“Is something wrong? she said. Well of course there is. "You're still alive," she said. Oh, do I deserve to be? Is that the question?” Pearl Jam.

- “Survive til 25, is now “Alive in 25” and could turn into “thrive in 25”. We all want a quick fix in 26 with no conflicts and less politics

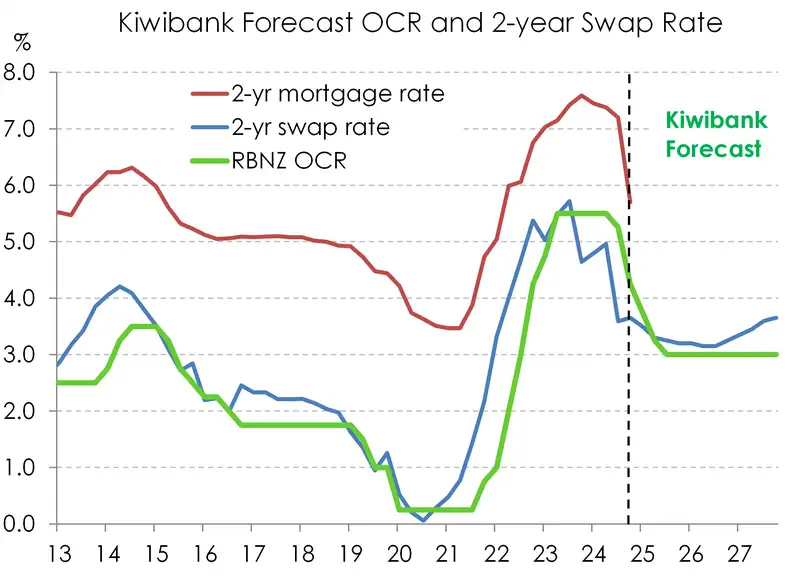

- We believe the RBNZ will continue cutting the cash rate, at pace, into the 3s. And then they’ll ease in incremental steps back to neutral, around 3%.

- Compared to our view, rates markets are adequately priced near term, but underpriced over the medium term. Basically, we’re saying the RBNZ will cut to 3.0%. Whereas market traders are hung up at around 3.35%. Time will tell. But the message for households and businesses is still one of rate relief. And the recession is over. Costs are coming down. Profitability is improving. And thoughts of reduction will turn to expansion.

Dance of the clairvoyants: Divination of the data

“So save your predictions. And burn your assumptions” Pearl Jam

The crystal ball is cloudy, but the direction of the Kiwi cash rate is crystal clear. We need to see rates pulled lower over 2025, if the current lift in confidence is going to translate into activity, and then investment and hiring intentions.

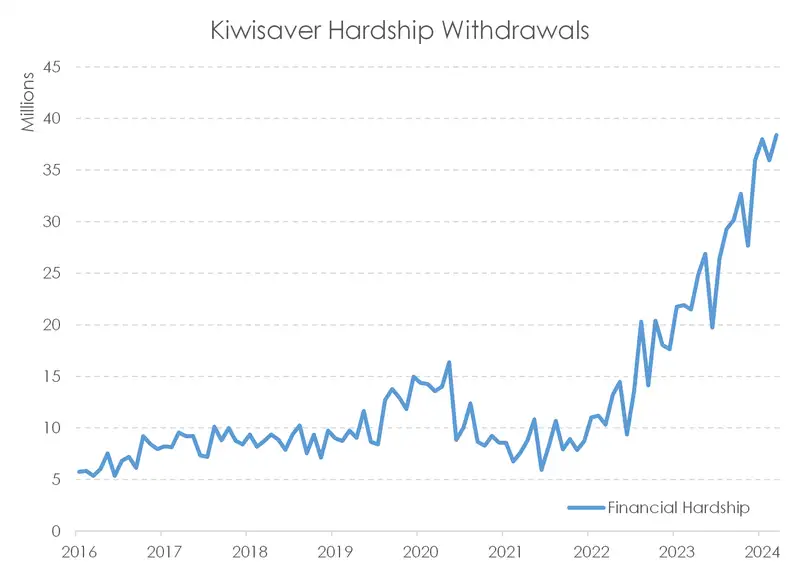

We have been fierce advocates of lower rates. We believe rates were hiked too high, for too long, and we’re suffering the consequences. The swift reversal of heavy-handed hikes is needed to limit the economic scarring, which is becoming more evident in labour market data, business failings and financial hardship. The spike in Kiwisaver hardship withdrawals, see chart, is one such development.

