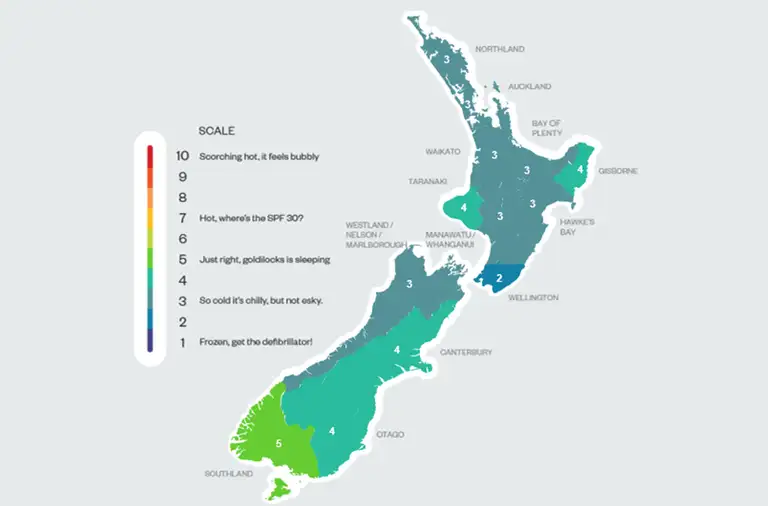

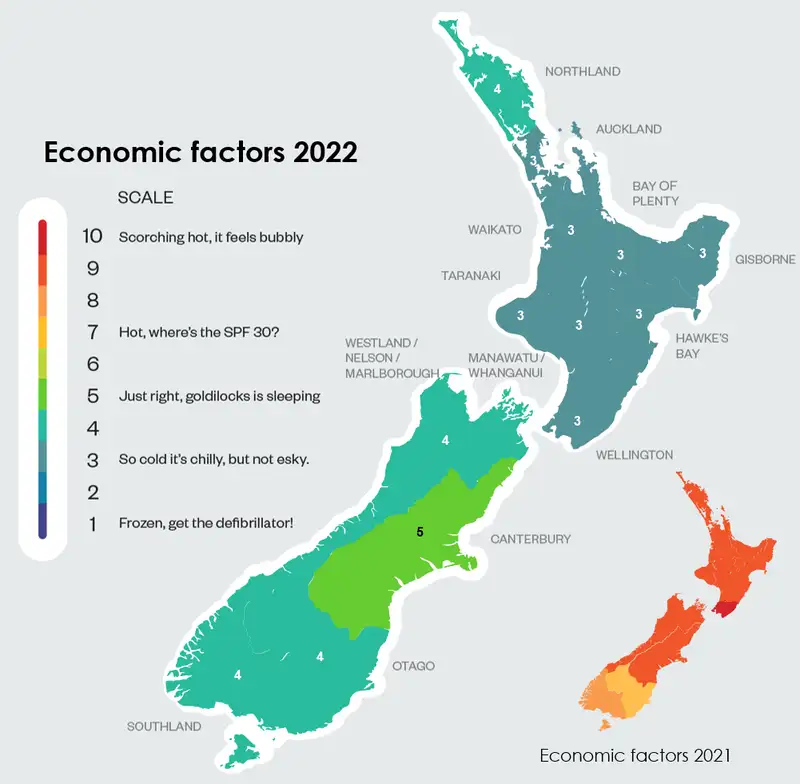

This is not a climate change map. It shows cooler economic activity, and is in stark contrast to last year’s heatmap.

- All regions have recorded a significant drop in momentum, with most regional scores coming in well below average.

- Canterbury gets bragging rights as the best performing region.

- The North Island is clearly weakening compared to the South. Employment growth is generally stronger in Te Waipounamu, and the housing market appears to be experiencing a softer landing.

“Coming off a scorching hot period...the feeling is the gas bottle is starting to run a bit low though.” Greg Bramley - Senior Property Finance Manager, South Island.

