- Kiwi inflation is stabilising. The headline rate was unchanged at 2.2% at the end of 2024. With each release, we grow in confidence that the inflation beast is back in its cave.

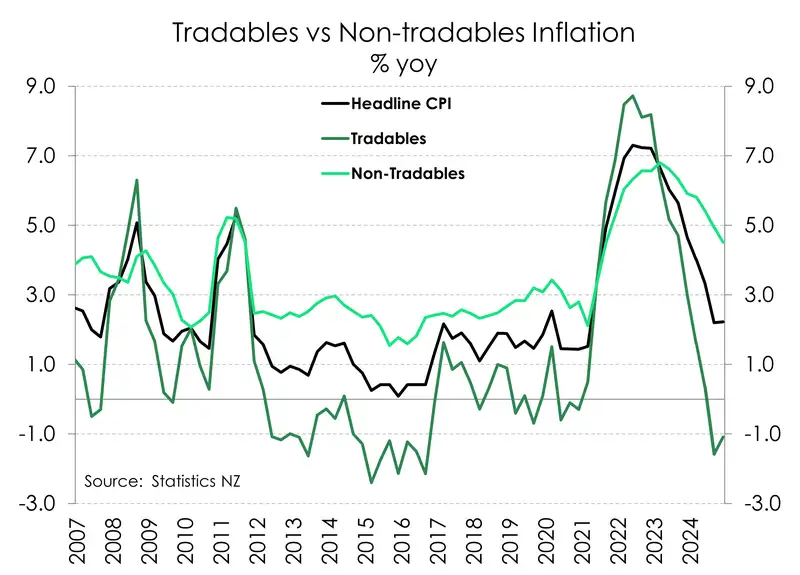

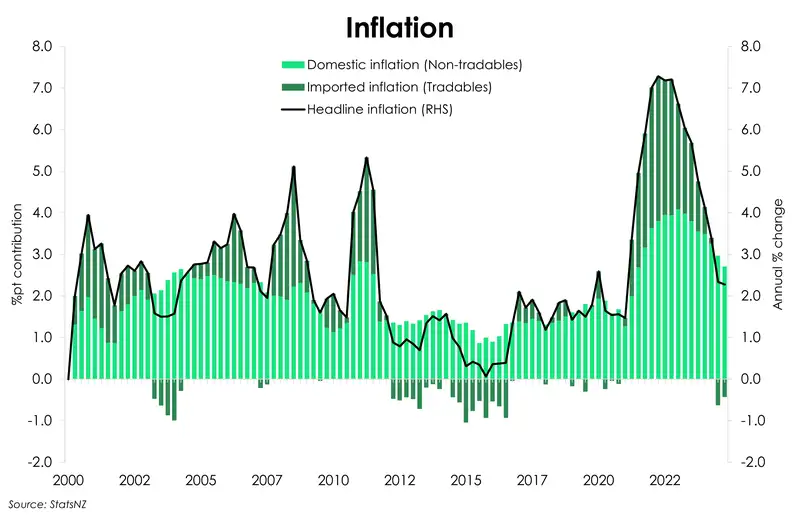

- There is more disinflationary pressure in the pipeline as the economy continues to operate below its productive capacity. Tradables is the reason we have returned to 2%. And the eventual normalisation in domestic price pressures is why we see 2% sustained in the medium-term.

- The light at the end of the tunnel is burning brighter. Cost pressures are easing. Great news for businesses and households, as interest rate relief is coming thick and fast. Policy settings are still restrictive, but more interest rate cuts are coming. We expect another 50bp cut in Feb. Falling inflation, and falling interest rates will help household budgets, and business opex.

Kiwi inflation is stabilising. Over the December quarter, consumer prices rose 0.5%, leaving the annual rate unchanged at 2.2% - a whisker stronger than the market estimate of 2.1%. With each release, we grow in confidence that inflation is becoming well contained. It took some time (2½ years), but the beast is finally back in its cave.