The RBNZ leapt into action, slashing 125bps in just 3 meetings, with the explicit promise of another 50bp cut in February. That’s good news. The cash rate was 5.5%, it’s 4.25% now, and will begin 2025 at 3.75%. The speed at which the RBNZ has moved is clear recognition of the deterioration in the economy, with inflation no longer a problem.

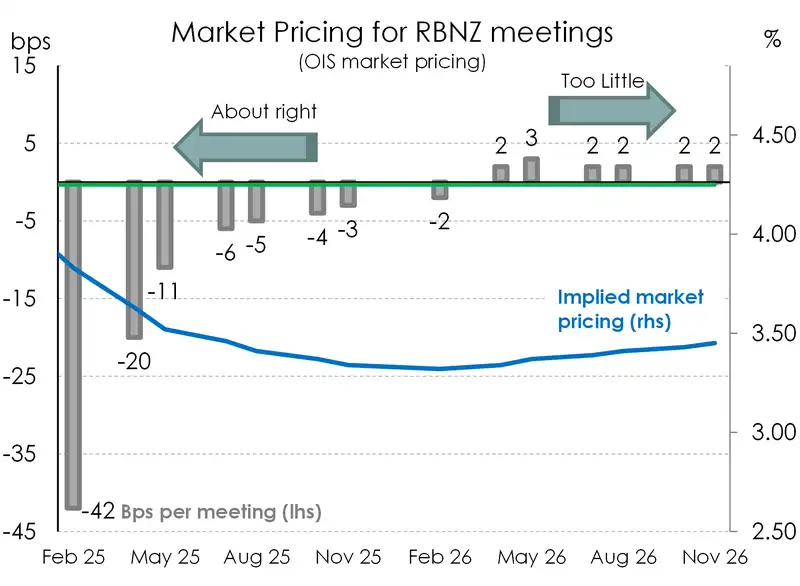

If we look at the OIS (overnight index swap) curve, traders have adequately priced the next two meetings, in line with the RBNZ’s OCR track. The chart below plots the basis points per meeting priced out to 2026 (grey bars), alongside the implied cash rate (blue line). Traders have placed 42bps into the February 2025 meeting, followed by another 31bps over the April (-20bps) and May (-11bps) meetings, taking the implied cash rate to 3.52%. And that’s pretty much it. The market implied cash rate hits a trough around 3.34%. So traders have placed a 16bp, or 65% chance (16/25), of a final cut to 3.25% - below the RBNZ’s near term track.

It’s beyond the next few meetings where we believe the RBNZ’s track is too high, too hawkish, and takes too long to get back to neutral. Because of this, there is not enough cuts priced in by markets. We believe the RBNZ will be forced to lower their track (again), and deliver faster cuts.

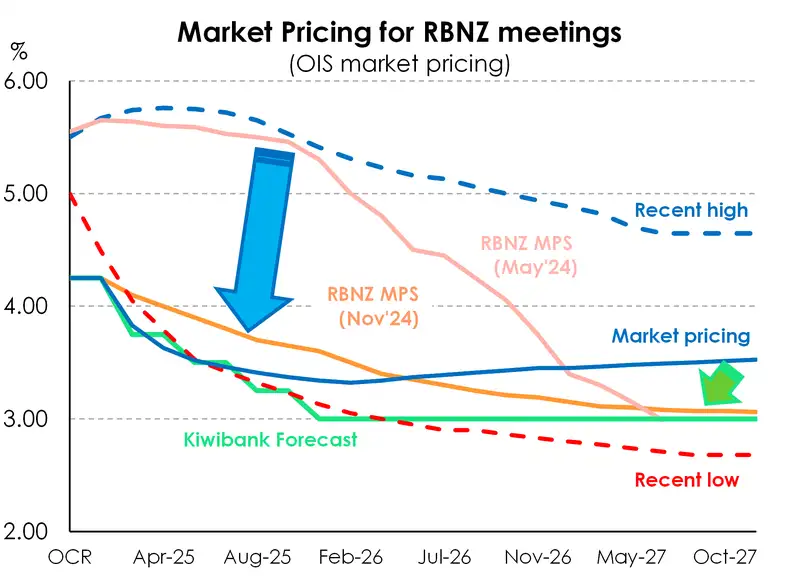

Our near-term forecast for the Kiwi cash rate is unchanged. But we have had to lift the end point a touch, to 3% (from 2.5%). The continued need for rate relief is obvious, to us. Taking off the handbrake and putting policy in neutral is now the game. Although thoughts of neutral have risen.

