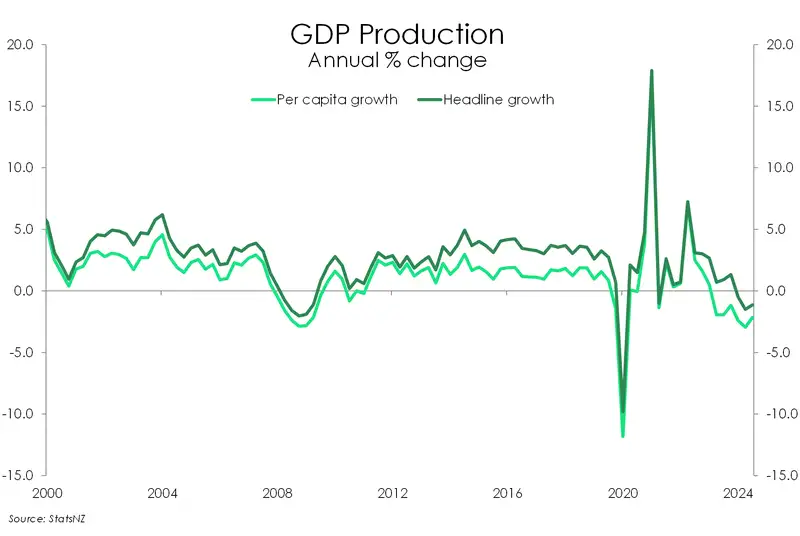

- The Kiwi economy took its first step into recovery and ended 2024 on a better note. Economic activity lifted 0.7% over the December quarter, pleasantly above our and the Reserve Bank’s forecasts. Even better, per capita output expanded for the first time in two years

- The annual prints however reveal a sombre 2024 year. The Kiwi economy is 1.1% smaller compared to Dec 2024, while per capita output shrunk 2.2%.

- Looking out to 2026, we're optimistic. And we believe in the process. The process of cutting interest rates until asset markets respond is happening. The light at the end of the tunnel is coming out of the RBNZ. Policy settings are restrictive, but more interest rate cuts are coming. High interest rates have hurt, and the economy demands more easing.

After some painful falls in activity over the second half of last year, the Kiwi economy ended 2024 on a better note. Economic activity lifted 0.7% over the December quarter ahead of ours and the Reserve Bank’s expectations of a 0.3% increase. The print also surprised on market consensus for a 0.4% expansion.

The December quarter was certainly an improvement from the steep 2.2% cumulative contraction in activity over the middle of 2024. And for the first time in two years, activity on a per capita (per person) basis lifted, up 0.4%. On an annual basis however, things are less rosy. Compared to December 2023, the economy is still 1.1% smaller, in aggregate, while output shrunk 2.2% on a per person basis.

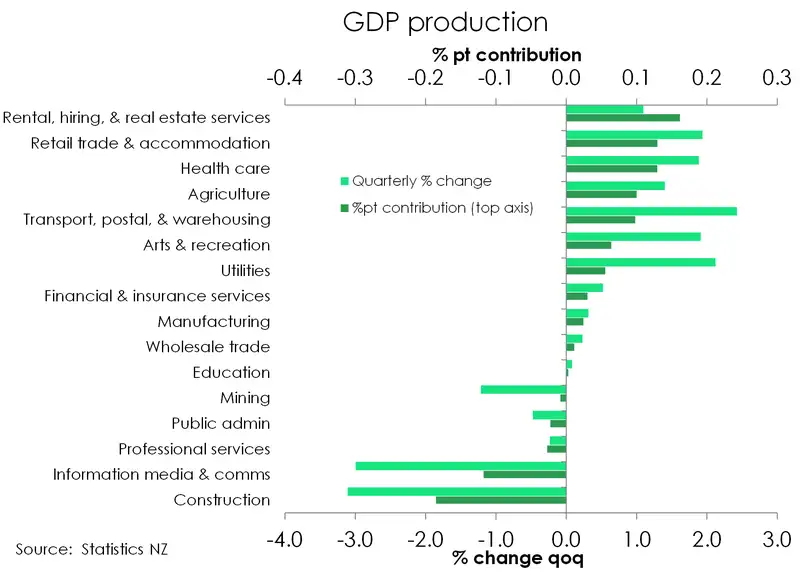

Nonetheless, we’re acknowledging this as the first step in the economic recovery. Of the 16 measured industries, 11 posted a lift in activity over the quarter. And green shoots have emerged across the services and primary industries. Growth over the quarter was driven by an uptick in rental hiring and real estate, alongside an expected increase in retail trade and accommodation. According to Stats NZ, the summer tourism season saw higher spending from international visitors which flowed through to an increase activity across accommodation, hospitality and transport. An increase in activity across health care off the back of higher central government healthcare and social assistance also helped add extra oomph over the quarter.

