- The improvement in business confidence continues. Expectations of a turnaround in demand underpins the improved sentiment. However, experienced trading activity remains weak. The here and now demands further rate relief. Especially as uncertainty over the global backdrop grows.

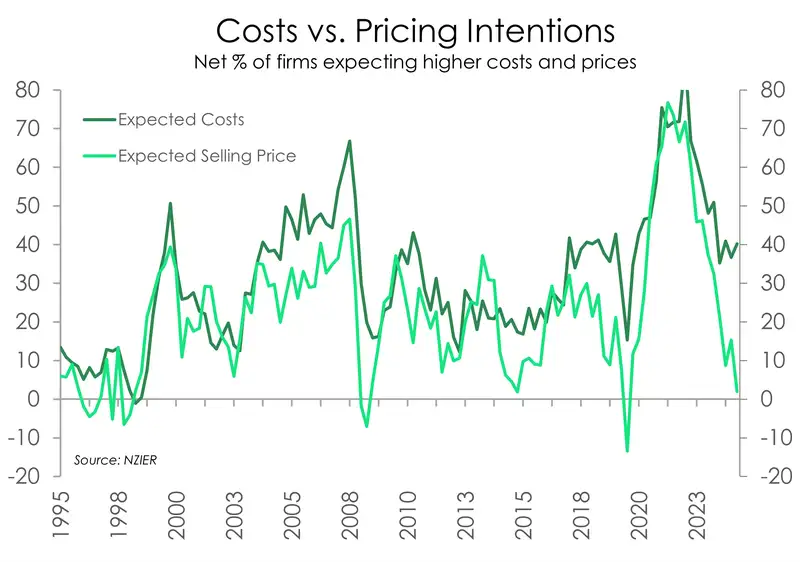

- Cost pressures intensified, following a marked depreciation in the NZ dollar. However, pricing metrics remain at historically low levels. Weak demand continues to limit firms’ pricing power.

- The violent volatility in markets happened after this survey was taken. What will firms make of the Trump tariff turmoil? Too much? Too soon? Too bad... which ain't good. Uncertainty kills growth.

The results of NZIER’s latest Quarterly Survey of Business Opinion was some much needed good news in a sea of worry. Business confidence improved in the March quarter – despite weak domestic demand and the tumultuous global backdrop. Over the quarter, a net 23% (seasonally adjusted) of firms expect economic conditions to improve in the coming months – an encouraging lift from the net 9% late last year. The results are somewhat surprising given that domestic greenshoots are few and far between, and that the global growth outlook is clouded by potentially destructive developments in US trade policy. It must be noted that survey responses were collected from Feb 27 to Mar 31. Tariffs have been threatened by US President Trump since elected. However, the reciprocal tariffs made on Liberation Day – just a few days after the survey close – were far worse than feared. If the survey was taken today, we suspect the responses would look a shade less rosy.

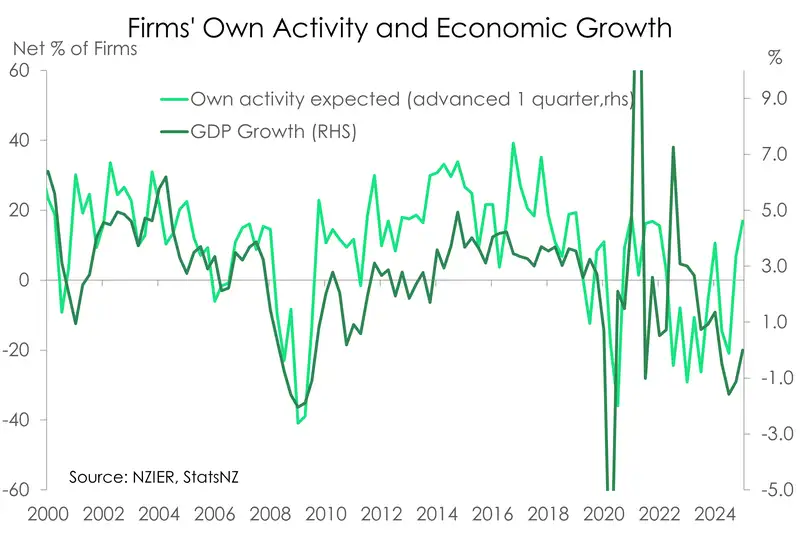

Nonetheless, business confidence has lifted to the highest since September 2016. But there continues to be a dichotomy between how businesses are feeling and what they are experiencing. Current activity levels remain weak, reflecting still-subdued domestic demand. According to Kiwi businesses, it is still a challenge to navigate the current economic environment. Over the March quarter, a net 21% of firms reported a decline in trading activity, similar to the previous quarter. However, businesses are still optimistic for a turnaround in activity. A growing share of firms (from net 9% to net 12% in Q1) see own trading activity increasing in the coming months.