The chart above plots the RBNZ’s OCR track, Kiwibank forecasts, and current market pricing. We, along with the market, are ahead of the RBNZ over 2025 (blue arrow). That’s not unusual. Markets turn much faster than central banks. And market pricing will test RBNZ estimates.

Release: the handbrake, and put it in neutral

“I'll ride the wave, Where it takes me. I'll hold the pain… Release me!” Pearl Jam

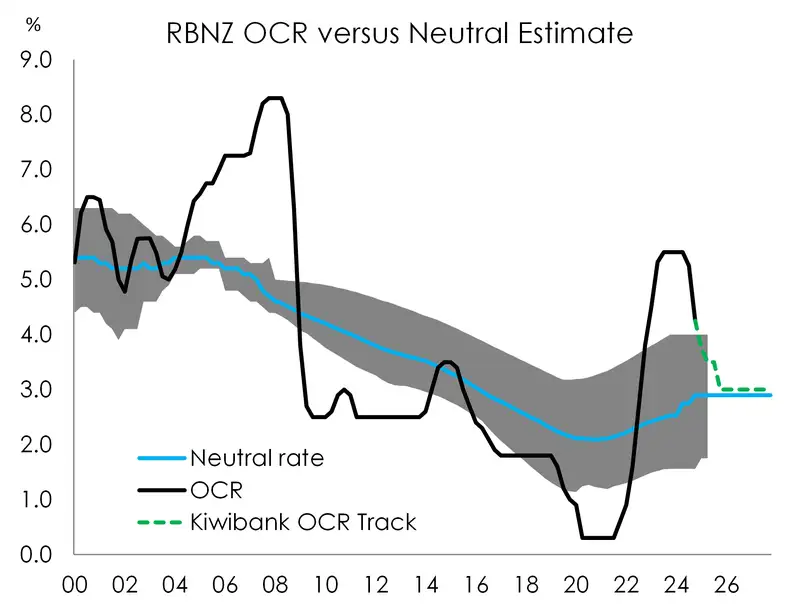

The chart below highlights the RBNZ’s estimate of neutral. It’s the theoretical rate that neither hurts nor stimulates. It’s the Goldilocks rate that’s not too hot or too cold. And you only know where it is, when you’ve gone past it. But it provides good guidance on how far the RBNZ thinks they need to go to remove the restrictiveness of policy. That Goldilocks rate was revised higher, again, from 2.75% to 2.9%. And accordingly, our end point forecast is higher today. We have changed our call from a 2.5% endpoint to 3%. So the cash rate has another 125bps to go, with 50 in February a nice start to the new year. And we believe the RBNZ will cut to 3% next year.

However, what surprised us in the latest RBNZ MPS was the time it takes to get monetary policy back to neutral. According to the RBNZ’s OCR track, the cash rate finishes 2025 at 3.5%. That’s just 75bps of cuts over the entire year, of which 50bps is delivered in February. And the final move to 3% does not happen until deep into 2027. It’s a strange track. There’s an argument that they should frontload cuts to 3.5%, which we agree with. But then they argue a need to keep the cash rate slightly restrictive over most of the forecast horizon. So frontload because the data has deteriorated, and inflation is back in its box. But then hold restrictive for an extended period to make sure inflation stays in its box. We’ll take the other side of this bet.

We believe the RBNZ’s track, and market pricing, will prove to be too high and hawkish. The implied cash rate is likely to move towards 3% in 2025, and thoughts of rate hikes (priced into the curve from 2026 and beyond) will be postponed. If we’re right, (receive) the 1-to-2-year rates will grind lower, as the RBNZ ultimately delivers more cuts.

And if we’re right, big if, then the interest rate curve should move as follows. We forecast the pivotal 2-year swap rate to ease towards 3.5% in the next quarter. And then we expect the 2-year to glide down to 3.2% by year-end ‘25.