It must be noted, however, that there were still pockets of significant weakness in today’s report card. Construction alone took away 0.2%pts of growth, with a sizeable, but not unexpected, 3.1% decline in activity. High building costs and a still sluggish housing market is not an environment conducive of a lift in construction activity. Meanwhile everything within the professional services landscape, from business services to public admin to media, continues to suffer under the weight of a deteriorating labour market. The number of total hours worked continued over 2024 fell a chunky 2.5%.

Shifting our gaze from the rear-view to what’s ahead, the outlook is positive. The RBNZ has delivered 175bps of rate cuts since August, with more on the way. With each cut, the restrictiveness of the current environment eases. In time, this easing should translate into stronger economic activity. Trust the process. For now, with the cash rate still above estimates of neutral (~3%), demand and economic activity will remain slightly constrained in the near-term. But as we move closer to a neutral rate environment, we anticipate momentum to grow. The second half of this year should see a material lift in economic activity.

That said, growing downside risks to the global outlook pose a significant headwind for the Kiwi economy’s recovery. And should the downside risks persist, then a move to a cash rate below 3% may be needed to get us back on track. Our base case scenario however is unchanged. We continue to expect another two 25bp rate cuts over the next two RBNZ policy meetings. Followed by at least one more 25bps cut to 3% in the third quarter of this year.

The breakdown

While we expected a rebound in performance across several services, we were pleasantly surprised by the strength that emerged towards the end of last year. The overall 0.8% increase across the services sector accounted for most of the rebound in activity during the December quarter. Most notable was the uplift in rental hiring and real estate, which saw a 1.1% increase over the quarter and contributed 0.2%pts. An increase in tourist numbers and higher spending played a significant role in driving this growth. Other industries also benefited during the tourism season, including retail trade and accommodation (up 1.9%), transport (up 2.4%), and arts and recreation (up 1.9%). The lift in activity across these industries may also reflect the passthrough of lower interest rates sparking a cautious rebound in consumer spending. And while we expect these areas to continue improving, challenges such as a weakening labour market could dampen consumer confidence and weigh on spending.

Looking at professional services, the picture was less pretty. Everything from business services to public administration saw declines during the December quarter. The information and media sector, in particular, experienced a significant 3% drop, due to weaker broadcasting and internet services. Beyond the challenges facing the media landscape, the decline across business services is likely closely tied to the ongoing deterioration of the labour market, with total hours worked continuing to decline.

The health of the primary sector continues to improve, with a strong performance within agriculture in Q4. Higher export prices for dairy and meat, combined with increased production and a rise in exports, resulted in a 1.4% boost in agricultural output. And no doubt the favourable lower Kiwi dollar likely helped build some momentum. We talked about this in our most recent podcast episode “Primary sector pulse picks up: Trade treks higher” so be sure to check it out for more insights on the primary sector’s rebound.

Turning now to some of the darker spots in today’s report, it was the goods producing sector that weighed most heavily on Kiwi growth over the December quarter. Overall, the goods producing sector contracted 0.8% towards the end of last year, primarily due to another significant but anticipated decline in construction. With construction falling 3.1% over the quarter, the industry alone accounted for a 0.2%pts reduction in growth. As a highly interest rate sensitive industry, we are looking to lower rates and a stronger housing market to help revitalize the sector. However, today’s decline confirms that the recovery will take time and, indeed, more rate relief.

The overall decline in the good producing sector was at least somewhat offset by a normalisation in activity across utilities. In the September quarter, utilities experienced a significant 3.5% contraction due to supply constraints caused by low hydro lake levels. The resulting surge in energy prices consequently reduced the value added from electricity generation. However, with supply conditions now restored, utilities have nearly reversed this decline, rebounding by 2.1% in Q4.

Tourism returns to pre-covid levels

On the other side of the same coin, the expenditure measure of GDP rebounded 0.8% on the quarter, following a downwardly revised 0.9% fall over the September quarter (from -0.8%). And it was growth across the board. Household spending eked out a 0.1% increase (from -0.3%), government spending rose 1.9% (from -2.1%), and gross capital formation lifted 1.2% (from -2.9%).

A 0.8% increase in durable goods consumption, helped break a two-quarter slide in private household consumption. Over 2024, however, households clearly tightened their purse strings as consumption slowed from 3.3% in 2023 to 0.8%. The lift in durables during Q4 however potentially signals an improvement in consumer appetite for big-ticket items. The RBNZ is in the process of a speedy cutting cycle, with 125bps of cuts delivered last year. As interest rates fall, the squeeze of financial conditions on household wallets should easing and disposable incomes should grow. Household consumption should strengthen this year.

The December quarter was also a good one for exports, with tourism doing the heavy lifting. Export of goods and services rose 3.5%, led by a whopping 8.2% increase in services exports. International tourism peaks during our summer months. Short-term visitor arrival numbers are crawling back to pre-covid levels, and with that international tourist spend. There’s no diminishing the challenge our tourism industry has faced over the last five years. But the December quarter saw export services volumes finally return to pre-covid levels. It’s been a long journey back.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.