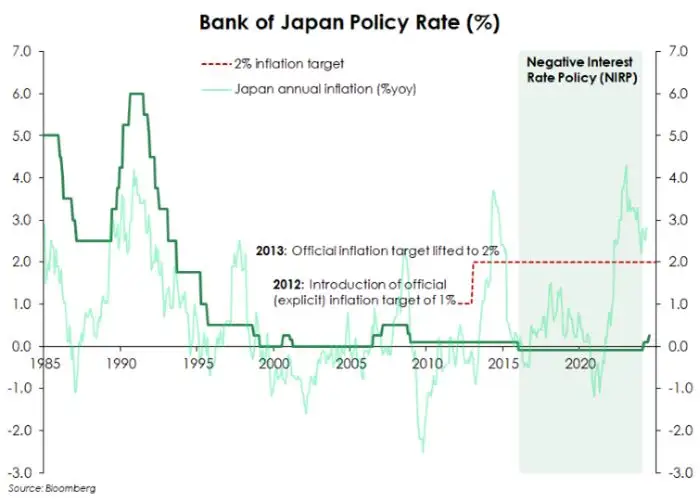

Just as other advanced economies are cutting, or about to cut, interest rates, the Bank of Japan is going the other way. Earlier this year, the Bank of Japan did away with its long-held unconventional monetary policy. In March, the BoJ ended eight years of negative interest rate policy and lifted rates to a range of 0%-0.1%. Yield curve control was also abandoned. Since March, picking when the BoJ would next hike rates has been fraught with difficulty. Several years of persistently low inflation in Japan has seen the BoJ take a conservative approach , wary of pulling the trigger (hiking rates) too soon. However, evidence has been mounting that domestic demand is strengthening and driving the current lift in inflation. And last week was the meeting and the BoJ raised rates by 15bps to 0.25%. It’s the highest the policy rate has been since 2008. And since the late 90s, the policy rate has not been any higher than 0.5%. A key message from the BoJ was that last week’s hike is unlikely to be the last: Especially as evidence of a virtuous wage-price spiral are clear. “if the aforementioned outlook for economic activity and prices is realized, the Bank will accordingly continue to raise the policy interest rate and adjust the degree of monetary accommodation.” The BoJ’s updated forecasts see inflation sitting above-target in the outer years. Further hikes are on the table.

Market speculation of a hike ahead of last week’s decision saw a dramatic unwind of the Yen carry trade, boosting the Japanese currency. The carry trade is a popular trading strategy in the world of currency. The strategy involves borrowing money where interest rates are low, and investing where they are high. With ultra-low rates in Japan, the yen has been an attractive funding source – with few alternatives. Shorting the yen and going long in higher-yielding currencies has been the go-to trade. Earlier this year, the Yen traded at its weakest level in almost four decades at 161against the Greenback (USD). The BoJ has suspected (and in some instances confirmed) to have intervened to boost the Yen, but the impact had been short-lived. The Yen would only sustain an appreciation if the BoJ were to lift rates. And that’s what we have seen unfold. The USD/JPY (Yen) has fallen almost 10% from the peak recorded just a month ago, with the Yen outperforming. Most of the move came ahead of the BoJ’s meeting, but the Yen continues to trade around 146 as the BoJ signals more hikes to come. Had the BoJ not delivered on market expectations, the Yen would likely be on its way back to 155 and potentially beyond.

The KiwiYen carry trade also quickly unwound which saw the currency pair tumble 12% from its recently recorded high. The moves have been swift and significant. And there’s more volatility to come as the BoJ goes one way, and its peers go the other.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.