Black: policy moves out of the red, and into…

“All the pictures had, All been washed in black. Tattooed everything” Pearl Jam

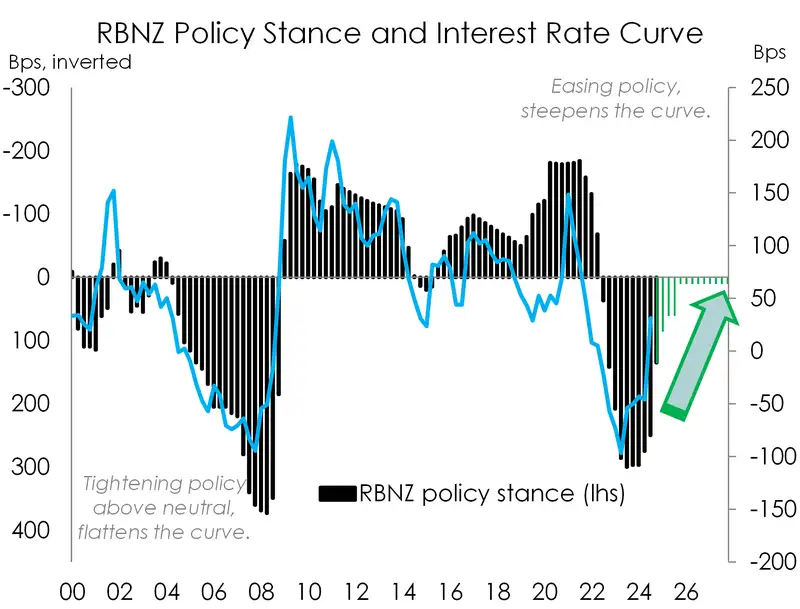

The chart below highlights how restrictive the cash rate was, and still is. The heavy-handed hikes into a heated housing market have halted household spending habits. And it hurts. Businesses lost confidence and investment intentions were deeply negative, until recently. As the RBNZ returns the cash rate to a more neutral setting, markets will reprice, and interest rate curves will steepen.

The chart above plots the RBNZ’s (currently restrictive) policy stance, by taking the current cash rate away from the neutral rate (grey bars). The more restrictive monetary policy becomes, the more inverted our wholesale interest rates become. An inverted curve, where short term rates rise up above long term rates, points to a significant slowdown in growth, often recession. Historically, an inverted curve forewarns a recession in about 9-to-12 months. Our curve inverted in mid-2022, and the recession started at the end of 2022. And we’re still in recession, two years later.

Cutting the cash rate will steepen the yield curve. Short term rates will fall back below long-term rates. And these rate cuts will fuel expectations of higher growth. That’s the next big move in rates markets. It’s a big bull-steepening.

The fall in wholesale rates had enabled banks to lower lending rates, without an actual cut to the cash rate. – even prior to the August rate cut. And these lower wholesale rates, which should continue to fall into 2025 and beyond, will enable further cuts to carded mortgage and business lending rates.

The lowering of interest rates will provide much needed relief for indebted households and businesses. And it is the expectation of these rate cuts that has us in the more “optimistic” camp when thinking about economic growth, household wellbeing, business expansion, and the recovery of the housing market.

Rearviewmirror: rates rise on reflation risk and re-election

“I guess it was the beatings... made me wise.

But I'm not about to give thanks, or apologize.” Pearl Jam

Looking in the rearview mirror of the Kiwi economy, the future path for policy should be relatively straight forward. We’ve been in a prolonged recession, for two years, and the economic scarring is apparent. Despite a welcome uplift in confidence, we have yet to see the (meaningful) uplift in activity, as the labour market continues to soften. The lift in unemployment is snowballing and will get worse (with the usual lags) before it gets better, much later next year.