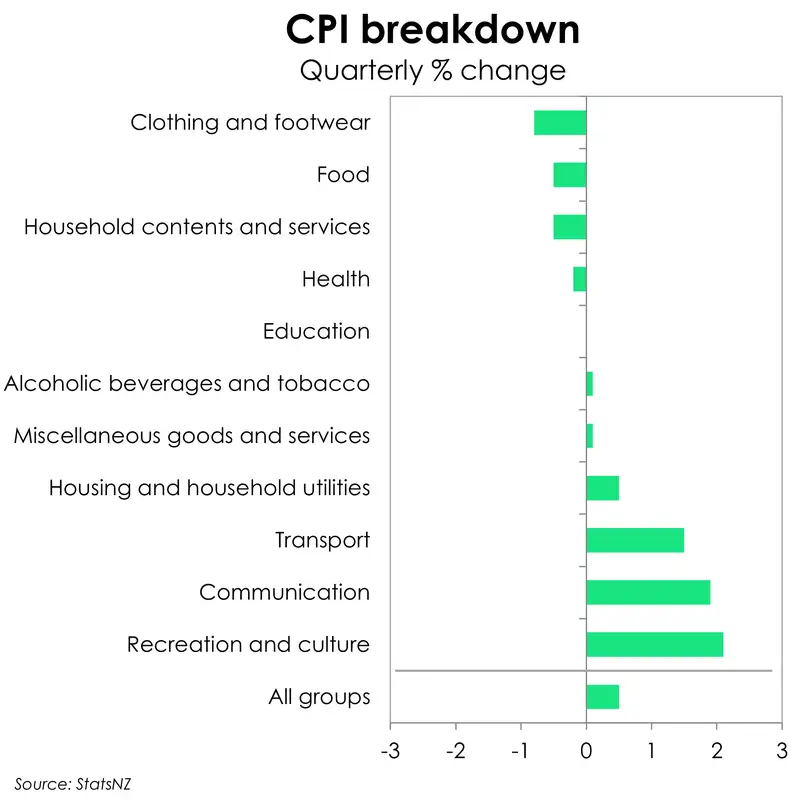

The good news – deflation pressures are becoming more broad-based. Over the December quarter, there were more goods and services recording a decline in price. Indeed 251 items in (or almost 40% of) the CPI basket recorded price decreases – the most since 2020, or 2017 excluding covid. At the same time, there were fewer goods and services recording price hikes. In fact, for the first time since the end of 2020, just under half of the basket recorded a price increase.

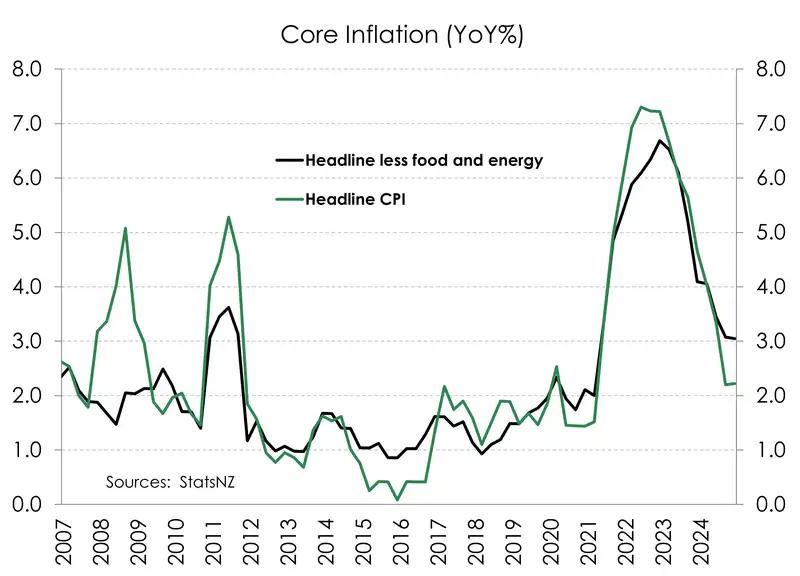

In even better news – the underlying trend in consumer prices continues to cool. The various measures of core inflation confirmed as much. Stripping out the volatile price movements in food and fuel, annual core inflation is down to 3% from 3.1%

Onwards and downwards

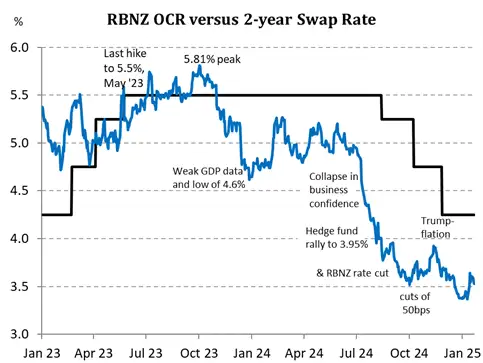

Looking at the CPI report card, there's enough disinflation in the data to support further rate cuts from the RBNZ. And a 50bp cut to 3.75% in February is pretty much a done deal. We'll then see, most likely, another cut to 3.5% in April (or May). It's the next move(s) below 3.5% that's in question. The RBNZ is signalling a pause at 3.5%... a long pause... We believe more needs to be done to stimulate the recovery into 2026 and beyond. We believe the inflation problem is no more. We believe households and businesses need rate relief. And we believe the RBNZ will be forced (once again) to deliver more, not less.

Imported inflation

Breaking a 4-quarter deflation streak, imported inflation lifted 0.3% over the December quarter. The transport group recorded an overall lift of 1.5% over the quarter. International airfares rose 6.6%. There was also an unusually large rise in prices for second-hand vehicles, up 4.7%. Providing some offset was the 1.3% fall in petrol prices. Annually, tradable inflation rebounded slightly but remains in negative territory at -1.1%, up from -1.6%.