Our heat map has cooled once again. From the depths of covid in 2020, the country flashed red-hot in 2021 as the economic recovery fired up. Now after binging on record low mortgage rates and dollops of fiscal support the economy is readjusting to high inflation and rising interest rates. In 2022, most regions scored below average according to the data feeding our regional indicator. Activity is fading in part because we’ve hit the economy’s natural constraints. Materials are hard to get, and firms continue to face challenges filling vacant positions. In addition, the relentless rise in mortgage rates since the middle of last year is sapping demand. Tight credit conditions have hammered housing market activity across NZ. And this will ultimately hit spending and investment as consumers and businesses tighten belts and hunker down. Ongoing covid disruption isn’t helping.

Canterbury wins the bragging rights in 2022, scoring the highest regional score. The Garden City is emerging as a place people want to live. Priced out of other major Kiwi cities, Canterbury has a lot to offer newcomers. We’ve seen Canterbury’s housing market experiencing much more of a soft landing compared to the sharp correction experienced in other parts of the Motu. However, in the current climate the standout Canterbury could only muster a lukewarm 5/10 in our regional score.

At the other end of the range the North Island is faring worse than the south. Northland hit 4, and that was the highest in Te Ika-a-Māui. The rest of the North Island could only generate a 3/10. Outside Canterbury, the South Island fared better than most of the North Island. No doubt buoyed by the reopening of our border and decent commodity prices for key agriculture exports.

A tight labour market: both a blessing and a curse

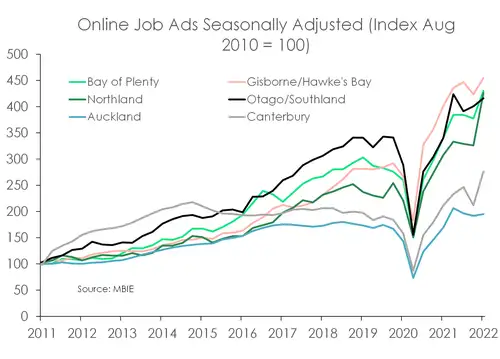

The labour market is a strong point in the economy for households and a sore point for business. The unemployment rate is at a record low. Jobs are plentiful. However, hiring momentum has eased, and not for want of workers. Firms just continue to find it difficult to fill vacant positions – a predicament repeated around the developed world. Consequently, wage growth is rising, and rising fast.

When quizzed, numerous KB Business Bankers pointed to the labour market being very tight at present across Aotearoa. In fact, the average across the 40 respondents gave the labour market a score of 8/10. “Biggest issue remains, "where do I get quality staff"” – Mike Mangino, Commercial Manager. Auckland. “Still seeing a shortage in skilled labour, a lot of businesses aren't able to operate at full capacity because of this, especially in the hospitality sector.” - Rory Milne, Commercial Manager, Nelson.

Backing the Bankers’ sentiment are the very elevated levels of online job ads across NZ. Several regions reported their highest number of job ads in the March quarter according to the data compiled by MBIE. Unemployment rates in the regions are approaching record lows in many places. And in the case of Taranaki, smashing their record and posting an unemployment rate of 2.4% at the start of 2022.

However, employment growth has generally slowed from the peaks of 2021. Most of the North Island and the top of the South experienced below average employment growth in March. Omicron disruption can’t have helped though. Exceptions to slowing jobs growth included the Wellington region and most of the South Island. Posting above average employment growth in the March quarter. In the case of Wellington and Southland both experiencing 5%+ gains in employment on a year earlier.

The labour market is for now offsetting some of the pain from the rising cost of living, and wage growth is playing catch-up with inflation. However, we see the unemployment rate lifting into the end of this year and beyond. The RBNZ is putting the brakes on the economy as it fights multi-decade high inflation.

