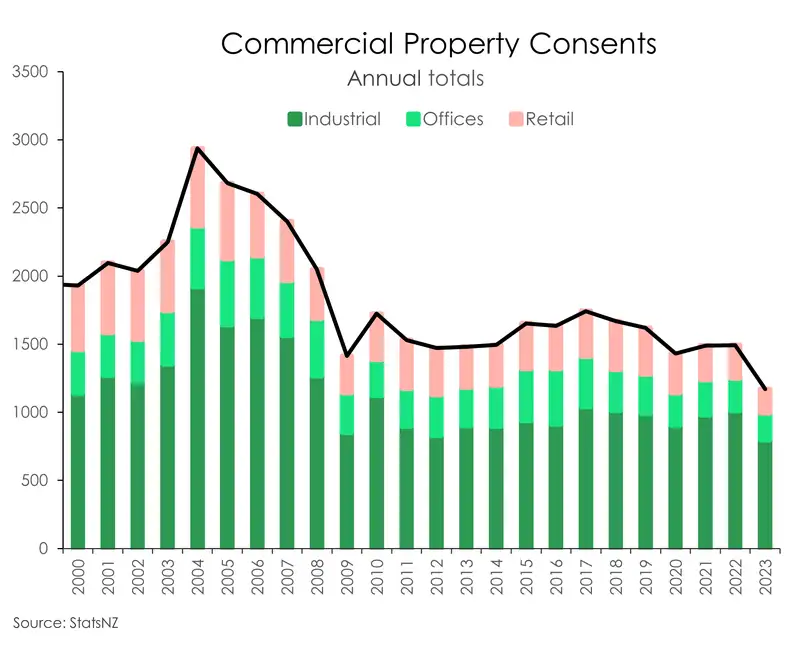

And the shortages are likely to continue. Lending growth for the development of commercial property as a whole has dropped significantly over the past couple of years, falling as much as 33% at the start of the year. It’s a clear reflection of investor appetite in the market as high interest rates and high costs, along with these structural shifts, has made development in commercial property less appealing at present. At the same time, consents for new commercial properties have also come off, down 22% in 2023 compared to 2022. And while StatsNZ data shows that we’re track to have more consents in 2024, it’s still unlikely to solve any shortage problems anytime soon. Either way, in the case for industrial properties, so long as demand continues to hold, which we think it will, shortages will continue to drive rental growth in the industrial sector.

Location, location, location

Beyond sector differences, location is another driving factor in the performance of commercial property. Some regions have performed better, while others face unique headwinds and tailwinds.

Auckland being the central business hub, has faced the biggest demand shift in the “flight to quality” for offices. While Wellington, subject to public sector demand and geographic constraints on land availability, has faced disrupted demand along with limited new supply for the industrial market. And then there’s Christchurch. The apparent golden spot for housing and commercial property. The 2010/11 earthquakes, though devastating, have given Christchurch the opportunity of a clean slate; one which they have run with and delivered a much more balanced supply of both housing and commercial property. And as such, prices have remained relatively stable and vacancy rates have remained low across all sectors compared to Auckland and Wellington. Plus because of the recent rebuilds, the majority of Christchurch’s office properties are already of a high quality. And as such Christchurch is not suffering from the same flight-to-quality phenomenon faced by Auckland and Wellington.

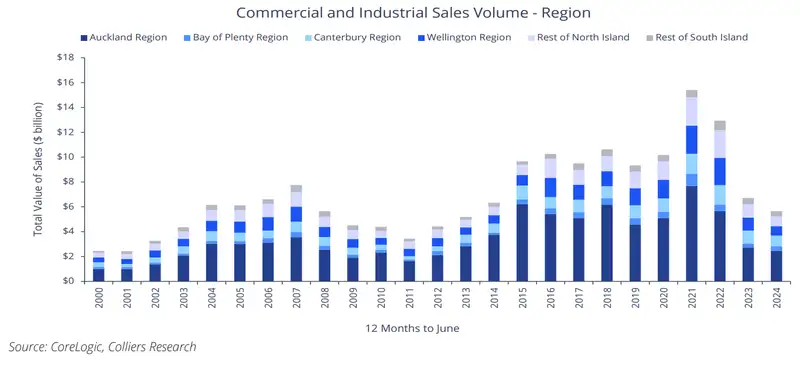

Overall though, across sectors, Auckland continues to trump commercial property sales according to data from Colliers. In the year to June 2024, Auckland made up 45% of total commercial sales over the year – although that does remain below the long-term average of around 53%. Canterbury, however, has surpassed their long-term sales volumes of 12% and accounted for 16% of national sales in the year to June 2024.

