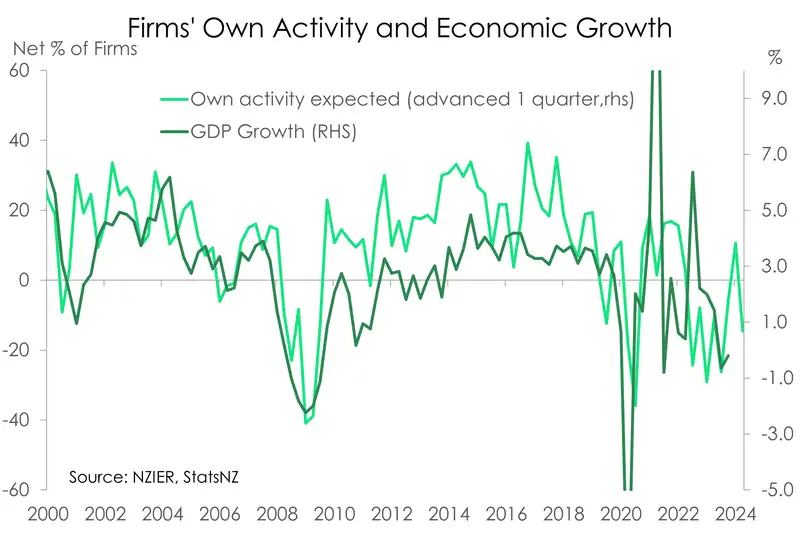

The RBNZ’s softening in tone at the July MPR reflects the collapse in business confidence, and the gallows level of confidence amongst households. The RBNZ referred to firms hiring decisions, with the increase in labour supply, and investment intentions.

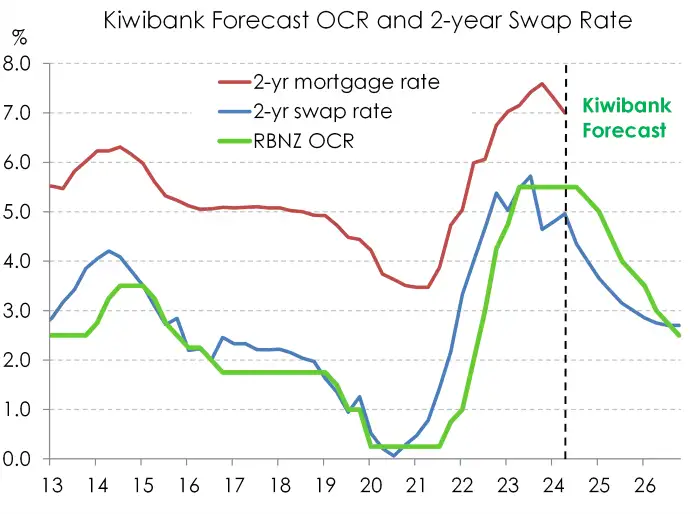

We’re confident that the next move in rates is down. And we’re growing in conviction that the easing cycle will begin in November – the latest. Because week after week, the data has printed weak. A contraction in June quarter economic activity looks increasingly likely. As several business surveys have shown, downbeat firms are reporting depressed trading activity as high interest rates curb demand. Labour demand indicators have also softened, with firms now looking to decrease headcount. We expect a continued climb in unemployment from here. The economy is clearly responding to restrictive monetary policy. And the longer rates remain restrictive, the greater the economic damage inflicted.

“Members discussed the risk that this may indicate that tight monetary policy is feeding through to domestic demand more strongly than expected.” RBNZ July MPR Summary Record of Meeting

Another notable change, or tweak, was the reference to inflation piercing below 3%. In the May’24 MPS summary record of meeting - “The Committee noted that annual headline CPI inflation was expected to return to the target band in the December quarter of this year.”

In the MPR summary record of meeting – “The Committee is confident that inflation will return to within its 1-3 percent target range over the second half of 2024.”

It doesn’t sound like much, but it opens up the door to rate cuts this year. The change in language reflects (Kiwibank’s forecast of 2.9% in the September quarter) the very high probability that inflation breaks below 3% sooner than their December quarter forecasts. Inflation is falling faster.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.