A major drag on the regions

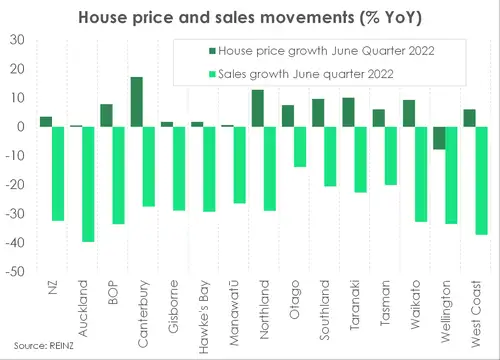

A big driver of regional activity last year is now a major drag. The housing market has capitulated under the pressure of tightening credit conditions, such as rapidly rising mortgage rates, investor tax policy changes and stretched affordability. Properties are taking longer to sell as shown by the median number of days to sell lifting off recent lows. And the impact of a slowing market will be felt beyond housing, with falling household wealth weighing on spending and future residential investment.

While housing markets are cooling everywhere, the experience varies across regions. The lower North Island, which led the market during the covid-era boom, is experiencing the sharpest correction.

Wellington’s housing market fell nearly 8% in the year to June. Whanganui/Manawatū and Hawke’s Bay regions have also experienced sharp reversals in house prices. Auckland too is feeling a market correction clocking up the fastest fall in sales in Q2 of near 40%. Interestingly, regions surrounding Auckland are faring a bit better.

Seemingly late to the party on the upswing, Canterbury is experiencing a much milder slowdown on the other side. Although easing, house price growth still came in at 17.2% in the Second quarter. Comments from Kiwibank Mobile Mortgage Managers (MMM) based in Canterbury were less downbeat too:

“It's definitely a bit quieter but I think the prices are fairly stable, and we are still getting a good level of enquiry. Its better in some ways as people are finding it easier to obtain a property, rather than missing out all the time.” – MMM Rachael Delahunty, Canterbury.

“Seems to be slightly plateauing off. Canterbury was due to increase in value. Properties taking longer to sell as sellers become more realistic about sale price.” – MMM Blair Milne, Christchurch.

“The market is definitely taking a breather. Enquiries have dried up - in particular construction enquiries. Everyone's expectations at the moment are unrealistic and so the market feels like it is in a stalemate while expectations adjust to the new reality.” – MMM Alan Bush, Canterbury.

Another factor weighing on regional housing markets is newly built housing supply coming online. Residential consent issuance was propelled higher following the 2020 covid lockdown. And annual consents across Aotearoa reached a record in the year to May 2022 of over 50,000. Pent up demand caused by pre-covid population growth, mixed with record low mortgage rates have ignited a nationwide building boom.

However, building consents are coming off their highs and are trending lower in most regions. The exceptions include Auckland and Canterbury. The correction in the housing market combined with accelerating building costs and a lack of infrastructure are putting many off from residential building. The Bay of Plenty appears indicative of much of the country:

“Property listings are on the rise and taking longer to sell. Demand for construction of new dwellings is still very high, however rising building costs (and continuing supply chain issues) are making it less affordable and some construction firms are beginning to struggle.” – Jason Reddish, Commercial Associate, Bay of Plenty.

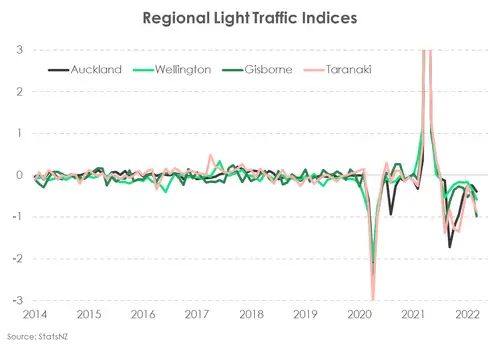

Light(er) traffic is a familiar theme across all regions

One area that is reasonably consistent across the regions, is the softening in light (commuter) traffic. Although the levels of traffic are weakest in Gisborne and Taranaki. The Covid pandemic has thrown up many challenges, including a change in work habits.

During the (various) lockdowns, traffic volumes were (deliberately) halted. And according to the latest data, traffic volume has failed to recover to pre-Covid levels.

