Thousands of 'virtual economies' are booming in classrooms throughout New Zealand.

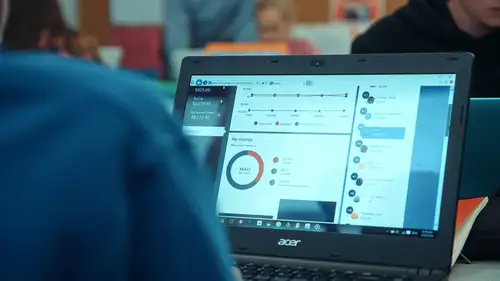

Banqer is a breakthrough online education programme boosting the financial capability of New Zealand kids. With Kiwibank fully funding 1000 classrooms, more than 30,000 primary school children aged 6-13 are learning and applying essential money skills such as saving, investing, borrowing and purchasing.

Kiwibank chief economist Zoe Wallis said teaching core financial skills through virtual economies now will benefit the real economy later.

"We simply have to confront the fact that, right now, we’re not up to the mark in terms of understanding money and making good financial decisions."

"Many New Zealanders don’t seem to fully understand the trade-offs associated with spending beyond our means. For example, we’re in debt with the rest of the world because we spend more than we save."

"Hands-on education programmes like Banqer are perfect for children to learn and apply essential money skills such as savings, debt, and planning for your retirement. Because the training is social, it gets people at a young age comfortable with talking about money. Undoubtedly that will help break the money taboo."

Banqer is an interactive, virtual classroom economy designed to help schoolchildren in years four to eight put into practice life lessons around saving, investing and insurance. It is currently used by a total of 30,270 students in 449 schools.

Teachers set up the economy and students earn digital money for performing classroom tasks and for good behaviour. But they also incur economic costs for such things as “hiring” school desks. The digital money can be used to purchase real world goods and services such as classroom parties or the ability to bid on items in end-of-term class auctions.

Teachers can also trigger "shock" events such as interest rate rises or natural disasters, which have a ripple effect on the classroom economy.

"This is an extremely significant milestone not only for Banqer, but also our partnership with Kiwibank," said Banqer co-founder and developer Kendall Flutey.

"It demonstrates demand for financial education in schools, and affirms that there is appetite for the solution we’re providing."

"The growth we’ve seen throughout New Zealand schools has been phenomenal this last year, tracking ahead of projections – any startup founder’s dream. Having 1000 classrooms involved is a great achievement. We’re already looking to extend it further to ensure Banqer is an educational tool accessible by even more New Zealand kids, so we’re keen to hear from more schools and teachers that want to get involved."

Riding on the successful rollout in New Zealand, Banqer will be available to 15,000 students in classrooms across Australia over the next year.

"We’re able to take a lot of our New Zealand growth learnings and apply them to this new market. This is proving very effective, and a little over two weeks from our official launch we’re already seeing more than 1000 Australian kids using Banqer."

Kiwibank also provides banking and financial technical expertise for Banqer’s curriculum, including developing modules in lending and debt, KiwiSaver and careers planning.

More information on Banqer can be found at www.banqer.co.nz

Banqer - by the numbers

- 30,270 students in 449 schools

- Financial literacy of individual students improved by as much as 90%

- 46% of students have experienced saving for a retirement scheme

- 97% of students have experienced earning an income over several tax brackets

Media contact

John Mitchell | Media Specialist | john@blacklandpr.com | 027 975 4094 | Lv. 12 City Chambers | 142 Featherston Street | Wellington