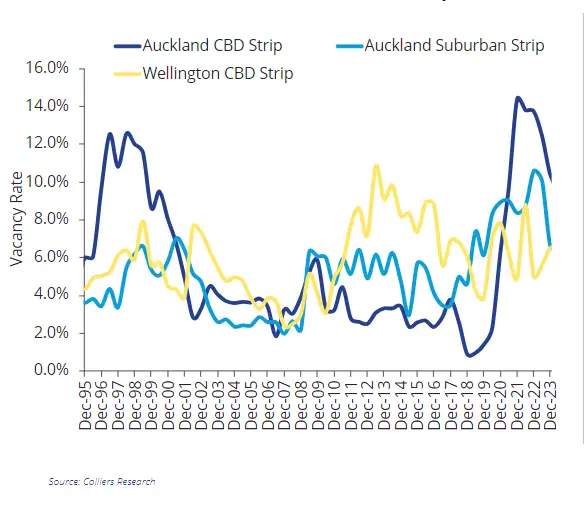

What’s probably more interesting though is the differing performance of commercial property at a metropolitan to suburban level. Particularly within the retail sector. With increased hybrid working, and growing suburbanisation, consumers that aren’t shopping online are gravitating more towards their local malls. As such retail vacancies in CBD areas, particularly in Auckland have lifted dramatically and remain elevated in recent years. Back in 2018, retail vacancies for the Auckland CBD sat below 2%. Flash forward to the end of 2021, and vacancies had reached a peak of around 14%. Coming out of the Auckland lockdown has helped. However, vacancy rates today of around 10% in the Auckland CBD remain well above their long-term 4% average. And remain above the vacancy rates of suburban shopping areas. It’s a trend that is likely to continue with growing urbanisation and the retreat out of central cities.Areas with high vacancies are also in a way contagious and self-reinforcing. Foot traffic in the area decreases, tenant demand drops. Before you know it, you have a dead zone where nobody wants to open up shop.

Retail Vacancies (Source:Colliers Research)

Time may change me, but…

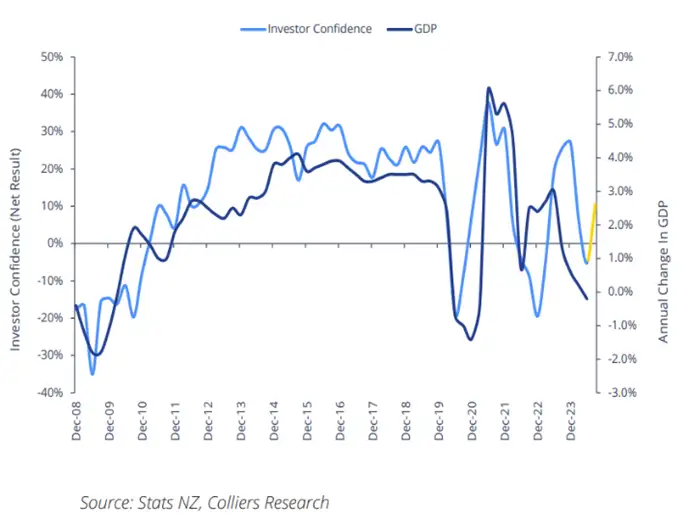

It’s safe to say times have been running wild for the commercial property market. Things will get better from here with rate cuts underway and more to come. Confidence amongst commercial property investors has already started to lift markedly off the back of the RBNZ’S recent rate cuts. Colliers latest survey of commercial property investor confidence showed confidence finally return to net positive. And with more rate cuts to come we expect this confidence to push higher into 2025. In time that confidence should translate to activity.

Colliers Investor Confidence

However, rate cuts aside, there will still be these structural changes in commercial property that will weigh on the market. Industrial property seems prepped to fly as shortages remain amidst growing demand. Meanwhile retail will continue to face headwinds from growing online retailing and urbanisation, especially as technology improvements continue. What happens to long-term vacant retail shops is still unknown. Some secondary office spaces that face lower demand and higher vacancies can either be turned into apartments or have value added options to improve it’s overall quality. But for retail properties, primarily those in the metropolitan strip, such a conversion is more difficult and expensive given their relative size and location. There’ll always be demand for physical store fronts but it’s likely we’ll see these pushed into more suburban areas. Unless we see some revival to our CBDs. While for the office sector, the future looks to be all about increased competition for higher quality spaces. Overall, it’s a changing environment, one which investors will need to adapt to. And from there who knows what demand patterns we’ll see next...

Still after more?

Check out our episode “It’s all about commercial property” on our Markets, Mystics & Mayhem podcast.

A big thank you to Ian Little – National Director | Research, at Colliers for the discussion and insights.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.