There are a variety of reasons for the reduction in traffic. Firstly, the impacts of Omicron persist, with worker absenteeism a common ailment for businesses. Secondly, more of us are working from home. Thirdly, tourism levels are still low. And finally, elevated petrol prices have forced commuters to rethink their travel. Although we expect petrol prices to decline into 2023. We believe the working-from-home phenomenon is structural and is simply the new way of working. Indeed, the ability to work from home has made the regions more attractive. We can work for that Auckland or Wellington based firm, from the Hawkes Bay. Higher absenteeism will persist, with the pandemic far for finished and regular seasonal ailments – kept at bay by a closed border – come back with a vengeance such as the flu. Tourism levels will recover, albeit slowly. The likely resurgence in tourism will help the regions, like Otago, but also revitalise retail activity in the main city centres. Traffic will pick up over the year ahead, tourism will be a key ‘driver’, but may remain lower than pre-Covid levels for some time.

Robust retail

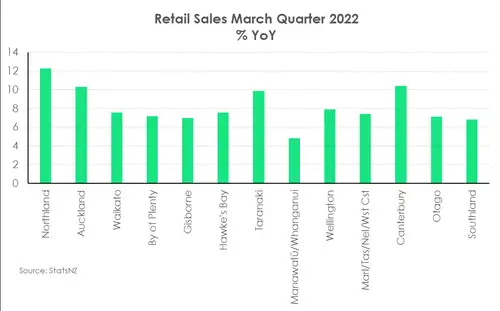

Record low unemployment in Aotearoa continues to underpin consumer spending. Despite an increasingly expensive environment, households still appear willing to pull out their wallets. Reasonably stable job security and the reopening of our border are helping to drive up retail sales. Compared to last year, retail spending is up 9% nationwide. And Northland is experiencing the strongest growth, with spending up 12.3%.

Close behind are Auckland and Canterbury, each posting just over 10% growth. The Manawatu-Wanganui region may have posted the ‘slowest’ growth at 4.8% but is still outpacing its long-term average rate of 4.3%. And that’s a theme consistent across the regions - retail sales are growing at rates well above average.

To date, consumer spending has been a key source of economic momentum and strength. But we question its sustainability. Our latest Household Spending Tracker showed that rising prices, rising interest rates and a housing market in retreat are starting to take a toll on household spending. The number of times Kiwi tap, swipe and insert their cards is evidentially slowing. Kiwibank credit card data shows that compared to a year ago, the number of transactions is down 5.2%. And it’s discretionary spending that’s on the firing line. We’re doing less DIY on the house and more DIY for our morning coffees. The official numbers are yet to show a pullback. But it’s only a matter of time.

The feel good (or bad) factor

Again, we asked our Kiwibank business banking and mortgage manager colleagues for the word on the street. Here is what they said:

4 - Northland feels far more of a 6

“The current business climate in Northland is strong but there is a feeling of uncertainty for the 12 months ahead. Most companies have been surprisingly resilient, surviving & some thriving through a lockdown which isolated the region from the rest of the country for almost five months.” - Daniel Heswall, Commercial Associate.

3 - But Auckland feels a warmer 5 despite the housing market feeling more like a 3

“Customers are very cautious due to ongoing headwinds of large cost increases, wage inflation, staff shortages and significant rising interest rates.” - Scott Wilson, Relationship Lead.

“Coming off a period of strong bullishness, there is increasing levels of softness in patches, and in some specific businesses and industries - but broadly confident” – Luke Hurring, Regional Manager.

“All businesses appear to be struggling with capacity (mainly people shortages), many businesses are still focused on growth with several looking at acquisitions of other businesses to grow as opposed to trying to build organically. I believe this is largely due to long wait times for imported machinery as well as the difficulty and cost of bringing on qualified staff. Some businesses are starting to shy away from debt leverage given rising interest rates. Property investors are getting pushed more to 2nd and 3rd tier financers given current main bank property investment lending appetite generally now requires LVRs < 40%.” - Max During, Commercial Growth Manager.

“Business operators are currently holding their breath. Biggest issue remains, "where do I get quality staff", but now closely followed by, "how do I maintain a steady supply of stock" - Mike Mangino, Commercial Manager

“Overall things are starting to look up for a number of our customers. Several covid-related issues like staffing shortages, restricted travel and freight costs are easing. We are seeing a lot of activity in the market with businesses looking to grow organically and also via merger/acquisition opportunities. Non-banking finance companies are back in a big way and meeting market demand as banks pull back on their lending appetite.” - Jyoti Lath, Relationship Lead MCG.