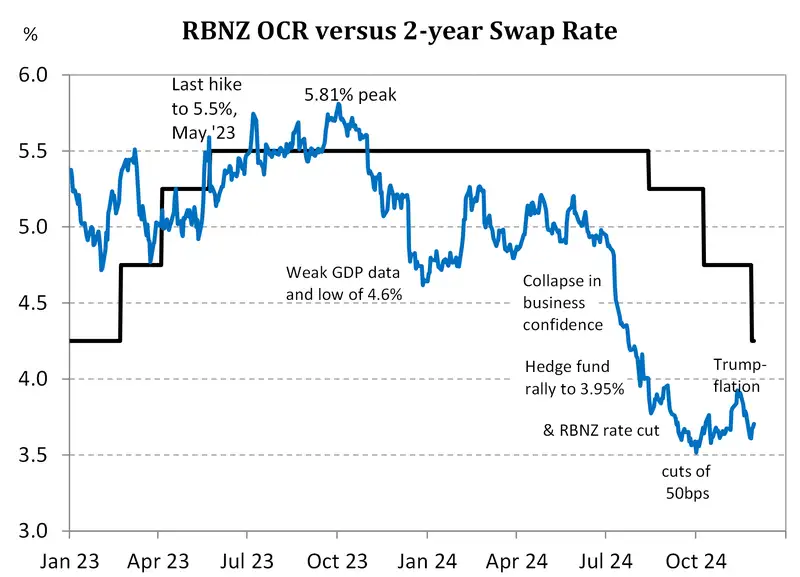

We have seen a dramatic move in wholesale rates in recent weeks, and months. The biggest move, south, occurred in the lead up to the RBNZ’s first cut in August. The pivotal 2-year swap rate dropped from a recent high of 5.2%, all the way down to just 3.5%. Thoughts of the commencement of the rate cutting cycle turned quickly to heavy bets, and ultimately, the delivery of rapid fire 50bp moves. A lot can change in just a few weeks and months.

It was a Kiwi specific rally in rates. The RBNZ sprang into action and rates fell, hard, fuelled by hedge funds. And that’s all fine and good. It made sense. But then we had to sideline good sense, and incorporate nonsense. Trump.

Wholesale interest rates have found themselves entangled in a global move higher. It was an alien idea, with the RBNZ cutting so assertively. And it has been foreign in nature and origin. Just weeks out from the US election, market traders started betting on a Trump re-election. The trade was simply, buy US equities and sell US bonds. Trump’s re-election was deemed pro-growth, or pro US business, at the expense of everyone else. And of course, the “at the expense of everyone else” bit, namely tariffs, was seen as inflationary. Trump’s fiscal largesse was also seen as expansionary, and therefore, requiring even more debt. US stocks were better bid, reaching fresh record highs, while US interest rates popped higher – with more growth, more inflation, and more debt feeding into higher required yields.

Wholesale rates have eased since, but the volatility in financial markets will continue.

2025 will be another volatile year. Geopolitical tensions will continue to hog the headlines. Whether it’s Europe, the Middle East, or closer to home in Asia, the potential for conflict to derail financial markets is a known unknown. Trump’s influence is unpredictable is many areas and predictable in others. Trump is also a known unknown.

Accepting volatility offshore, we believe the most likely path for longer dated interest rates is higher. Shorter term rates should be somewhat anchored by central banks cutting back towards neutral settings. But the combination of rate cuts fuelling confidence in the recovery, and disruptive, expansionary and inflationary US policies should keep longer dated rates higher. Curves are likely to keep steepening. And we forecast the Kiwi 2s10s curve, which hit a low of -100bps in 2023, to keep steepening from +35bps today towards 85bps through a combination of lower short rates and higher longer rates. It’s an MMA style move where central banks grapple the short end and the long end is subject to a greater risk premium.

What this means for the Kiwi currency is much the same. The RBNZ is cutting harder and faster than their peers, especially the US Fed and Australia’s RBA. Our forecast for 59c by year end is looking good, and we see some downside risk into 2025. The depreciation in the Kiwi, from a recent high of 0.6379c in September (ignoring the RBNZ rate cuts), to 59c today, will help Kiwi exports… We need a boost in tourist numbers, and help on the commodity side. China’s demand has been weak in many areas. Our last FX tactical, published in September, revised our forecast for the Kiwi to 59c, from 57c. See “Leapfrog: the Kiwi currency has recalibrated, higher, we now target 59c (up from 57c).” And our thoughts on the Kiwi next year are in two halves.

We see downside pressures dominating in the first half of 2025, before a global recovery adds demand and therefore strength to the Kiwi flyer. We see the Kiwi ending 2026 in a 63-65c range. But more on this in our next FX Tactical out in a week (or so).

The choice of Pearl Jam song titles has a very specific audience in mind. Mary Jo Vergara and Sabrina Delgado appeal to all demographics. Whereas I’m focussed purely on the angry middle-aged realists. The ones who had dreams, but have just realised they won’t happen.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.