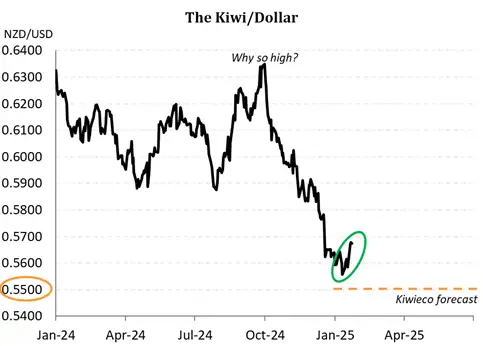

Imported prices peaked at a whopping 8.7%yoy and have fallen swiftly with the decline in global inflation rates. Indeed, weakening imported inflation has done most of the leg work in wrangling inflation back within the RBNZ’s target band. But momentum can be easily disrupted. And the recent depreciation in the Kiwi dollar is a lurking threat. The Kiwi dollar began 2025 on the backfoot, falling to the lowest level since 2022. The fall in the Kiwi currency is a double-edged sword. On the one side, our exports become cheaper to foreigners, as New Zealand goes on sale. That's good for goods demand, and tourism. It's provides an income boost for exporters who get paid in dollars and convert back to Kiwi. Think farmers and growers. But our purchasing power declines on the other side. Imports become more expensive... including petrol. There's a real 'need' or desire to focus on the negatives and minimise the positives. That's the recessionary mindset we'll struggling to shake off. Wellington is absolutely, positively pessimistic. And with the drop in the Kiwi currency, worries immediately turn to higher petrol prices (even though they are currently down 9%)

Domestic inflation

Unlike imported inflation, domestic inflation is a slow-moving beast. The good news is that it is moving in the right direction (south). As expected, non-tradable prices rose 0.7% over the quarter, which saw the annual rate ease from 4.9% to 4.5%. The RBNZ will be happy with that. Today’s print comes below their estimate of 4.7%. Non-tradables is pulling further and further away from the 6.8% peak. That said, domestic inflation is still sitting high above the long-term average (~3%).

Rental inflation (which makes up 9% of the CPI) let off a bit of steam. The 0.8% increase over the quarter saw the annual rate slowing to 4.2% from 4.5% - the lowest since early 2023. Still, rental inflation was the largest contributor to the headline rate. Home construction costs accelerated slightly, up 0.3% over the quarter. But from a year ago, construction costs continue to cool, from 2.5% to 2% and a fair distance from the crazy peak of 18.3% in 2022. The change in how StatsNZ records the cost of pharmaceutical products – leading to a particularly large 5.5% decline over the quarter – may also have had a hand in dragging the non-tradables measure lower. All up, the data supports a continued easing in domestic prices.

A blemish in the report was the lift in services sector inflation. Still running hot at 1.4% over the quarter, services inflation rose to 4.8%yoy from 4.5%yoy. We’re yet to see a sustained turnaround. But it’s coming. Services inflation is closely aligned with the labour market, specifically wage growth. Several indicators of labour demand suggest a continued softening. The slowdown in wage growth as the labour market loosens, point to an eventual (necessary) slowdown in services.

There is more disinflationary pressure in the pipeline as the economy continues to operate below its productive capacity. The rapid deceleration in tradables is the reason we have returned to 2%. And the eventual normalisation in domestic price pressures is why we see 2% sustained in the medium-term

Basket breakdown

There are lots of moving parts in the updated inflation profile. Many of which continue to be stubborn price pressures that we’ve come to know all too well. As well as some seasonal moves. Comparing to a year ago (December 2023), some notable price movements include:

- Rental inflation up 4.2%. Despite cooling net migration, rents remain uncomfortably elevated. Indeed, they’re moving away from their 4.8% peak seen in June 2024. But they remain at least a whole percentage point higher than their long-term average. And contributed almost a fifth to December’s annual increase in overall prices.

- Another 12% increase in council rates over the year to December, which accounted for 16% of the annual headline rate.

- The 7.6% increase in cigarette and tobacco prices ahead of the annual tobacco excise tax increase on 1 January 2024.

- Going the other way, petrol prices declined 9.2% helped by the removal of the Auckland regional fuel tax.

Meanwhile over the quarter, large price movements were seen across:

- Domestic and international air fares. Prices for international air transport increased 6.6% over the quarter and accounted for almost a quarter of Decembers 0.5% quarterly rise. Meanwhile domestic air fairs were up 9.3% and contributed about 12% to the quarterly lift.

- A 4.7% increase in the price of second-hand cars which contributed nearly 20% to the quarterly move.

- An offsetting 11.5% decline in the price for vegetables thanks to seasonal impacts. Which removed 0.17%pts from the headline quarterly inflation rate.

Market reaction

Today's report did not generate much reaction in financial markets. It was a report that didn't change much. Traders were armed and ready for a surprise, and moved on pretty quickly. They came, they saw (nothing), they moved on. And that's good news in itself. The Kiwi dollar was recovering from a sharp fall into the mid 55s (against the Greenback).... rising up to 0.5680 from an overnight rate of 0.5620 (and a recent low of 0.5542). The data did little to dissuade the move already in motion. Kiwi interest rates have crept higher, but remain fairly priced in our opinion. The 2-year swap rate (used by banks to price and hedge 2-year mortgage rates) has moved from a recent low of 3.35% to a high of 3.65% last week. At 3.55% today, the 2-year is looking good, and is inline with our forecasts. And our forecasts have the RBNZ cutting to 3%. Traders agree (for now). And it's more about foreign markets, especially the US at the moment.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.