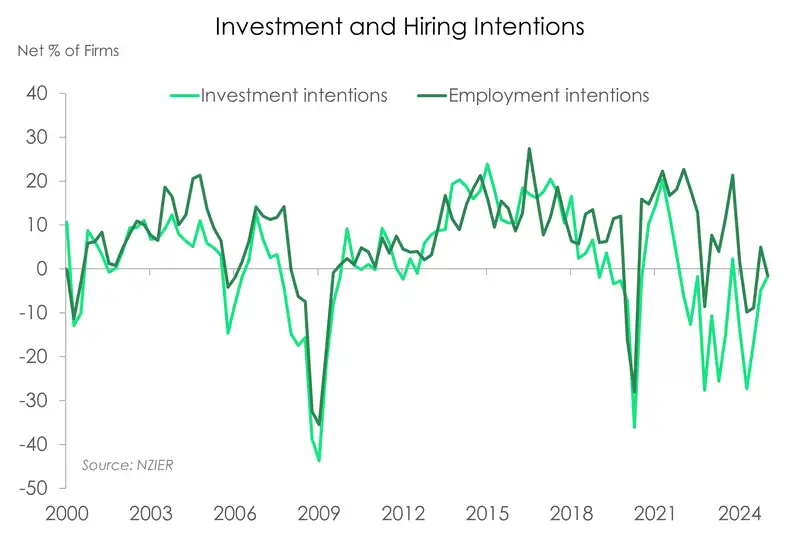

While businesses are more optimistic, that sentiment is yet to translate into activity. And firms are still feeling cautious when it comes to hiring and investing. A net 17% of firms cut headcount over the quarter, while a net 2% intend to reduce investment in plant and machinery. While appetite among business to grow is not there yet, it is building. Investment intentions are the strongest they’ve been for a long time, but coming off very weak bases.

As in previous reports, sentiment varies across sectors. And over the March quarter, the retail sector dethroned the building sector as the most upbeat. A net 24% of retailers expect an improvement in economic conditions in the coming months. And that’s despite soft retail demand and the recent rise in costs alongside a fall in the NZ dollar. Half of all firms reported facing higher costs over the quarter, but most acutely felt among retailers (net 70%). Some retailers were able to pass on higher costs by raising their prices over the quarter. But pricing power is limited given weak demand. Nonetheless, it seems that lower interest rates, and thus higher disposable incomes, underpins the retail sector’s optimism. In stark contrast, only a net 6% of builders see the economic environment improving – well below the net 29% in the previous quarter. Continued weak demand, as reflected in a decline in new orders and output, is weighing on confidence in the building sector. The sector is also facing higher costs, with a net 35% of builders reporting a lift over the quarter.

Continued weakness in activity levels points to a period of below-trend growth. A disruption to global trade would also weigh on Kiwi activity going forward. We continue to expect a 25bps cut from the RBNZ tomorrow as well as in May. And as downside risks to growth mount, the case strengthens for a cash rate below 3%.

While business sentiment continues to improve, the reality of the March quarter still reflected a period of weak activity for Kiwi businesses. On a seasonally adjusted basis, a net 21% of firms reported reduced activity in the March quarter, not far from the net 24% seen in the December quarter. However, much like the previous quarter, there is a growing sense of optimism for the months ahead. Looking further ahead, we anticipate economic growth will gain momentum in the second half of the year. Growth which should translate to further lifts in activity for Kiwi businesses.

Like last quarter, businesses are still holding back on investment and hiring in the current climate. While gradually improving, investment intentions overall remain in negative territory. A net 4% of firms are still intending on pairing back on investment in buildings, while a net 2% are still planning on reducing investment in plant and machinery. Looking over at hiring, firms continued to reduce headcount over the start of the year, with some still planning on more cuts in the coming months. A net 17% of firms reduced staff numbers in the March quarter, while a net 2 percent expect to cut more jobs in the next quarter. NZIER perfectly summed it up in saying that firms are “holding off on hiring and investment until they have more conviction about a sustained recovery in demand.”

Cost and price pressures were somewhat mixed this quarter. The weaker Kiwi dollar appears to have played a significant role in driving up costs during the March quarter, with half of the surveyed firms reporting higher costs. Most notably, cost pressures were particularly felt among the retail and building sectors, with a net 70% of retailers and 35% of builders reporting increased costs. Despite these rising costs, the proportion of firms that raised prices fell to a net 8%, down from a net 10%, and remains at historically low levels. And even more notable, the net proportion of firms planning to raise prices in the current quarter dropped to just a net 2%, compared to a net 15% previously. It’s clear that ongoing economic weakness continues to limit the ability among firms to lift prices.

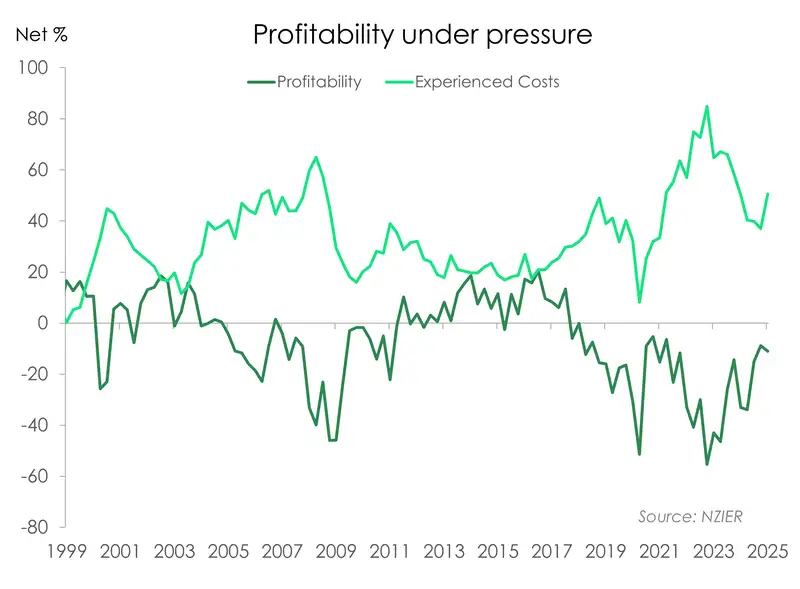

With higher costs and the inability to lift prices, firms’ profitability remains under pressure. A net 36% of firms reported a decline in profits last quarter, up from a net 32% the previous quarter. It’s certainly a challenging time with looming uncertainty. We’d like to say that the anticipated recovery in the economy will help sustain demand. And our forecast of the Kiwi dollar ending the year higher should provide some relief further out. But we also can’t ignore the potential near-term lift in costs for imports in a world with escalating trade tensions.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.