3 - But the Waikato feels a much brighter 7

“The local housing market is slowing, prices dropping, and people are generally taking the "wait and see" approach. There are a lot of new subdivisions so there is room to grow within the small towns of the region. However, builders are struggling to get product and price increases in this space is confusing for customers” -Leanne Richards, Mobile Mortgage Manager.

3 - On the ground the Bay of Plenty is closer to a 6

“The retail and hospitality sectors are currently benefiting from relaxed Covid restrictions however this is likely to be short-lived as disposable incomes are continually being squeezed. Cruise ships are due back in Tauranga from October 2022 which will provide a boost to some local business, but passenger numbers are unlikely to return to their pre-2020 levels for quite some time.” – Jason Reddish, Commercial Associate.

3 - Gisborne feels a 4

“The tide has turned. The bubble is deflating (rather than bursting). House prices falling and inventory is taking longer to sell, cost-of-living increases hitting home, supply chain issues continue, tight labour market, sentiment pessimistic as a result. Challenges aplenty over the next few months.” – Garth Duncan, Commercial Manager.

3 - The Hawke’s Bay feels more like a 5

“The new $350m wharf at Napier Port has already welcomed its first ships. The port will provide increased shipping capacity and improve the availability, operational performance across all wharves. Unseasonable rain and good growing conditions have improved confidence particularly for sheep and beef farmers. The region’s apple industry has struggled with Labour shortages and a lot of this year’s crop was left unpicked. House prices have turned, and stock is taking longer to sell” - Karl Trafford, Commercial Growth Manager.

3 - But on the ground Taranaki positivity is more like a 7

“Taranaki, like Aotearoa, is going through a challenging period, with high inflation and increased living costs, compounded by supply constraints and talent shortages, caused in part by Covid-19 restrictions. There are pockets of positive news, such as the region's unemployment rate sitting at a record low of 2.4% (May 2022). The Food and Beverage industry in Taranaki, alongside farming, has been recognised as significant opportunities for growth. Food production and farming currently employ approx. 10,000 people around the maunga, and there is confidence growing that the region can leverage the existing skills and help strengthen and diversify the Taranaki economy.” - Jayden Devonshire, Commercial Manager.

3 - The heat looks to have come out of Whanganui/ Manawatū, which feels a 4

“Slowing down generally but especially in areas based on the publics discretionary such as hospitality and entertainment. A lot of those areas were already hit by Covid over the past couple years and this has impacted them further. People are tightening their spending with increasing interest rates and fuel prices. A lot of local discussion about increasing base cost of goods that is increasing the end cost to the consumer. Not the point of panic at all however people are certainly more cautious with their decisions.” - Nathan Ryba, Business Manager

3 - And Wellington feels like it

“The labour market remains tight in Wellington with employers struggling to find and retain staff. The housing market has slowed substantially in the lower to middle part of the market, whereas the top end of the market remains sought after currently. The impacts of Covid-19 and isolation requirements are very disruptive for businesses which is delaying projects/jobs from being completed.” - Caitlin Osmond, Commercial Manager

4 - The top of the south Marlborough, Tasman and Nelson feels a warmer 6

“Stilted, it feels like a lot of people are waiting to see what unfolds. Houses are still selling for good prices but with fewer buyers they are taking a lot longer to sell.” – Kevin O’Donnell, Commercial Manager.

5 - Canterbury’s feel-good score is also 5

“There seems to be a noticeable 'haves' and 'have nots'. Businesses are either doing well or poorly when normally the bulk is 'stable'” - Richard Lemon, Commercial Manager.

“Challenging times, high interest rates and inflation has put pressure on businesses which have already suffered due to COVID 19 implications.” - Jono Blyth, Commercial Manager.

4 - Outside tourism, Otago feels like a 7

“Tourism recovering from Covid lows. Of note current gaming sector showing huge growth with some 16 new studios gaining grants of up to $750k supported by Dunedin City Council and Otago University.” - Martin Hannagan, Commercial Growth Manager.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.